Why Bitcoin is still in a bear market and what this means for BTC price

- Bitcoin performance suggests that the bottom might already be in. However, analysts are waiting for an entire year to pass since the 2022 bear market rally.

- Bitcoin on-chain flows show the amount of Bitcoin transferred from miner addresses to wallets owned by exchanges has declined to multi-year lows.

- BTC is on track to climb higher with reducing on-chain flow of Bitcoin from miner addresses to wallets owned by exchanges.

Bitcoin is currently in a bear market, according to analysts, despite the massive rally of January. The selling pressure on the asset has reduced, with miner inflow to exchanges declining to multi-year lows. Despite the bullish catalysts, analysts are waiting a year post the 2022 bear market rally to conclude that the bearish phase is now behind us.

Also read: Bitcoin on-chain metrics show compelling signs of accumulation and continuation of BTC price rally

Bitcoin performance signals the last phase of a bear market

Bitcoin price performance suggests that the bottom might already be in. Despite these signals, analysts at cryptocurrency exchange Bitfinex argue that we must wait a whole year to pass since the 2022 bear market rally to conclude that the bottom is in and the bear market is behind us.

Analysts told traders in a note that,

Early 2020, before the third bitcoin rally of eight green candles, was a time of massive volatility amongst bearish macro conditions; this might be what we experience now in the first and second quarters of 2023.

The note cited that long-term holders continue to hold massive spot positions, a bullish catalyst for the asset.

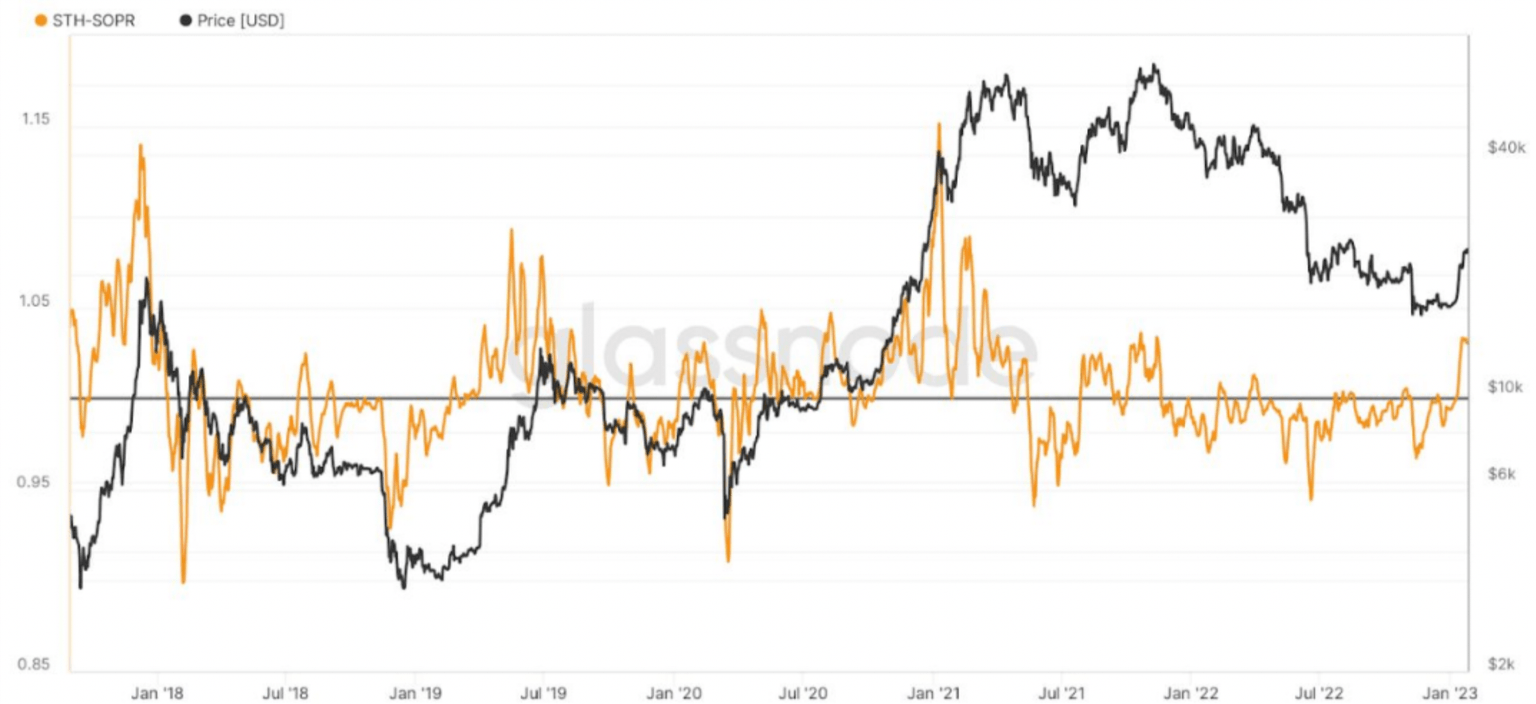

Short-term holders are selling BTC at a profit, while long-term holders accumulate

Bitcoin miners' inflow to exchanges hit multi-year lows

The selling pressure on Bitcoin from miners hit three-year lows. Miners are entities that supply computing power to the Bitcoin network in return for “rewards” in the form of tokens. Miners sell their BTC rewards to recover operational costs.

Throughout the prolonged bear market of 2022, Bitcoin miners filed for bankruptcy protection and liquidated holdings, contributing to selling pressure in the market. Reducing miner sales implies selling pressure on Bitcoin is weakening; this makes it a bullish development for BTC.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.