Why ApeCoin price could hit $20

- ApeCoin price continues to march higher with little impediment.

- Clear evidence of dip buying and support by bulls.

- Elliot Wave Analysis helps project and determine where the next major resistance level may occur.

ApeCoin price fell into a support zone previously identified on March 24, 2022, and then moved into the specified target zone in the $15 value area. Consolidation between $15 and $15.50 is now present, and there may be a short pause before another breakout occurs.

ApeCoin price action digests recent rally, to continue higher after ending consolidation

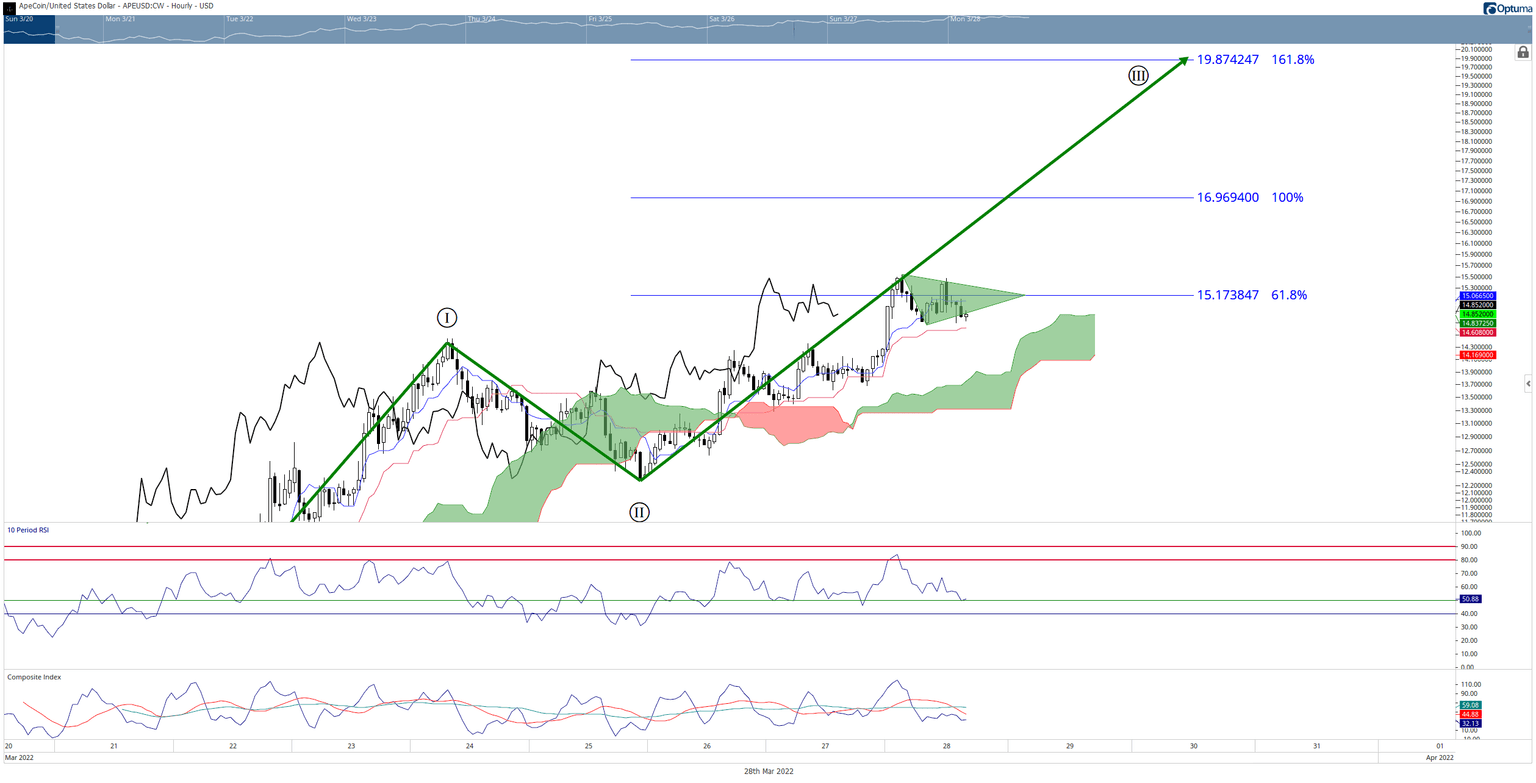

ApeCoin price is likely to continue its current run higher and complete the third wave of a broader Elliot Impulse Wave. Wave Three is typically a 161.8% extension of Wave One – but it can end short or slightly above the projected range. For APE, the 161.8% Fibonacci expansion is just shy of $20 at $19.87.

On the hourly chart, ApeCoin price has pulled back a little after hitting the 61.8% Fibonacci expansion at $15. This same behavior may occur again at the 100% Fibonacci expansion at $17.

From an oscillator perspective, ApeCoin price is highly likely to continue higher. The Relative Strength Index is in bull market conditions, and it is currently bouncing off the first oversold level at 50. Additionally, the Composite Index has an almost imperceptible hidden bullish divergence – this occurs when the price chart shows higher lows, but the oscillator displays lower lows. If the Composite Index crosses above its fast-moving average, then ApeCoin price will likely begin its next push higher.

An hourly close at or above $15.40 would likely begin the next uptrend towards $17 and then the $20 value area.

APE/USD 1-Hour Ichimoku Kinko Hyo Chart

However, downside risks do exist. The broader altcoin market has seen significant growth and gains over the past several weeks, but some profit-taking may occur. If selling pressure does enter the market, then ApeCoin price could see a swift return to the bottom of the Ichimoku Cloud (Senkou Span A) near the $13 value area before finding support.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.