- Bitcoin price is retracing its steps after hitting $35,500 this past week, even as the market awaits a recovery.

- Even though the investors might be extremely bullish for even a short-term rise, 88% of all BTC HODLers are awaiting a rise to at least the ATH of $67,789.

- Their conviction is long-term, hence why the network has been noting less than $2 billion worth of selling/realized profits this past week.

Bitcoin price, following the recent rally, is moving sideways at the moment. The likeliness of a downtrend from here would stem from the possibility of investors looking to book profits, but surprisingly, that sentiment is not relayed in the case of 17.2 million BTC.

Daily Digest Market Movers: Bitcoin investors are HODLing fiercely

The recent rally in Bitcoin price incentivized some people to sell their BTC for profits while others are holding on, awaiting a climb back to $40,000. This optimism comes from the hope of a spot Bitcoin ETF being approved soon enough. Thus, we could see some significant profit booking around $40,000.

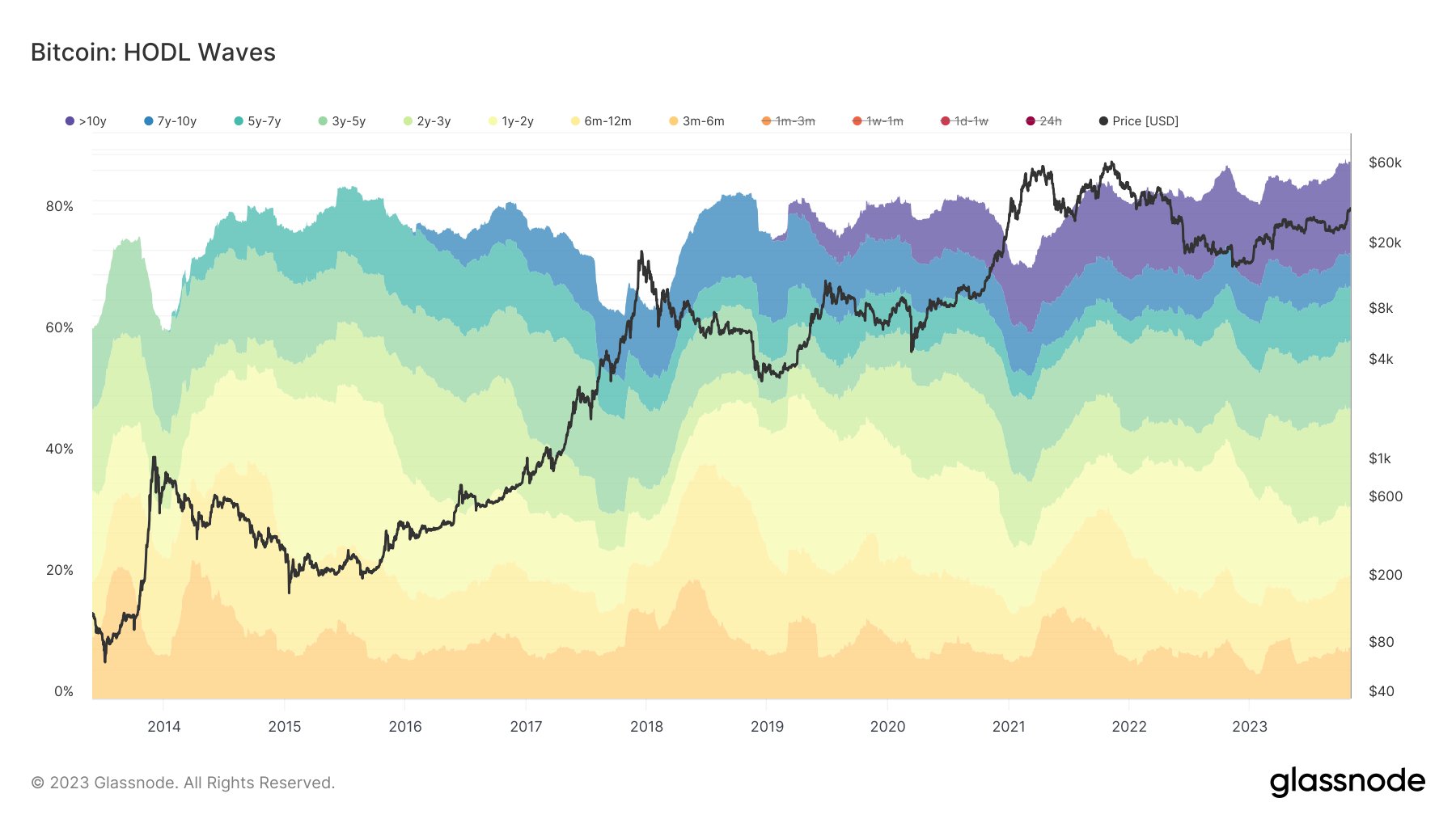

However, that does not even begin to relay the actual picture and what Bitcoin investors actually want. According to the HODL waves metric on Glassnode, the supply of BTC aged between three months and ten years has been unmoved despite the 32% rally that took place towards the second half of October.

These BTCs represent about 88% of the entire circulating supply of Bitcoin, amounting to over 17.285 million BTC worth nearly $600 billion.

Bitcoin HODL waves

As noted by former crypto fund manager Ulrik Lykke,

“This static supply signifies robust conviction among holders. It illustrates a collective long-term vision over short-term gains, hinting at a maturing market rather than just a trading vessel.

This conviction is verified in the fact that following the rally when the market was expecting considerable profit booking, less than $2 billion worth of BTC was sold for profits in the entire week. Since then, the realized profits have returned to their average, confirming that BTC holders are waiting for a much bigger price tag to sell their supply at.

Bitcoin realized profits

The most likely figure that they would consider selling their assets at is once Bitcoin marks a fresh all-time high. Until the ATH is broken, their HODLing will continue. This places their target price 96% above the market price of Bitcoin of $34,684.

The 96% rally would send the cryptocurrency to $67,789, which would potentially trigger some intensive selling from these long-term investors.

BTC/USD 3-day chart

Technical Analysis: Bitcoin price micro outlook remains unchanged

Bitcoin price noted some minor decline following the release of the US Nonfarm Payrolls report on Friday, but for the most part, the cryptocurrency is staying put. As long as BTC does not fall through the support line at $33,901, the sideways movement could lead to the uptrend being resumed.

This sets the next Bitcoin price target at $40,000, which would require BTC first to flip the $36,833 resistance into a support floor.

BTC/USD 1-day chart

Nevertheless, if the uptrend does not resume soon and the investors' conviction of another rally breaks, profit booking could send Bitcoin price into a descent. If the $33,901 support is invalidated, the cryptocurrency could test $31,507 as support. Losing this line would invalidate the bullish thesis, leaving Bitcoin vulnerable to falling to $30,000.

Read more - Bitcoin price spikes in response to US Nonfarm Payrolls for October

(This story was corrected on November 6 at 12:24 GMT to say, in the third bullet point, that less than $2 billion worth of BTC was sold for profits in the entire week, not less than $1 billion.)

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[19.45.16,%2003%20Nov,%202023]-638346511158075925.png)