Who can say no to 35% profits in Crypto.com Coins

- Crypto.com Coin price is getting pumped for the next jump.

- The hot crypto summer is underway, with global markets focussing on rate cuts next year.

- More room to the upside is forecasted as price action remains underpinned and set to break $0.20.

Crypto.com Coin (CRO) price is on fire and riding the wave of the long-awaited hot crypto summer rally. Against that backdrop, investors are starting to focus on forecasted rate cuts as several central banks are starting to get a grip on inflation. With several growth sparks and recoveries in equities and other asset classes, risk on is back on the table and this is creating a solid tailwind for cryptocurrencies.

CRO price can only go north

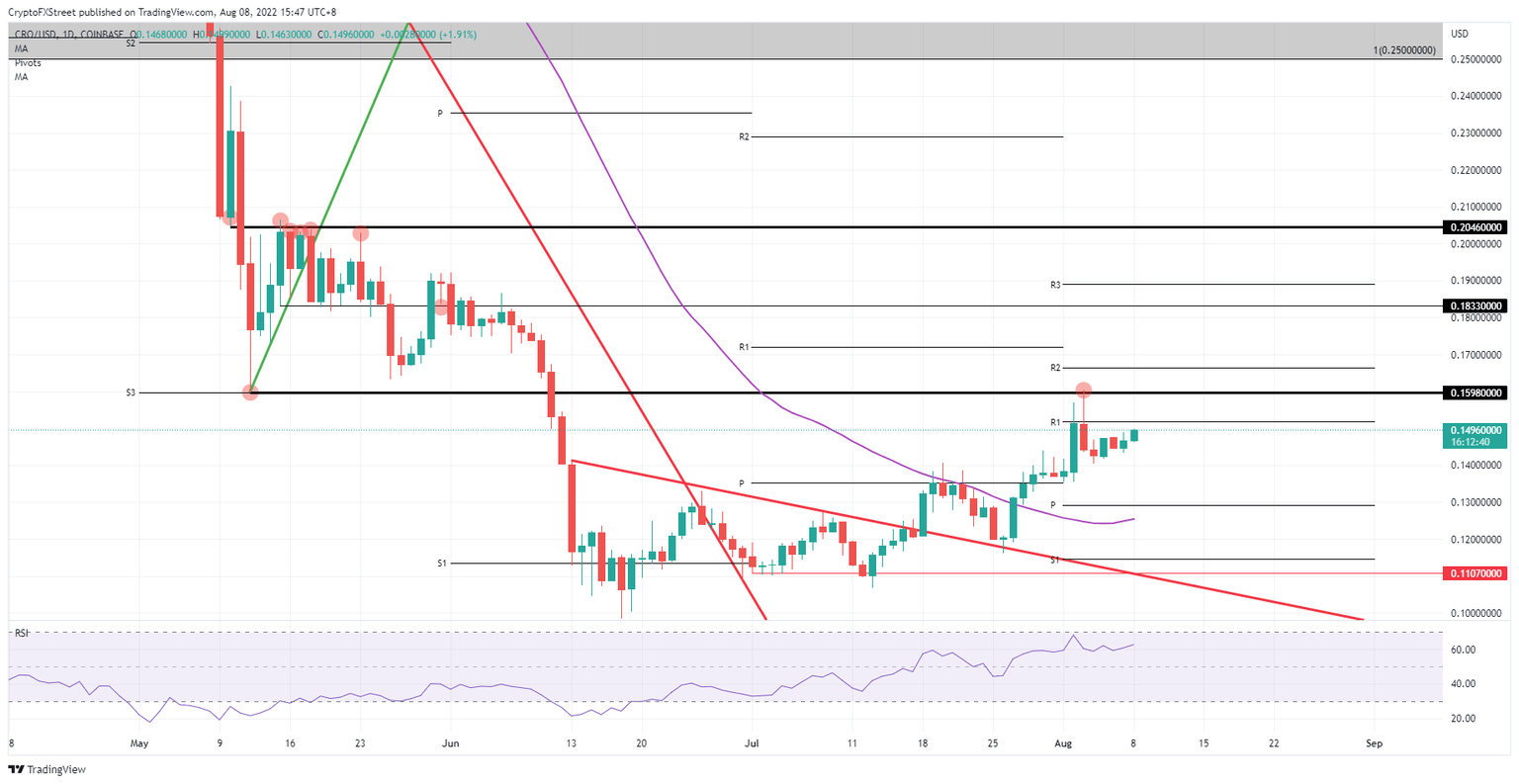

Crypto.com Coin price is showing a solid technical pattern with a bullish footprint, which is underpinning price action and keeping fades under control. This is an entirely different story from June, and the chart nicely shows the distribution phase in July, where price action trades sideways before starting to see a bullish uplift. The Relative Strength Index (RSI) also clearly shows the bulls' hand reflected in the price action as it nears the overbought barrier again.

CRO price looks like it will jump above $0.16 soon in the coming days as price action remains underpinned and buy-side volume is getting swamped with investors jumping on the summer rally. Once above $0.16, the road is open for another stretch towards $0.20, holding 35% of gains should bulls get CRO price action back up there.

CRO/USD Daily chart

The risk to the downside is that another rejection could unfold when trying to break through that $0.20 level. That, in addition to the RSI set to cross into overbought, are two arguments that could see attempts for another jump being cut short. In such a scenario, expect a fade back to $0.14, as price action remains underpinned with global markets currently back on the front foot.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.