Why analysts expect wild rally in Ethereum killer Cardano price

- Cardano investors are at the highest level of profit-taking since March 2022, based on data from Santiment.

- Charles Hoskinson assured ADA holders that Vasil hard fork development is on track, 700 employees are working on the project.

- Cardano price could rally to $1.4 to $2 in the current uptrend, analysts argue.

Cardano investors are active and engaged in profit-taking, in the ongoing cycle. With assurances from Charles Hoskinson and developers on the Cardano network, ADA holders are convinced that the Vasil hard fork is on track.

Also read: Cardano price rally is imminent, analysts set $0.72 target for ADA

Cardano investors’ profit taking hit a peak

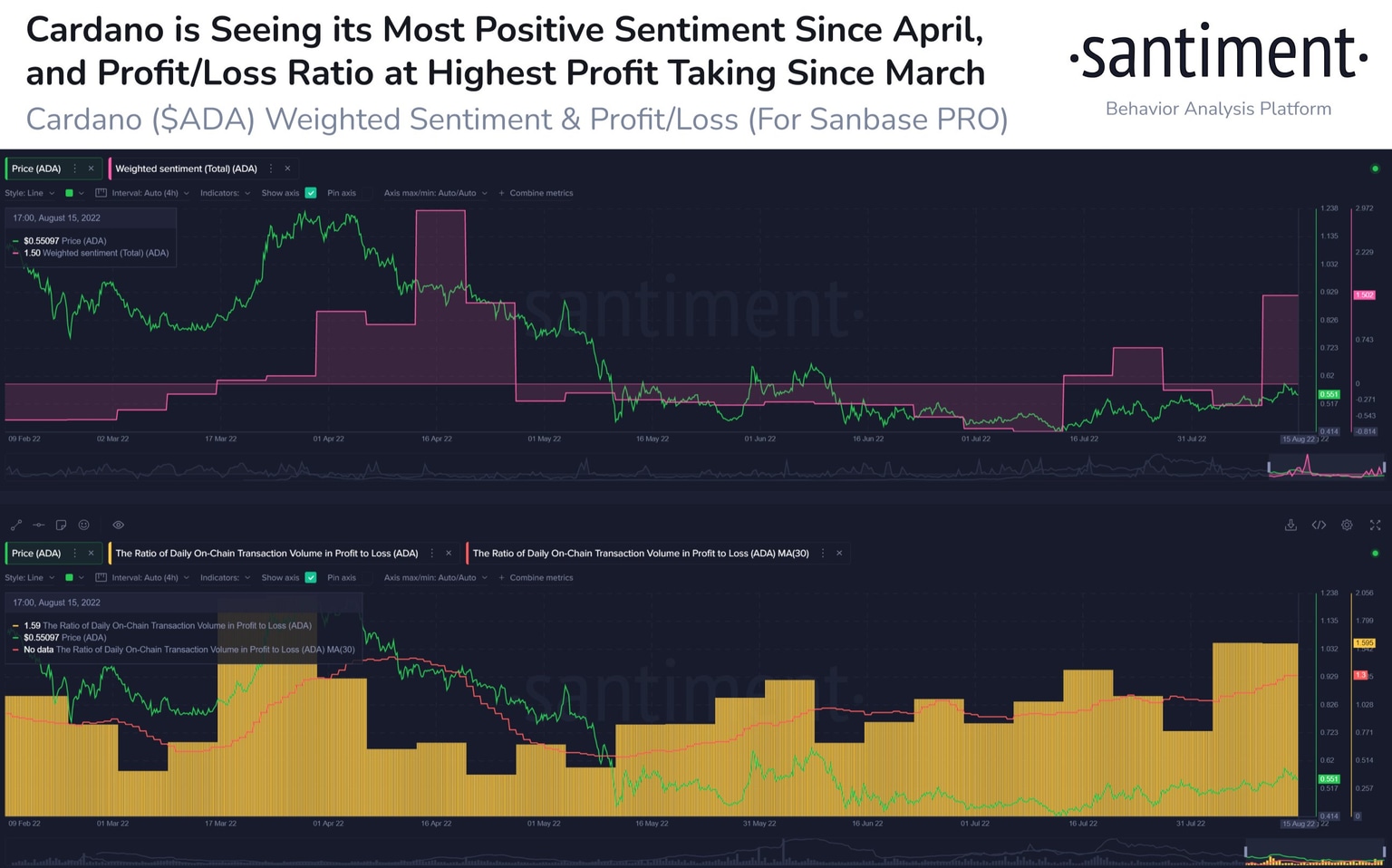

Crypto intelligence platform Santiment revealed that profit taking is at its highest point in four months in Cardano. In March 2022, Cardano price was sitting around the desired $1 level. Profit taking has hit a peak at $0.55, nearly 50% below the bullish target of $1.

Sentiment among investors is rather positive, Cardano price is up 22% in the past three weeks. The ratio of on-chain transactions as profit taking/selling at a loss is at its peak, for the first time in four weeks.

Cardano Sentiment among holders

Charles Hoskinson assured the crypto community that the Vasil hard fork will proceed without a hitch and no further bugs were discovered in recent tests. In the first two weeks of August, Hoskinson said that the Cardano testnet was hard forked to run version 1.35 of the Vasil upgrade.

Internal testing revealed three bugs, engineering and quality assurance firms have noted no need for significant changes on version 1.35.3. Hoskinson told ADA holders that the chances of something going wrong are really small, therefore fueling bullish sentiment in the Cardano community.

Though Cardano is notorious for its low profitability, ADA recently released its smart contract technology. Analysts have a bullish outlook on Cardano and predict a rally in the Ethereum-killer altcoin.

Cardano price could hit $1.40 to $2 in its uptrend

Gert van Lagen, a leading crypto analyst and trader believes bull market structure in ADA is intact. On the weekly Cardano price chart, high timeframe support is $0.40 to $1 and low timeframe resistance is $1.40 to $2.

A decline below $0.17 could invalidate the bullish thesis for Cardano price. Gert van Lagen believes the extension targets for waves IV-V are $6, $8, $12 and $27.

ADA/USD 1-week price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.