- Bitcoin and Ethereum prices witnessed a rebound after oversold conditions, however on-chain activity and demand for the assets decline.

- Ethereum miners generated $571 million in revenue in July 2022 and analysts consider this ETH will be put right back on the market.

- Analysts believe the rebound was bear market relief, Ethereum price could hit a new low before a trend reversal.

Analysts at Glassnode and former Goldman Sachs executives believe that Ethereum holders could witness maximum pain before a recovery in the altcoin. Bitcoin price could likewise witness a drop in its price before the crypto bear market is over.

Also read: Is Ethereum price at risk of decline with plummeting NFT volume?

Bitcoin, Ethereum witness short-lived burst of market activity

Analysts at Glassnode have assessed whether the recent recovery in Bitcoin and Ethereum prices is a bear market relief rally or a sustained bullish impulse. A decline in on-chain activity in the two assets suggests lackluster demand, and that the downtrend may still not be over despite the recent rebound from extremely oversold conditions.

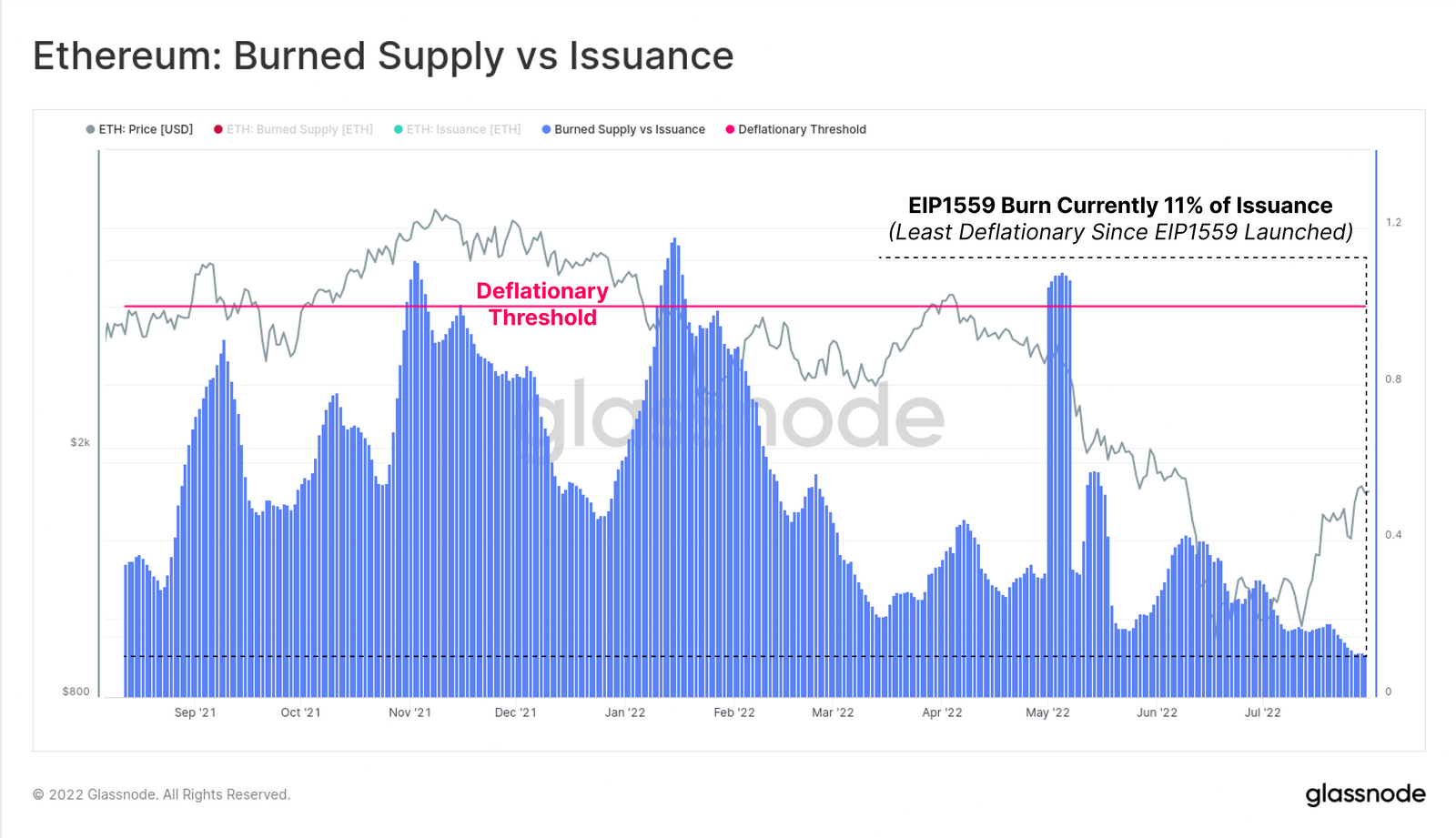

Their conclusion is that the recovery is not convincing enough if it comes off the back of low demand. Bitcoin blocks are partially empty, Ethereum gas prices have hit multi-year lows and the rate of EIP-1559 burn has hit an all-time low. The Bitcoin network continues to be dominated by HODLers (those who buy and hold indefinitely), with no significant increase in new demand, therefore BTC price outlook remains bearish when viewed through the lens of on-chain activity.

Ethereum burn rate has declined, hitting an all-time low. The total Ethereum burned stands at 11% of the total issuance of the altcoin. This implies that a large volume of Ethereum remains in circulation, despite the implementation of EIP-1559.

Ethereum: Burned Supply vs Issuance

Ethereum could face $571 million in selling pressure

Ethereum miners generated $571 million in revenue in July 2022. Adriano Feria, a market analyst and software developer argues that most of that $571 million worth of ETH mined will be put right back on the market. The selling pressure thus caused could push Ethereum price lower, however the altcoin is set to recover once the Merge goes live.

As miners cover their operating costs by selling earned ETH, there is a likelihood of a part of $571 million hitting exchanges. However, Feria is confident that Ethereum price will recover from the setback once the transition to proof-of-stake is complete.

Most of that $571 million worth of $ETH is put right back on the market. That's sell pressure that drives the price down, but it is going to vanish when the merge goes live. https://t.co/MXPs0S6Q9Q

— Adriano FΞRIA (@AdrianoFeria) August 1, 2022

Maximum pain scenario for Bitcoin and Ethereum holders

Raoul Pal, the CEO of Real Vision argues that there is a “general feeling” that macro conditions are so poor that ETH could drop to retest its recent low. The former Goldman Sachs executive argues that Ethereum is likely to move against crowd sentiment,

But my hunch is that the path of MAX PAIN is higher… $2,200 to $2,300 is the key one for me… a break of that either happens pre-merge or post-merge. Once everyone has got back in, the market can correct sharply before rising again based on the macro.

Analysts at FXStreet explore possibility of ETH price drop to $300

Amidst bear market woes, analysts at FXStreet are exploring the possibility of a continuation of Ethereum’s downtrend. This could result in a drop to $300, according to analysts’ prediction. For more information, check the video below:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top gainers Virtuals Protocol, Floki, Hyperliquid: Altcoins extend gains alongside Bitcoin

The cryptocurrency market sustains a market-wide bullish outlook at the time of writing on Tuesday, led by Bitcoin (BTC) and select altcoins, including Virtuals Protocol (VIRTUAL), Floki, and Hyperliquid (HYPE).

Token unlocks over $625 million this week across major projects SUI, OP, SOL, AVAX and DOGE

According to Wu Blockchain, 11 altcoins with one-time tokens unlock more than $5 million each in the next seven days. The total value of cliff and linear unlocked tokens exceeds $625 million.

TRUMP meme coin on-chain activity surged following dinner announcement: Kaiko

Kaiko Research published a report on Monday highlighting the significant impact of TRUMP's team dinner announcement on the meme coin sector. The announcement triggered a surge in on-chain activity and trading volumes, with TRUMP accounting for nearly 50% of all meme coin trading volume.

Coinbase launches new Bitcoin Yield Fund, offering investors 4–8% annual returns

Coinbase has launched a Bitcoin Yield Fund, aiming to offer non-U.S. investors sustainable 4–8% returns paid directly in Bitcoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.