- Bitcoin open interest volume by expiry date indicates a majority of bearish sentiment in the market.

- BTC options worth roughly $2 billion will expire by the end of this week.

- However, options expiry has correlated with massive liquidations and price crashes in the past.

Following the options expiry on January 21, the cryptocurrency market prices plunged. The options expiry, involving the open interest of roughly $600 million seemed to have weighed on the market, sparking volatility among most digital assets.

Where is Bitcoin price headed?

Bitcoin price fell below the psychological level of $40,000 as support, sliding toward a swing low near $33,000. Liquidations across trading platforms were significant, with Bitcoin positions accounting for $292 million. BTC dropped over 50% from its all-time high on November 21, marking one of the most significant pullbacks since.

The options expiry on January 21 benefitted the bears, as Bitcoin price dipped below $40,000, while the maximum pain level was at $41,000, which is the price at which BTC would cause financial losses for the largest number of options holders at expiration.

Since maximum pain is the option’s strike price for which the most number of options contracts will expire worthlessly, the theory suggests that the asset price, Bitcoin will gravitate toward the max pain price as it heads toward option expiry.

The theory indicates that market makers will attempt to remain hedged against their open interest, by shorting or longing the futures market. There is a large incentive for market makers to manipulate spot prices closer toward the maximum pain price.

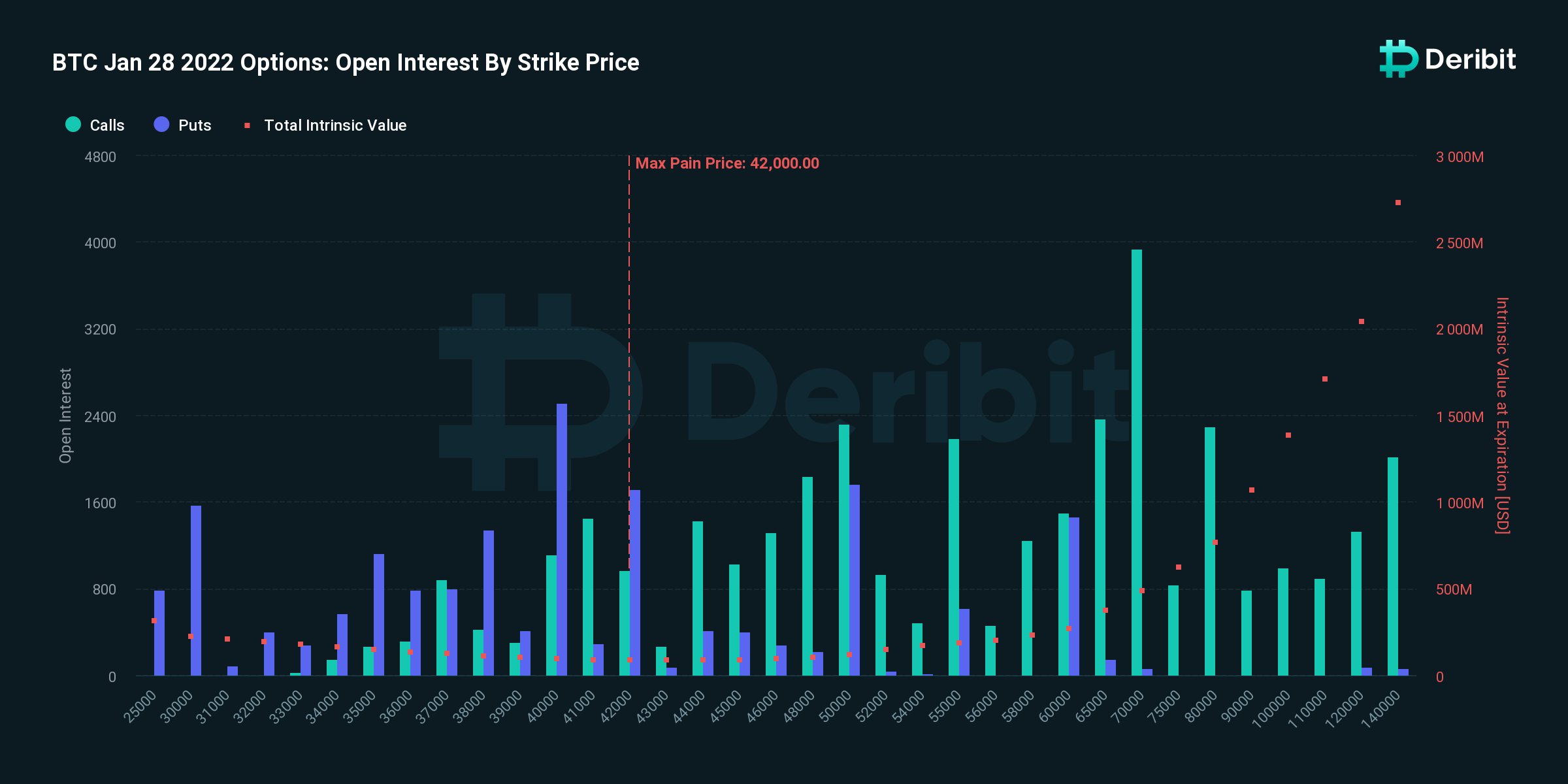

Roughly $2 billion worth of Bitcoin options is about to expire on January 28, while speculation continues to increase regarding the recent volatility in the market. Open options contracts were worth over 200,000 Bitcoin according to crypto data analytics site Coinglass.

While open interest shows that there are more calls than puts, the volume by expiry date indicates a majority of bearish sentiment.

Crypto analysts are expecting Bitcoin price to form a bottom after the January 28 options expiry, the last great options expiry date by volume and open interest in the month. Investors should note that this time, the max pain is at $42,000.

The size of total Bitcoin options open interest was at nearly $2 billion in December 2018, which was followed by a crypto market crash that witnessed BTC drop to a low of $3,160. The low was recorded on the first trading day after expiry. Bitcoin price also formed a bottom on the first trading day after the March 2020 expiry.

Bitcoin price could see a quick bounce toward the resistance zone near the max pain price at $40,000 to $42,000, before dipping again to form a bottom at around $30,000, as previous data suggests that BTC could form a bottom on the first trading day following options expiry.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Monero Price Forecast: XMR soars over 19% amid rising demand for privacy coins

Monero (XMR) price is extending its gains by 19% at the time of writing on Monday, following a 9.33% rally the previous week. On-chain metrics support this price surge, with XMR’s open interest reaching its highest level since December 20.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH stabilize while XRP shows strength

Bitcoin and Ethereum prices are stabilizing at around $93,500 and $1,770 at the time of writing on Monday, following a rally of over 10% and 12% the previous week. Ripple price also rallied 8.3% and closed above its key resistance level last week, indicating an uptrend ahead.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.