Why Binance’s BUSD market cap growth is bullish for the BNB price

- Binance’s stablecoin BUSD market cap has risen over 400% this year, reaching $20 billion.

- BNB's price has risen 7% in market value since October.

- Binance Coin circulating supply has been persistently reducing throughout 2022.

Binance Coin price has risen 7% to start the month of October. Several industry advancements behind the scenes accompany the bullish influx.

Binance Coin paves the way forward.

Binance Coin price ascends 7% in stair-step formation this month, making investors wonder what to make of the current market conditions. While the technicals may be more of a guessing game, Binance has recently made several advancements in the crypto space.

Most notably, BUSD, the pegged US dollar stablecoin powered on the Binance blockchain, has crossed the $20 billion mark of market cap. That is more than a 400% growth in market cap since the start of the year. According to Binance, the stablecoin has become a reliable favorite amongst investors.

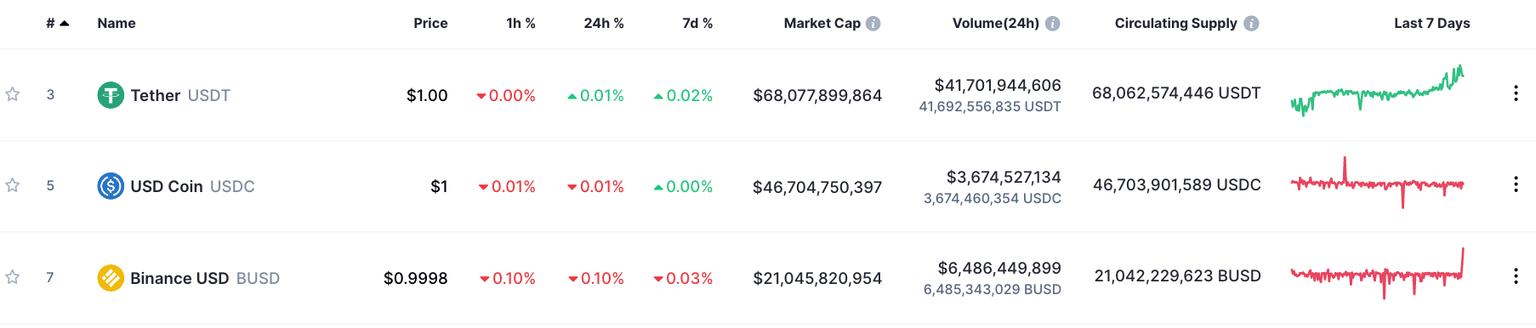

CoinMarketCap's Stable Coin Market Cap

The rise brings BUSD third place beneath the USDC and USDT powerhouse competitors. This is a promising gesture for the Binance Coin's future, as BUSD requires BNB gas fees with each transaction. In theory, more demand for BUSD should also create a demand for BNB.

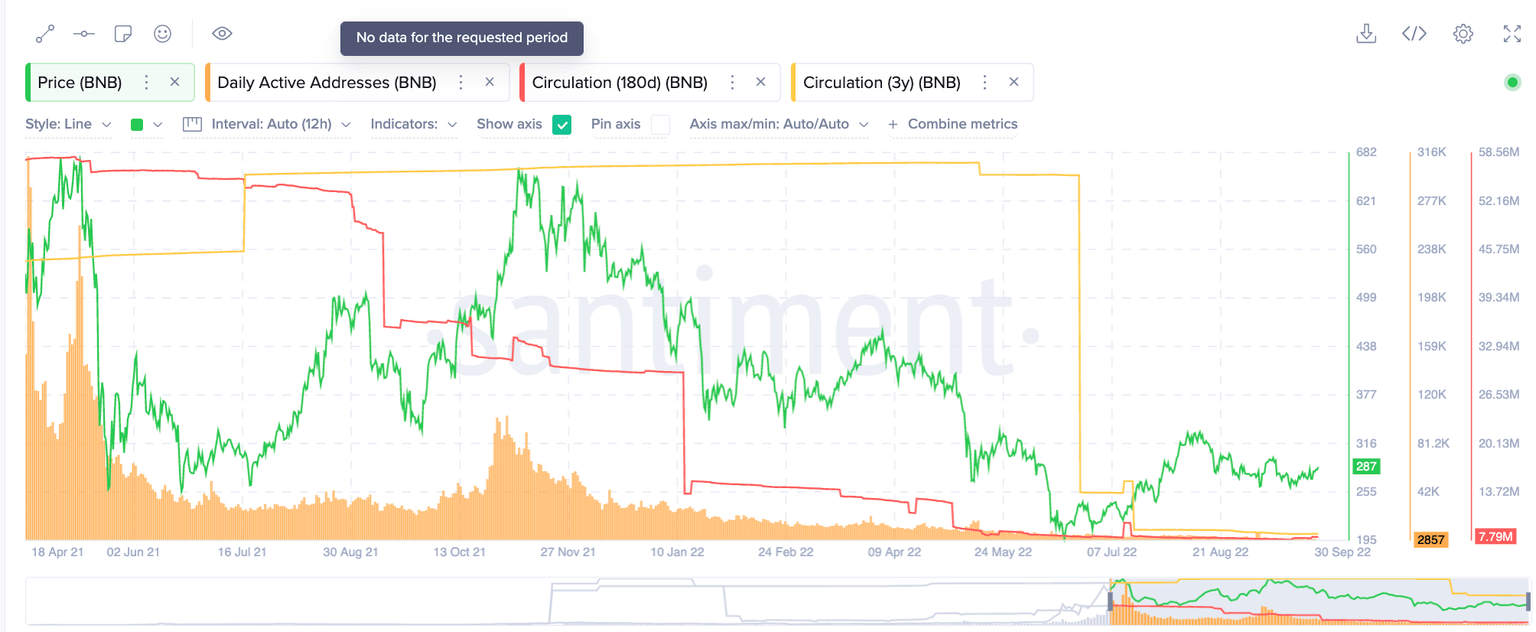

Santiment;s Circulating Supply Indicator

The BUSD component adds an interesting mix to the grand scheme of things. According to Santiment's 2-year circulation indicator, Binance Coin has witnessed a significant influx of coins being locked away in cold storage. Currently, BNB has 21 million tokens in circulation. A supply that was last witnessed in 2020 when BNB traded at $14 just before the infamous 5x rally by 2021.

Combining these factors, Binance appears to be positioning itself for crypto dominance. If the crypto market does witness another bull run, Binance Coin could be a key player in terms of growth and support through the help of the evergrowing BUSD token.

In the following video, our analysts deep dive into the price action of Binance Coin, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.