Why Bitcoin needs to defend $30K

An analysis of trades in the bitcoin options market reveals a crucial price threshold where selling might accelerate.

The simplistic days of trading bitcoin (BTC, -3.49%) by scanning technical charts and the spot market order book are passé.

The bitcoin market has matured since the March 2020 crash, and participants can no longer turn a blind eye toward macroeconomic developments and activity in the futures and options market.

That was especially the case on Thursday, when the risk-off mood on Wall Street put downward pressure on bitcoin and pushed the cryptocurrency toward $30,000 support, which, if breached, could invite more selling pressure from options traders, leading to a quick slide.

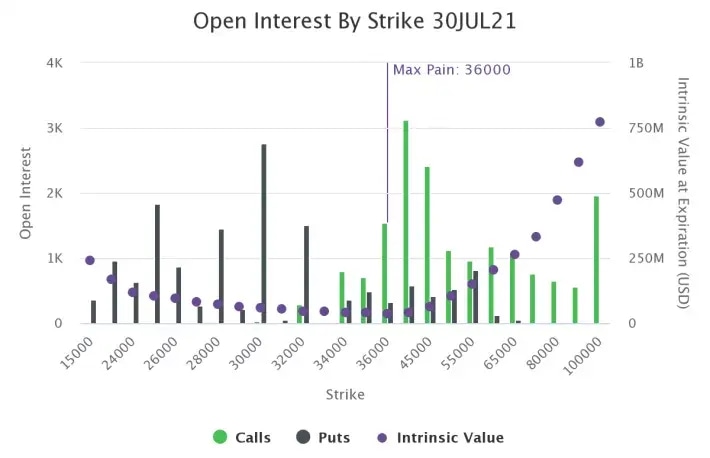

With bitcoin locked in the broad range of $30,000 to $40,000 since mid-May, many options traders have been selling puts at the $30,000 strike and selling calls at the $40,000 strike. These trades were booked on Deribit and other crypto-derivatives exchanges in hopes the consolidation would continue, leading to a drop in the implied volatility and the value of calls and puts.

A put option gives the purchaser the right but not the obligation to sell the underlying asset at a predetermined price on or before a specific date. A call option gives the right to buy. In plain English, selling a put option is akin to offering insurance to the put buyer against a price sell-off below a particular level – in this case $30,000.

“After the mid-May selling, volatility hit peak heights, but since then spot prices have been trading in a base range. These types of consolidation periods are perfect environments for lower-volatility trades,” said Greg Magadini, CEO and co-founder of Genesis Volatility. “The main idea is for prices to meander between support and resistance, and traders sell options expecting these levels to hold.”

But bitcoin is pushing toward the lower end of the range at $30,000. If that level breaks, traders who sold puts at that level may resort to hedging downside risk by shorting bitcoin futures or selling bitcoin in the spot market. That, in turn, could add to bearish pressures around the cryptocurrency, leading to a more profound price drop.

“If support or resistance levels break, traders will need to quickly hedge because prices will move to new levels fast,” Magadini said. “The hedging activity from various traders on the same side of the volatility trade also creates a self-reinforcing event.”

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.