“I think it’s essential to remember that just about everything is cyclical. There’s little I’m certain of, but these things are true: Cycles always prevail eventually. Nothing goes in one direction forever. Trees don’t grow to the sky. Few things go to zero. And there’s little that’s as dangerous for investor health as insistence on extrapolating today’s events into the future.”

- Howard Marks, billionaire investor

With Bitcoin deep in the midst of a bear market as it hits its decennial anniversary, we wanted to look back at the cryptocurrency’s full historic cycles (from bear market trough to the next bear market trough) to see what insights they can provide for investors moving forward.

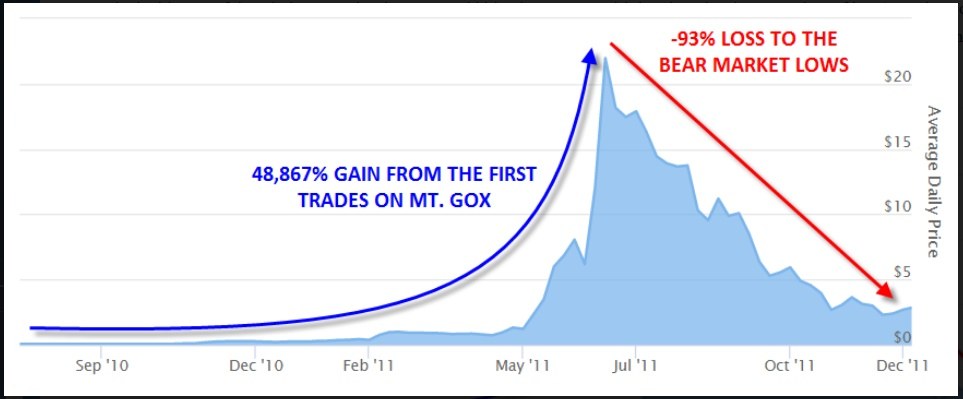

2010 – November 2011: The First Bull/Bear Cycle

For most of bitcoin’s first year, it was merely a niche experiment for a dedicated group of developers called cypherpunks. The nascent cryptocurrency’s first expansion beyond this tightknit group was kickstarted by the establishment of Mt. Gox, the first major bitcoin exchange, in July 2010. From that point until the exchange was hacked in June 2011, bitcoin’s price rocketed from $0.06 to a peak of $29.38, a nearly 50,000% rally in less than a year!

As even casual followers of the market have discovered by now though, cryptoassets oscillate between periods of excessive euphoria and deep depression; bitcoin’s first big bubble provided the quintessential example. With nowhere to easily exchange their newly acquired assets and fears about the legitimacy of the whole enterprise, investors sold bitcoin en masse, driving the price down to a low of just $2.14 by November, a full 93% decline in less than half a year. At the trough of peak despondency, even the most diehard believers were no doubt second-guessing their commitment to cryptocurrencies.

Source: 99Bitcoins, FOREX.com

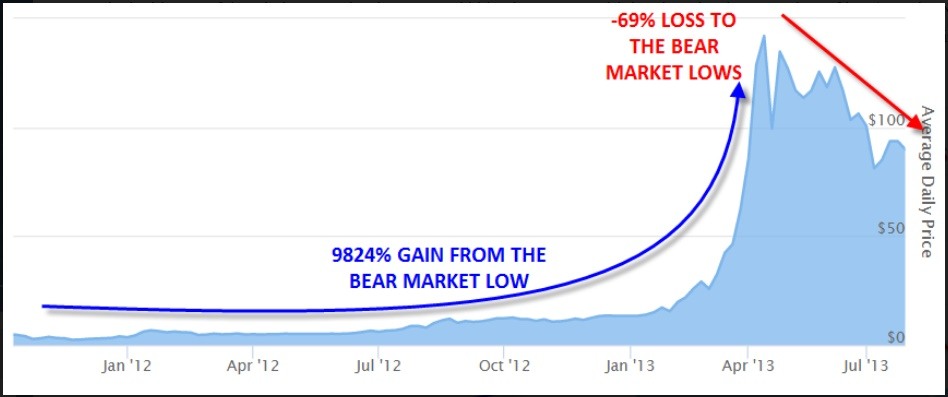

November 2011 – July 2013: Cyprus Sparks Another Run

The night is darkest just before the dawn, as they say, and bitcoin embarked on another bull cycle starting in late 2011. While there were several brief 20-30% declines along the way, bitcoin bulls remained in control throughout 2012 and into early 2013 as the cryptocurrency’s supranational status appealed to investors in the midst of Cyprus’s financial crisis (to say nothing of its utility in illicit transactions).

Bitcoin eventually peaked at $212.38 in April 2013 amidst (what else?) issues with the newly-revived Mt. Gox exchange, this time centered around the site’s stability and regulatory concerns. From there, prices fell nearly 70% over the next week to trade below $66, and after bouncing through the rest of Q2, revisited that low again in early July.

Source: 99Bitcoins, FOREX.com

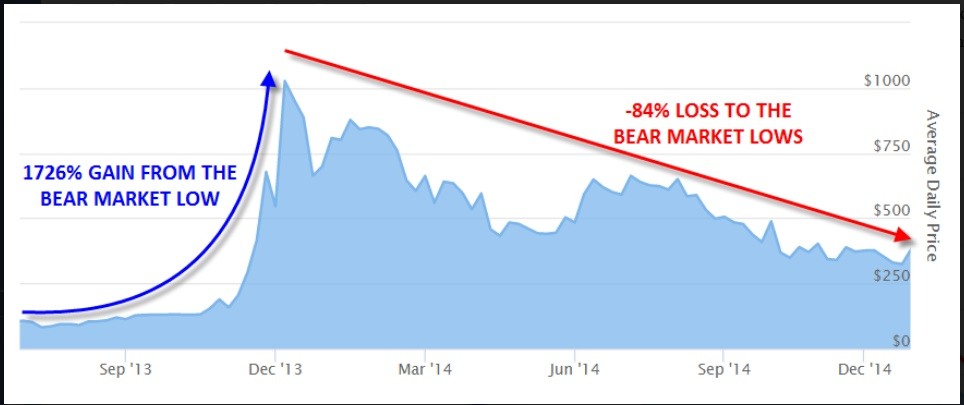

July 2013 – January 2015: China Enters the Fray

In late 2013, the center of the bitcoin trading world migrated from Tokyo (where Mt. Gox was based) across the Sea of Japan to China, the planet’s most populous country. Amidst a booming economy and relatively strict capital controls, Chinese traders took immediately to speculating on bitcoin, bolstered by an endorsement from the People’s Bank of China in November 2013. However, in what’s since become a common theme for cryptoassets, China seemingly reneged on its support a few weeks later, banning financial institutions from using bitcoin in early December. The Chinese government went on to issue additional strict regulations on the market in the coming months, putting an end to bitcoin’s third major cycle.

Bitcoin rode the regulatory tide from a trough of $68 in July 2013 to peak above $1200 by late November. From there, the cryptocurrency endured its longest (though not deepest) bearish cycle; prices eventually bottomed out below $200 in January 2015, losing a full 84% over more than a year.

Source: 99Bitcoins, FOREX.com

January 2015 – ???: Bitcoin Goes Mainstream

Befitting the recovery from its longest bear market, bitcoin began its longest bull run in January 2015, though few investors knew it at the time. Prices gradually began to grind higher as new exchanges cropped up and an increasing number of vendors started to accept bitcoin for payments. Climbing the proverbial “wall of worry,” the cryptocurrency was able to shrug off continued exchange hacks, a “halving” of the reward for mining a bitcoin block, and multiple forks on its way to peak near $20,000 the week before Christmas 2017.

It's been long year since the euphoric highs of a year ago, and sentiment has done a complete 180° over that period. With prices down over 80% from the highs and price still definitively within a pattern of “lower lows and lower highs,” most casual traders have written off their investments in the crypto space and moved on to other markets.

Source: 99Bitcoins, FOREX.com

Conclusions

Make no mistake: the current concerns surrounding regulation, manipulation, and adoption present a bleak outlook for digital assets as a whole, but it’s important to remember that Bitcoin has gone through similar periods of strife in the past. As Howard Marks noted, “…Few things go to zero. And there’s little that’s as dangerous for investor health as insistence on extrapolating today’s events into the future.”

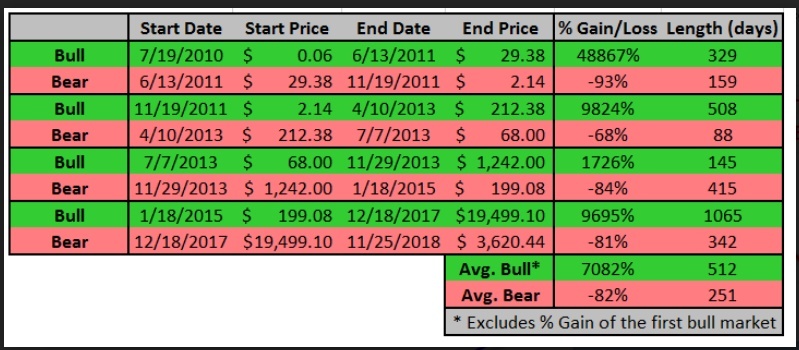

As the table below shows, bitcoin’s current bull-bear cycle is not dramatically different than the previous three cycles:

Indeed, the present bear market loss almost perfectly matches the percentage drawdown of previous major bear markets. After the longest bull market in history, it certainly wouldn’t be surprising to see this bear market stretch into 2019. That said, downbeat sentiment and periods of 70-90% drawdowns from euphoric highs have historically presented strong buying opportunities for Bitcoin and the cryptoasset space as a whole.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.