- Shiba Inu price sees investor interest fading as price consolidates far away from $0.00001708.

- SHIB price drifts further to the downside as pressure builds for a new low for 2022.

- Expect to see a correction back to $0.00000507, saying goodbye to $0.00001000.

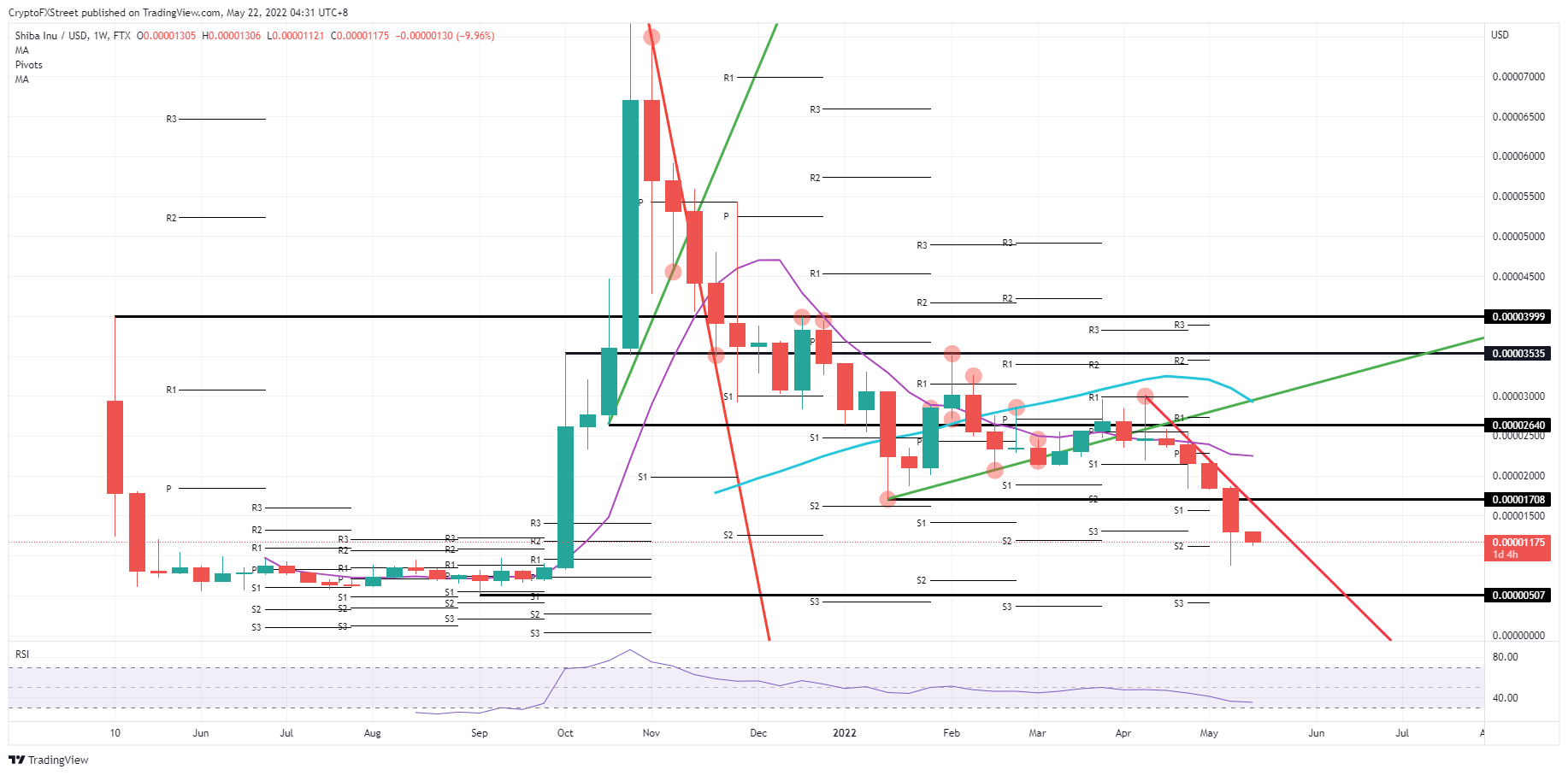

Shiba Inu (SHIB) price is too far gone from the significant pivotal level of $0.00001708 to make a strong comeback for now. Expect to see price action consolidate around current levels, slightly above $0.00001000, before another round of tail risks will come back to bite price action and trigger another drop in value. SHIB price looks set to slip below $0.00001000, trigger a trust crisis amongst investors, and finally settle at $0.00000507, losing another 60%.

SHIB price set to trigger a confidence vote amongst investors

Shiba Inu price is not really falling on the right side of the trade these past few weeks as SHIB is set to close out the week with a fifth consecutive loss. By doing so, investors and traders must start to be fed up with the almost puberal mood swings the cryptocurrency is having and being an outlier when cryptocurrency markets are rallying, and SHIB price being one the few that is bleeding at that exact moment. Expect to see more outflow of capital funds, making the price action less supportive and possibly triggering a falling knife soon.

SHIB price still has the $0.00001000 big figure in its corner, backing price action to consolidate above for now. But the backpack of geopolitical issues and tail risks is growing by the day as more unresolved issues are putting too many question markets around the secured path forward. Expect with that uncertainty and the sometimes unpredictable price moves in SHIB, investors start to lose confidence and could trigger at least another test at the $0.000010000 psychological level. Should that level be breached again, expect to see SHIB price axed in half towards $0.00000507 as investors will be fed up with carrying the loss on their investments and look the other way.

SHIB/USD weekly chart

One element that could ease the weight of the bearish backpack is when those tail risks can be deflated. That would come with some dovish comments from the FED or BOE or if the Ukraine news flows fades further to the background as the situation on the ground stabilises. That could trigger a quick turnaround with SHIB price back to $0.00001500, and bulls pressing against the red descending trend line to create a breakthrough on the descending trend line and touch $0.00001708 before trying to rally towards $0.00002100 and testing the 55-day Simple Moving Average as price cap to the upside;

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

ZKsync suffers security breach; hackers steal $5 million worth of ZK tokens

ZKsync (ZK), an Ethereum layer-2 scaling solution, reported on Tuesday that its admin wallet had been compromised. The hacker then minted 111 million unclaimed ZK tokens worth $5 million. The ZK token price dipped nearly 19% and closed at a 5% loss that day.

Ripple Price Prediction: Exchange inflows surge as XRP slides, what comes next?

Ripple (XRP) corrected along with other major digital assets, including Bitcoin (BTC) and Ethereum (ETH), and traded at $2.08 at the time of writing on Wednesday. The drawdown cut across the crypto market, causing the total capitalization to drop 3.2% to $2.736 trillion.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC struggles for a breakout while ETH and XRP extend losses

Bitcoin (BTC) price is stabilizing around $83,500 on Wednesday after it faced multiple rejections around its 200-day EMA at $85,000; a breakout indicates a bullish trend. Ethereum (ETH) and Ripple (XRP) extended their losses after facing resistance around their key levels.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC struggles for a breakout while ETH and XRP extend losses

Bitcoin (BTC) price is stabilizing around $83,500 on Wednesday after it faced multiple rejections around its 200-day EMA at $85,000; a breakout indicates a bullish trend. Ethereum (ETH) and Ripple (XRP) extended their losses after facing resistance around their key levels.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.