Why Bitcoin price still targets $50,000 despite inflation woes

- Bitcoin price dips lower again today, with pressure mounting on $45,261.84.

- The BTC price looks heavy, but the overall picture reveals that the uptrend is still in good health.

- Expect BTC price to dip further before rebounding and rallying towards $50,000.

Bitcoin (BTC) price looks to be under the control of some bearish pressure these past few days. It coincides with the correction that is happening as well in the equity markets, with Nasdaq leading in the losses. Investors are reshuffling their portfolio as a 50 basis point rate hike is back on the table after the FED signalled it would speed up its balance sheet runoff. Now investors and bulls appear to be awaiting better levels to reenter for the longer-term with Bitcoin set to test $50,000 in a matter of days.

Bitcoin price waits for the right moment to blow up

Bitcoin price is under some downward pressure as investors are being shaken up by comments from Dovish FED member Brainard yesterday, who said that the FED will speed up its timetable and start earlier and quicker with the balance sheet runoff. This will trigger more headwinds for risk assets in the short-term and has led equities and cryptocurrencies to trade on the backfoot since the comments came out. A short pull back need not to be a bad thing, however, as a broader picture of the charts shows that the uptrend is still very much in play, and a better entry level will attract more investors and bulls to provide more room for the uptrend and to prolong its lifespan.

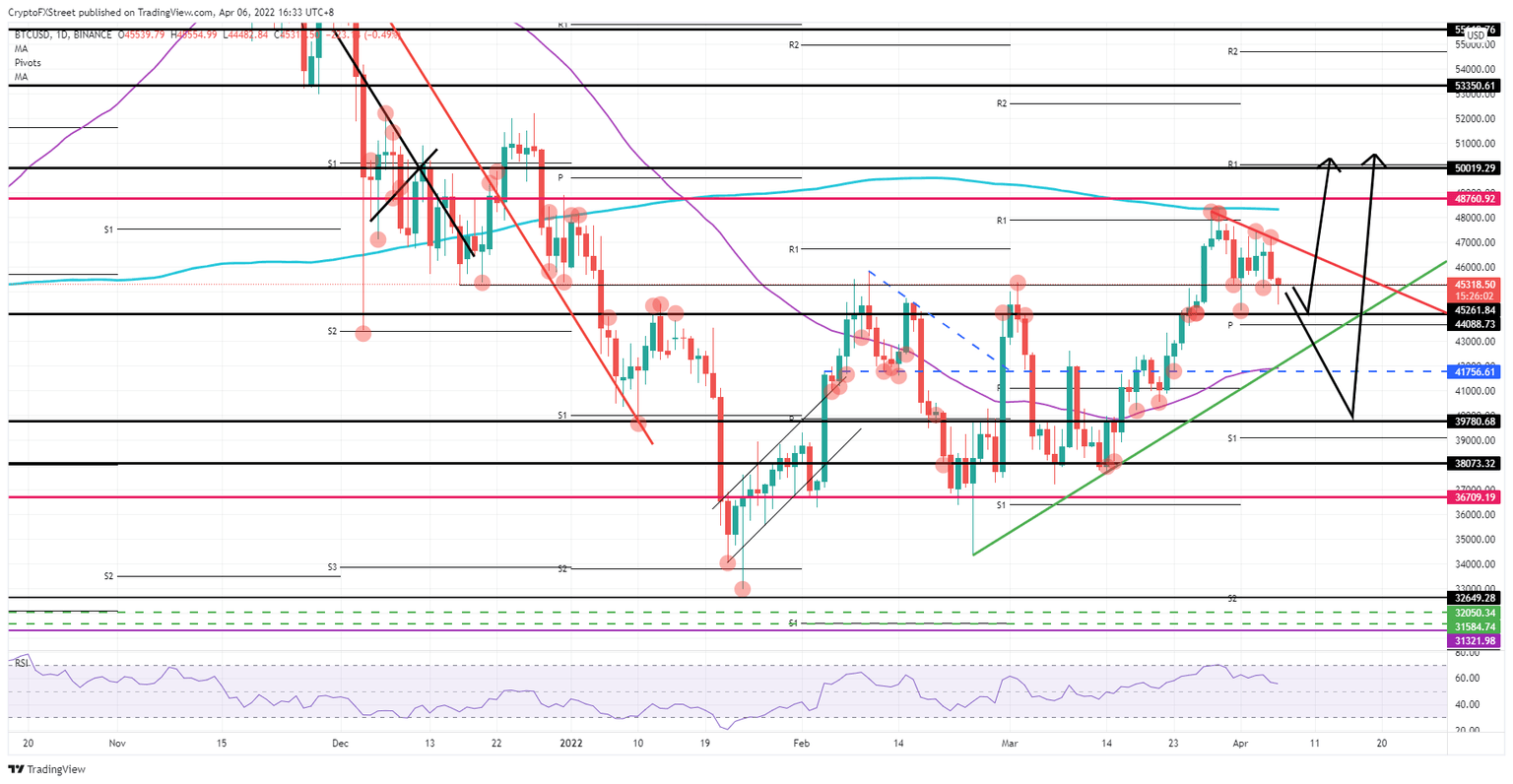

BTC price will see either investors or bulls engage at $44,088.71, which some already did on April 1st, since $45,261.84 is undergoing some heavy selling pressure, and looks undoubtedly set to break, with only the bodies of the candles holding above, but the wicks breaking through already a couple of times. The aforementioned $44,088.73 also favours the monthly pivot supporting price action around $43,671.84. Should that level not hold, expect then to see a massive inflow at $39,780.32. This will likely make a break below $40,000.00 a ‘false break’ and investors rubbing their hands to be able to buy BTC price at such a huge discount. This should then jump start a swing-trade back up towards $48,760.92, to then pop above $50,019.29 and the monthly R1.

BTC/USD daily chart

The risk to the downside could be that BTC price remains under bearish pressure. If investors' buying power proves too weak on a break below $40,000, and they prove to be no match for the significant short position that sits behind BTC price action it could squeeze out investors quite quickly. Seeing them cut their losses could see price action push back towards either $36,709.19 or even $32,649.28, putting Bitcoin price back in correction territory.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.