Why Avalanche’s AVAX price can drop below $10

- Avalanche price downtrend snowballs with a perfect storm building in global markets.

- Continuation of the recent sell-off in cryptocurrencies likely as less liquidity becomes available.

- Expect a 40% drop to come and AVAX price to dip below $10 for the first time in a year.

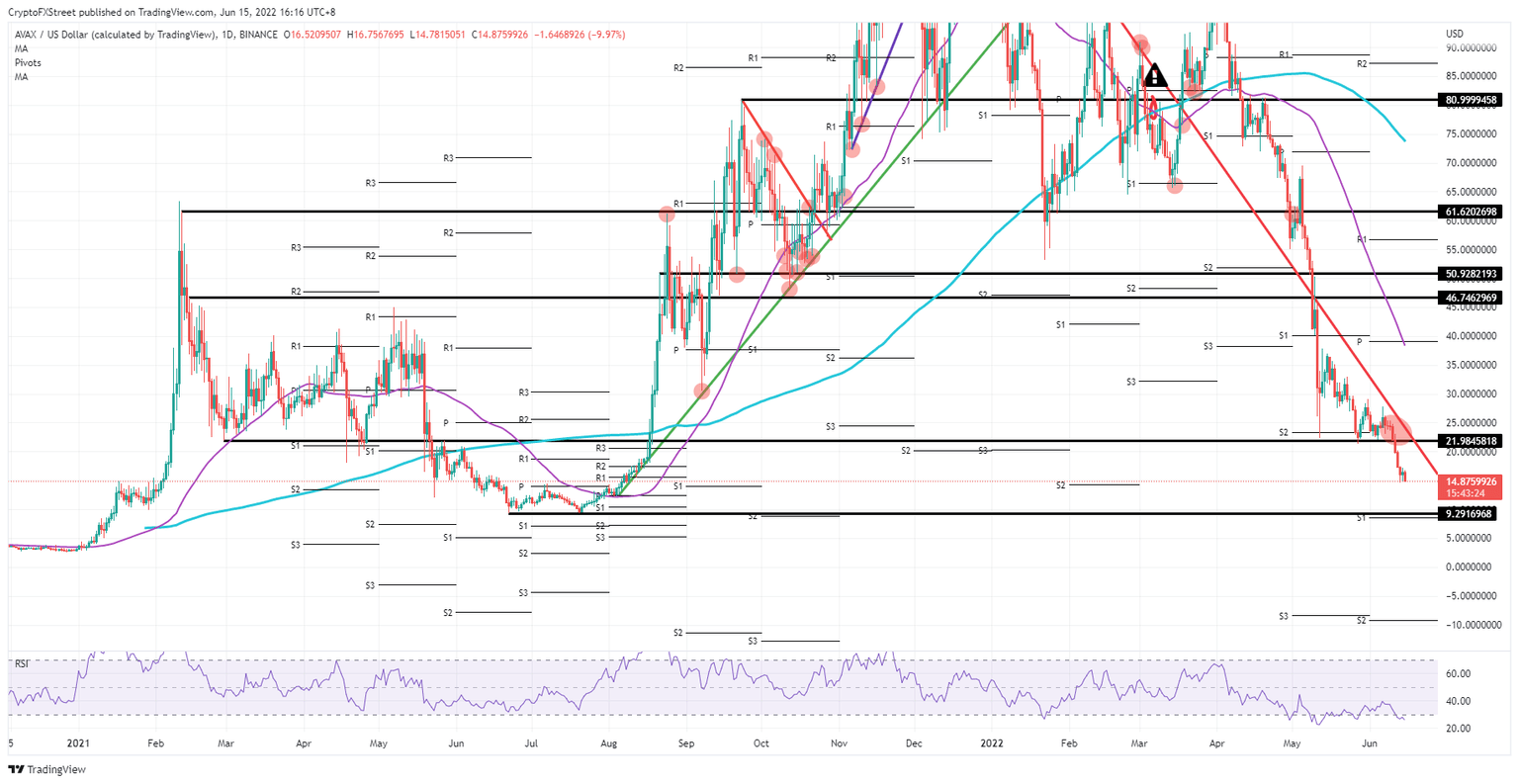

Avalanche (AVAX) price sees investors fleeing for the exit after what seemed to be an olive branch from the ECB already turned out to be a non-event. With AVAX price already testing the low of the past weekend, the market looks set to drop another leg lower. The biggest support nearby is at $9.29, the low of June 23, 2021, that has held thus far when tested but looks weak today.

AVAX price sees investors fleeing for the exit, putting crypto in a downward spiral

Avalanche price is suffering from the repercussions of the current dismal market mood, from which traders still need to make money. The economic reality explains why cryptocurrencies are correcting that much. With the rise in prices, households have less expendable income. This means fewer funds to put into cryptocurrencies, and in its turn, with descent, fear grows of a possible default in the cryptocurrency space.

AVAX price would drop quickly to $9.29 in case a default of a crypto broker emerges. On the back of that, investors would pull their money quickly out but will see issues to get dollars, as less buy-volume is there because households have the less expendable income to put into that asset class. So, investors will start to sell below the current price to get filled on their sell orders, triggering a spiral move that could easily break below the monthly S1 and even enter the danger zone near $0.

AVAX/USD daily chart

Markets could have come at a tipping point where a next year's recession is already priced in. That would mean that markets would finally start to rally from that point on. For AVAX price, that would mean a quick spin around upwards to $21.98, a break above the red descending trend line and rallying up to $40.00, to test the 55-day Simple Moving Average on the topside.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.