Ethereum underperforms Bitcoin, Solana and traditional stocks, experts weigh in on potential reasons

- Ethereum has underperformed key assets within and outside the crypto market.

- Ethereum is an innovation at the level of human civilization but is mispriced due to lack of killer applications, says F2pool co-founder.

- Ethereum could decline toward $2,111 if it fails to reclaim the $2,400 support level.

Ethereum (ETH) is down 2% on Thursday following a key analysis showing the top altcoin has underperformed assets, including Bitcoin, Solana, Nvidia, Meta, Apple, Gold and others. CryptoQuant analysts and the F2pool co-founder weigh in on why ETH has underperformed and what investors should expect.

Daily digest market movers: Is Ethereum underperforming or undervalued?

According to Ecoinometrics, Ethereum has been the worst-performing asset among large capitalization assets year to date. While Nvidia, Meta, Bitcoin, Apple, Gold, Google, Amazon, NASDAQ and Microsoft have posted gains of 142%, 48%, 38%, 22%, 19%, 18%, 18% and 12%, respectively, Ethereum struggles with a return of only 9%.

The fall outlook isn’t great, more downside risk:

— ecoinometrics (@ecoinometrics) September 5, 2024

• Small rate cuts probably won't boost market liquidity much.

• U.S. economic uncertainty may weaken the broader market.

Now is a time for caution rather than bold moves.

Follow @ecoinometrics for more charts and insights on…

Following anticipation of Ethereum's The Merge second anniversary marking the transition to a proof-of-stake consensus mechanism, CryptoQuant's analysts noted that the top altcoin struggles began after the event. According to the analysts, Ethereum has underperformed Bitcoin, Solana and BNB by 44%, 53% and 18%, respectively, since The Merge.

CryptoQuant analysts noted that some key reasons for the underperformance include a lower total transaction count in the Mainnet, which caused a decline in transaction fees. Additionally, Ethereum's supply has been rising and may not hold its deflationary status again. The analysts attributed the rising supply and weak network activity to the Dencun upgrade in March, which introduced new architectural dynamics in Ethereum.

Considering the FUD following ETH's underperformance, Shenyu, co-founder of F2pool, noted that Ethereum is still an innovation at the level of human civilization, and the market underestimates its value because killer applications have not yet emerged.

"As investors, we must tolerate this kind of mispricing and volatility in order to get real returns," said Shenyu.

Meanwhile, Ethereum ETFs recorded a second consecutive day of negative flows with net outflows of $37.5 million. Grayscale's ETHE posted outflows of $40.6 million, while its Mini Ethereum Trust saw inflows of $3.1 million.

ETH technical analysis: Ethereum could see further decline if it fails to reclaim key support level

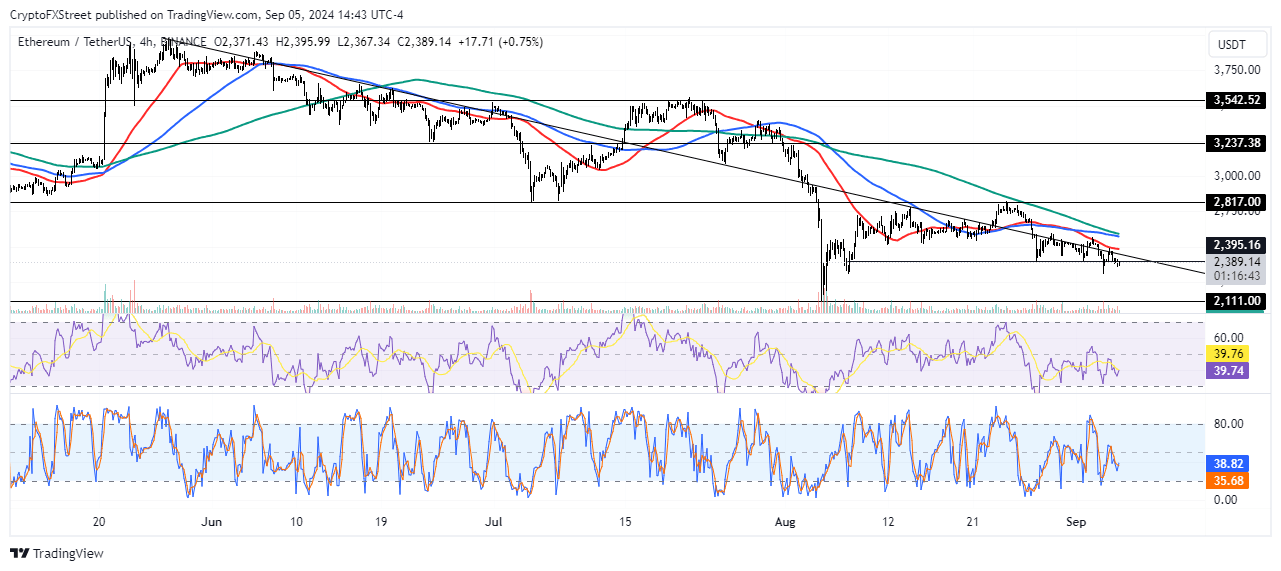

Ethereum is trading around $2,390 on Thursday, down more than 2% on the day. In the past 24 hours, ETH has seen $14.74 million in liquidations, with long and short liquidations accounting for $11.09 million and $3.65 million, respectively.

ETH has breached the support level around $2,400 of a key rectangle for the second time in the past three days. ETH traded inside this rectangle for over three weeks in August before moving outside it on Tuesday.

ETH/USDT 4-hour chart

If ETH fails to quickly reclaim the $2,400 support, its price could decline toward the $2,111 support level. This aligns with a key trendline that suggests ETH will likely decline to the support level around $2,111 before staging a rally.

The Relative Strength Index (RSI) is below its midline but attempting to move above its moving average. If it completes this move, ETH could see a brief rise.

In the short term, ETH could rise to $2,425 to liquidate positions worth more than $45 million.

Cryptocurrency prices FAQs

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi