Why Ethereum bears need to be cautious about shorting ETH before $2,000

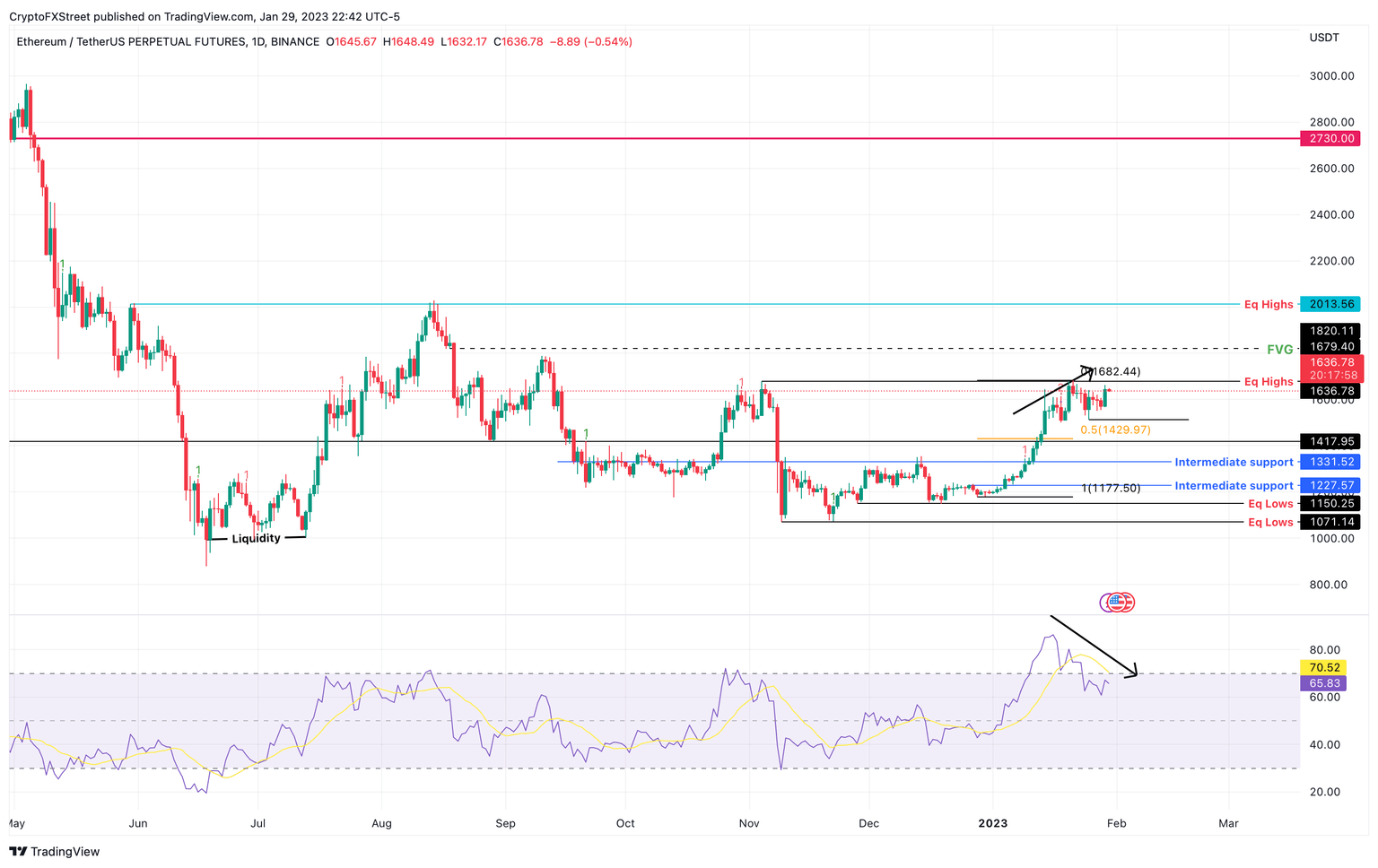

- Ethereum price shows a tight consolidation around the $1,679 resistance level.

- Short-sellers are likely to get trapped if ETH spikes up to tag the $2,013 hurdle.

- Invalidation of the short-term bullish outlook will occur if the altcoin produces a lower below $1,512.

Ethereum price has been consolidating after the January rally subsided after three weeks. This tightening continues even after BTC shot up 3% over the weekend. Therefore, a short-term spike in buying pressure should is likely. This move could propel ETH to tag immediate hurdles, liquidating early bears.

Ethereum price in between two outlooks

Ethereum price was inflated by 35% over the first three weeks in January, but the momentum subsided, resulting in a tight consolidation for the next week. As ETH hovers below the $1,679 hurdle, market participants need to be cautious of a short-term spike in buying pressure.

There are two reasons why this would happen:

- market makers or smart money are likely to push Ethereum price higher to collect the liquidity resting above the equal highs formed at $1,679.

- The second reason is that a retest of the $2,000 psychological level would invite a lot of investors to book profits, adding more pressure to the downside.

Additionally, this spike in Ethereum price would overextend, causing the Relative Strength Index (RSI) to delve deeper into the existing bearish divergence. This technical formation occurs when the underlying asset’s market value increases in the face of declining momentum. Such a development indicates that the ascent is built on a shaky foundation and is likely to result in a trend reversal soon favoring the bears.

Therefore, early shorters should be cautious of a sudden pump in Ethereum price to tag the $2,000 psychological level.

ETH/USDT 1-day chart

While the outlook for Ethereum price is slightly bearish, a minor pump could still be underway. A premature breakdown of the $1,512 support leading to a daily candlestick close below it would create a lower low. This break in the bullish structure would invalidate the bullish spike thesis and confirm an opportunity to short ETH. In such a case, the $1,429 and $1,331 support levels are good take-profit levels.

On the other hand, if Ethereum price flips $2,000 into a support floor, it would confirm the bullish outlook and increase the possibility of an extended run-up to the next significant hurdle at $2,730.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.