Why does Chiliz’s price show a bullish outlook?

- Binance and Bitget exchanges announce support for Chiliz’s new community token, PEPPER, and its airdrop.

- Santiment’s data shows the CHZ Exchange Flow Balance has a negative spike.

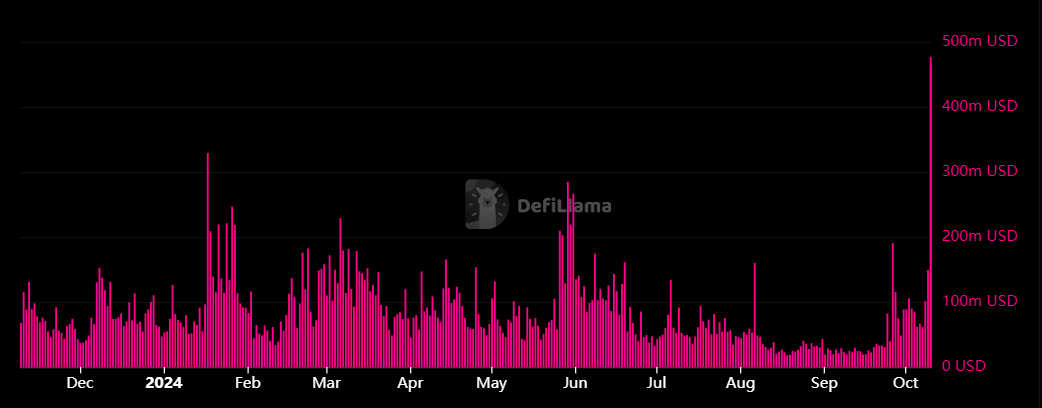

- Chiliz’s daily trading volume has reached a new all-time high of $477.01 million.

Chiliz (CHZ) extends its gains on Thursday, trading around $0.07, as the recent announcement of support for its new community token, PEPPER, by crypto exchanges Binance and Bitget, fuels optimism. Additionally, on-chain data further support the bullish thesis as CHZ shows a negative spike in Exchange Flow Balance and record daily trading volume, suggesting a potential rally in the coming days.

Binance and Bitget support Chiliz’s PEPPER airdrop

Crypto exchanges Binance and Bitget announced on Wednesday that they will support the PEPPER airdrop for Chiliz holders. PEPPER is a new community token built on the Chiliz Chain. Its purpose and utility are still a bit of a mystery—it was created for the community to take the reins and ride with it. Each CHZ holder is set to receive 150 PEPPER tokens per CHZ, creating significant interest and excitement within the community.

Binance will support the PEPPER airdrop https://t.co/sSHyAp796b

— Chiliz - The Sports Blockchain ⚽ (@Chiliz) October 9, 2024

Bitget will support the airdrops of the fair launch token - PEPPER ️

— Chiliz - The Sports Blockchain ⚽ (@Chiliz) October 9, 2024

⭐ 1st Snapshot Date: October 10th, 00:00 UTC

⭐ More info: @PepperChain#ChilizChain #PepperPeople ⚡️ $CHZhttps://t.co/eS8bVjA6YJ

Chiliz on-chain data shows strength

Chiliz’s on-chain metrics further support its bullish outlook. Santiment’s Exchange Flow Balance metric shows the net movement of CHZ tokens into and out of exchange wallets.

A rise in this metric indicates more CHZ has entered the exchanges than exited, hinting at selling pressure from investors. Conversely, a fall in the metric indicates that more CHZ left the exchange than entered, indicating less selling pressure from investors.

In the case of CHZ, this metric slumped from 2.63 million to -962.66 million from Monday to Wednesday. This fall in Exchange Flow Balance indicates increasing confidence among investors as holders remove Chiliz tokens from exchanges and store them in cold wallets.

%2520%5B09.56.10%2C%252010%2520Oct%2C%25202024%5D-638641340000584595.png&w=1536&q=95)

CHZ Exchange Flow Balance chart. Source: Santiment

Another aspect bolstering the platform’s bullish outlook is a recent surge in traders’ interest and liquidity in the CHZ chain. Crypto aggregator platform DefiLlama data shows Chiliz’s daily trading volume rose from $61.71 million on Tuesday to $477.01 million on Thursday, the new all-time high (ATH) in trading volume.

CHZ daily trading volume chart. Source: DefiLlama

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.