Ethereum Price Prediction: Is ETH heading below $1,000?

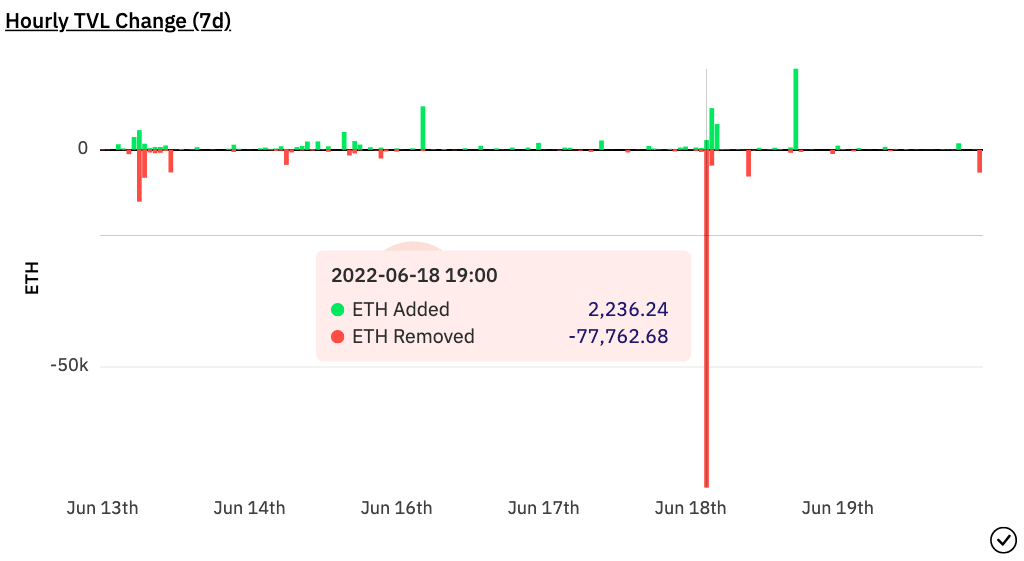

- Ethereum collateral position set a new record as 71,863.47 ETH were liquidated on June 18.

- Independent market analyst told his followers that latest Ethereum price rally would make for a clean fakeout.

- Analysts believe Ethereum price could plummet to $750 in the bear market, an 85% drop from all-time high.

UPDATE: Ethereum price predictions are mostly bearish as the main altcoin keeps trading between the psychological $1,000 support and a series lower highs that keep reaffirming the ongoing downtrend. Despite this, ETH price is enjoying a bounce-back Thursday, trading just above $1,100 at the time of this update (14.10 GMT). On-chain metrics are mostly bearish, as reported by FXStreet crypto analyst Akash Girimath, which also adds downside pressure to Ethereum, but there are some technical hints that at least an interim bottom could be surfacing around this area. According to Girimath, ETH bulls need to rally past the 8-day EMA to have a chance of turning the trend around and avoid the "fakeout" theory that could trigger another dive to $750.

PRIOR UPDATE: Ethereum price action is on the way to confirming the "fakeout" theory laid out in this article. After testing the $1,200 resistance, ETH bulls got rejected on Tuesday and the day closed with a second consecutive Doji candlestick, this time with a gravestone shape that hints at more losses to come. ETH price is trading in the red for Wednesday at the time of this update (10.40 GMT) and the psychological $1,000 support, which held up during the bearish attempt to break below it last Saturday, could be at risk this time. A lot will depend on the words of the Federal Reserve chairman Jerome Powell, scheduled to testify in the US Congress later in the day (14.00 GMT). Powell's words will have huge power over the whole financial markets, and particularly for high-risk, high-growth cryptocurrencies. A hawkish (more pessimistic) Powell could send Ethereum below $1,000.

Risk assets front-running Powell's speech + profit taking from those who caught the low.

— tedtalksmacro (@tedtalksmacro) June 22, 2022

Key levels to hold now are:

- #Bitcoin ~$19k

- Ethereum ~$1,000

- NQ ~11,000

Otherwise new lows. pic.twitter.com/uLMtuTcOiN

Ethereum price has rebounded from its recent slump, outperforming Bitcoin. Experts believe the recent rebound could end up being a “clean fakeout” as liquidations hit large Ethereum collateral positions. Some analysts are projecting a bearish outlook on Ethereum price.

Also read: This token could trigger the next meltdown in Ethereum and crypto

Largest Ethereum collateral position liquidated

Based on data from Dune Analytics, a crypto data intelligence platform, the wallet with code 0x2291F52bddc937b5B840d15E551e1DA8C80c2B3c liquidated a 71,863.47 ETH collateral position on Liquity at $927.13, at 19:39 GMT on June 18. This set the largest single liquidation record for Liquity.

Liquity is a decentralized borrowing protocol that allows users to draw loans at 0% interest against an Ethereum collateral. Loans are paid out in LUSD, a USD-pegged stablecoin on Liquity protocol. The chart below represents the hourly total value locked (TVL) change over the past week on Liquity and the largest ETH liquidation is represented on June 18.

Hourly TVL Change (7 days) Liquity

Ethereum price gained 30% in two days, outpaced Bitcoin

After its massive recent slump, Ethereum price has bounced back, rallying 30% within 48 hours. Experts noted that this ETH recovery has outpaced Bitcoin as the altcoin made a comeback above $1,100 within two days. Experts noted that Ethereum is currently the best-performing asset in the top five cryptocurrencies by market capitalization.

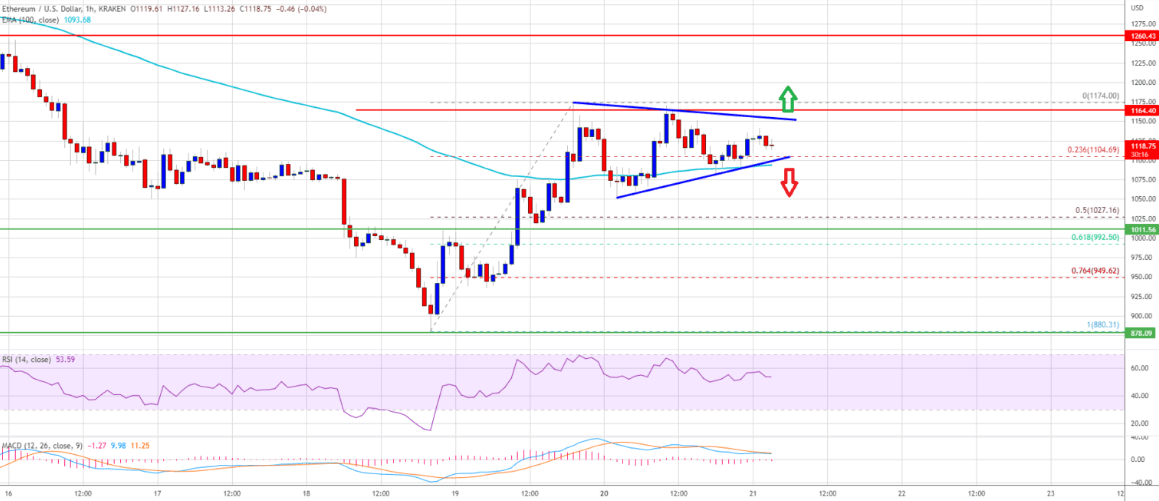

Ethereum started a short-term uptrend after dropping to the support zone at $880 on June 19 and climbed above $1,100 moving into a short-term bullish zone. The altcoin now faces major resistance near the $1,150 and $1,160 levels.

ETH-USD price chart

Analyst calls “clean fakeout” in Ethereum price

PostyXBT, a crypto trader and analyst, told his 79,900 followers to be careful of the recent rebound in Ethereum price. The analyst argued that the move “would make for a clean fakeout.”

The analyst was quoted in a tweet:

[Ethereum]... stopped out on the reclaim of the level. It looks like an opportunity to flip long towards $1250 but $btc still hasn't reclaimed it's like for like level. Would make for a clean fake out. Be careful.

Justin Bennett, co-founder of Cryptocademy, supports this fakeout prediction. Bennett noted that fakeouts to one side of the pattern trigger extended moves in the opposite direction. He considers $900 and $780 as support levels for Ethereum price.

Fakeouts to one side of a pattern usually trigger extended moves in the opposite direction. $ETH is a perfect example. Fakeout above 1200 on the 15th and breakdown today.

— Justin Bennett (@JustinBennettFX) June 18, 2022

$900 and $780 are support. #Ethereum probably visits the latter. pic.twitter.com/JSYEe6xGrj

Ethereum price could drop to $750 for this reason

Wendy O, the host of the O show and a leading crypto analyst, believes Ethereum price could plummet to a $750 low. Wendy argues that the current price of Ethereum is close to the beginning of 2021. Typically in bear markets, Bitcoin and Ethereum prices can drop up to 85%. If this holds true, an 85% drawdown from Ethereum’s all-time high of $4,800 would lead to $750 and this is the level that Wendy is watching out for.

Wendy told NextAdvisor,

Ethereum hit an all-time high in November 2021 at roughly $4,800, so an 85% correction would lead to around $750. However, it’s not going to be a straight shot down.

Key investment strategy before next Ethereum bull run

Analysts at FXStreet have recommended dollar cost averaging (DCA) as the ideal investment strategy before Ethereum’s next bull run. They consider $900 the bottom for Ethereum price and recommended $500 investments when price hit $1,000 and again when it hit $1,100. For more information, watch this video:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.