Why Ethereum bulls persist to regain $3,500

- Ethereum price slipped lower on Tuesday, but bulls refrained from a drop back to $2,695.79.

- ETH price sees a squeeze from both sides with lower highs and higher lows in price consolidation.

- Expect a bullish breakout with FOMC this evening, and ETH set to rally 10% intraday, 24% over the week.

Ethereum (ETH) price is in the consolidation phase before a bullish breakout with lower highs and higher lows since this weekend. Expect the trend to continue from Sunday and Monday, as investors are awaiting the FED decision this evening. Although a rate increase is expected, tailwinds will come from Powell’s press conference supporting the markets and taking away some inflationary or recessionary tail risk. This could trigger investors to dive into stocks and cryptocurrencies with ETH price on the front foot rallying to $3,500 by the end of this week.

ETH price sees FED meeting as a catalyst for the rally

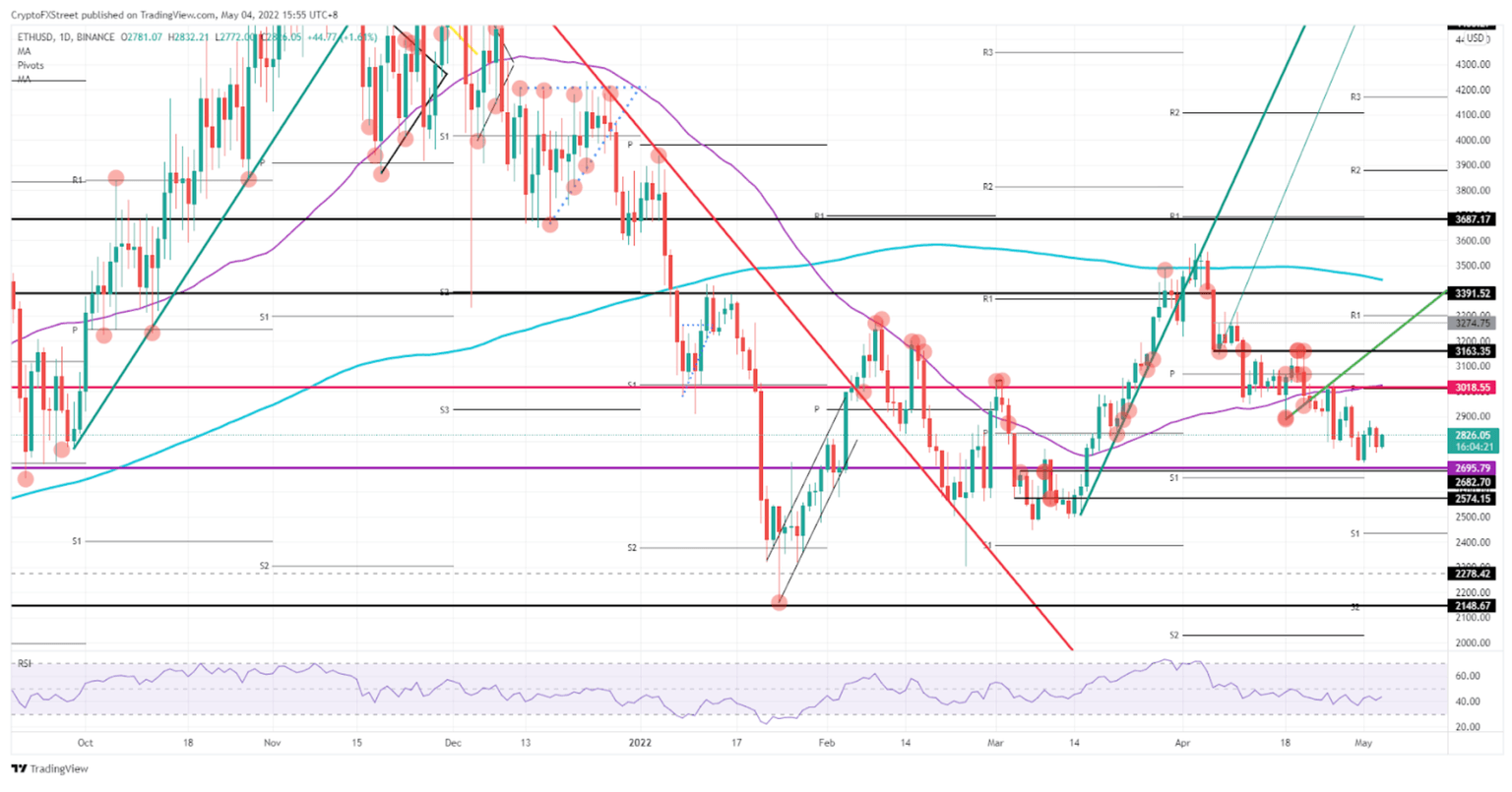

Ethereum price is on the cusp of rallying sharply higher with targets at the 55-day Simple Moving Average (SMA) around $3,018.55 and the 200-day SMA at $3,400. Both levels hold some solid profit margins, with the 55-day SMA near 10% of gains and the 55-day SMA just shy of 25% at 24%. The most significant catalyst for this move will be the FED rate decision.

ETH price will see a sell the rumour buy the fact event triggering a bullish breakout. Investors have been selling Ethereum coins since April in expectation of this FED meeting. Once the cat is out of the bag and the FED has pushed through its rate hike, expect to hear a very accommodative language from Powell, supporting the markets and setting a positive backdrop as the FED addresses inflation and ensures the economy is not overheating. Then expect to see an intraday move to the 55-day SMA, and a break above $3,000 for ETH price, rallying further into the week and by Friday, possibly touching $3,391.52, with a possible assault on the 200-day SMA over the weekend.

ETH/USD daily chart

This evening, risk comes with the same event, as the FED could deliver a hawkish sucker punch to the markets. Such a move will blindside markets if Powell speaks of more aggressive tightening and a rapid balance sheet run-off. This will cramp global markets and see investors run for the exit with cryptocurrencies and equities on the chopping block, triggering falling knives with ETH price set to pierce through $2,695.79 and possibly tank to $2,148.67, losing 23% in the drop.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.