Where's the crypto market heading as we near 2022? Top most promising GameFi tokens

Crypto investors who pinned their faith on the prediction that Bitcoin would soar to $100,000 by the year-end now have to reconcile themselves to the reality that there won't be a Santa Claus rally before the year is out. After it went above $69K in November, Bitcoin's price retraced greatly and is now struggling to hold above the 50K mark, pulling the rest of the cryptocurrencies along with it.

It looks like the market is about to recover

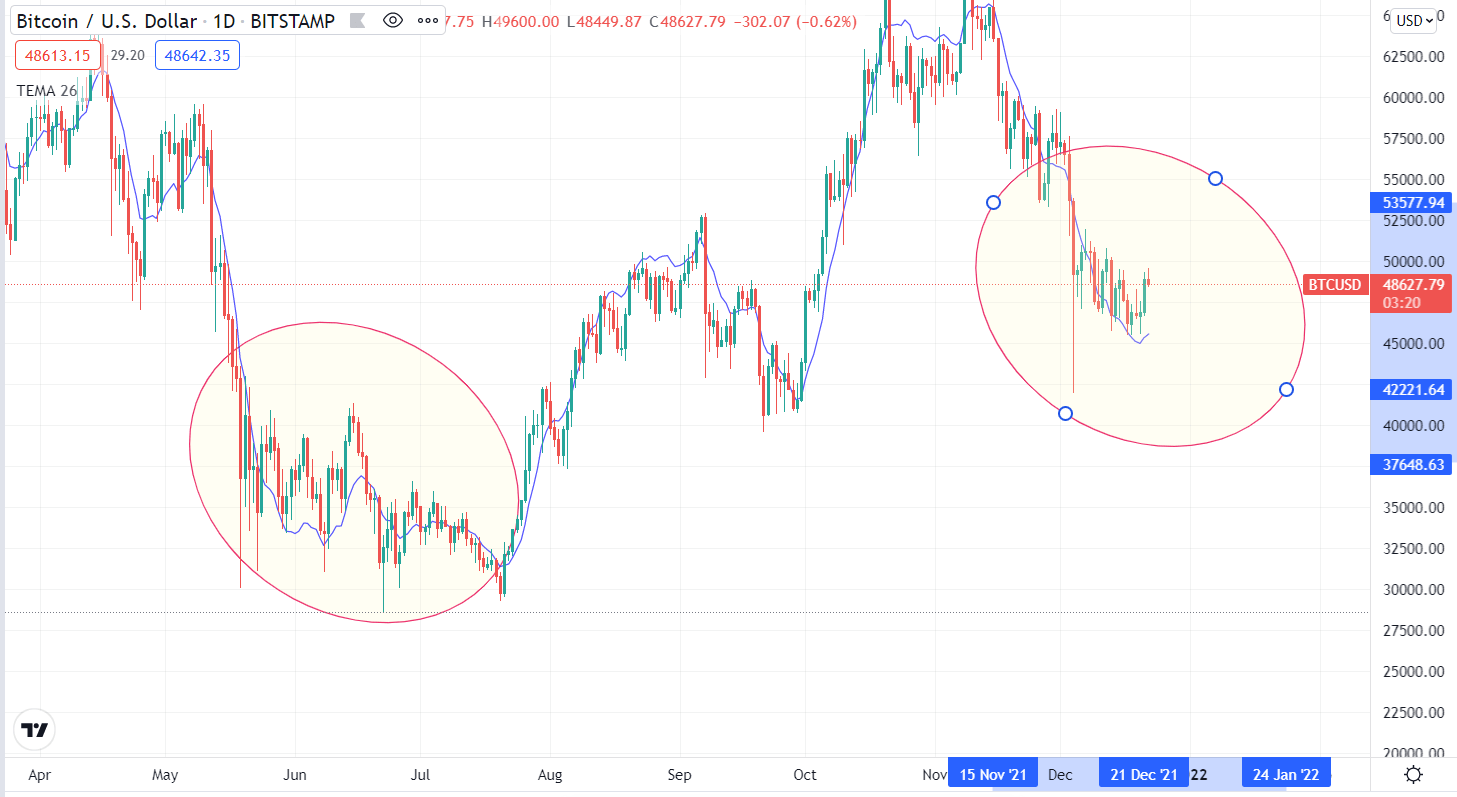

However, technical analysis comes into play when we cannot see a clear trend and there are no strong fundamentals to help us make sense of how the market is going to behave.

There are often repetitive patterns in price fluctuations due to the psychology of the market, which is driven by emotions like fear or excitement. The technical analysis examines chart patterns to identify these emotions and subsequent market movements to discover trends.

The cryptocurrency Fear & Greed Index fell to 27 a couple of days ago, but currently it stands at 40. Although it's still a fear territory, this could be a solid buying opportunity.

Source: Alternative.me

The current BTC price pattern resembles that of the consolidation phase we witnessed from May to July 2021. The weakness is likely to last until about early January or late February 2022, and then we might see a BTC rally that will take it to new heights, with ripple effects on the rest of the top cryptocurrencies.

Source: TradingView

GameFi: Blockchain's next big thing

Meanwhile, the $68 billion GameFi industry, which is a hybrid of blockchain gaming and DeFi, is on the rise and is expected to continue its rapid growth in 2022 even amid a sour mood in the wider crypto market.

As of now, the majority of wallets in existence — 1.12 million — are connected to blockchain games.

Source: DappRadar

The play-to-earn segment has been boosted by the metaverse narrative, allowing players to earn tokens for their gaming activities, which can be used to purchase in-game assets, or traded for other cryptocurrencies or fiat on exchanges.

GameFi games can be categorized into two types:

-

Liquid mining games.

-

Games based entirely on mining.

In liquid mining games, users must pledge tokens or NFTs before they can begin gameplay, whereas in the second game type, players can begin immediately and receive game props or NFT equipment which can be sold at a profit.

GameFi projects you should know

In order for a GameFi project to succeed, it is critical that the number of active crypto wallets continues to grow, as well as the volume of transactions and the value of the game.

Following are the top DApps in the Games category, ranked by unique wallet addresses, which continue to increase, so it makes sense that the tokens that power them would also thrive.

Splinterlands (SPS)

Splinterlands is the most popular game, with 315,447 unique wallet addresses interacting with its smart contracts over the past 30 days, and a total asset value of $664,862.

It is a collectible trading card game, with cards acting as non-financial tokens and its design reminiscent of Pokemon cards and World of Warcraft characters.

Throughout the game, a mystical world is revealed through a great deal of storytelling. This game is built on the Steem blockchain and offers high-speed transactions. Although Splinterlands is based on the HIVE blockchain, Splinterlands' tokenized assets can be transferred to the WAX blockchain by means of the Splinterlands WAX bridge.

As of now, its SPS token is priced at $0.221667 and is not soaring due to the weak overall market, but the popularity of the project could lead to strong gains next year.

Source: CoinGecko

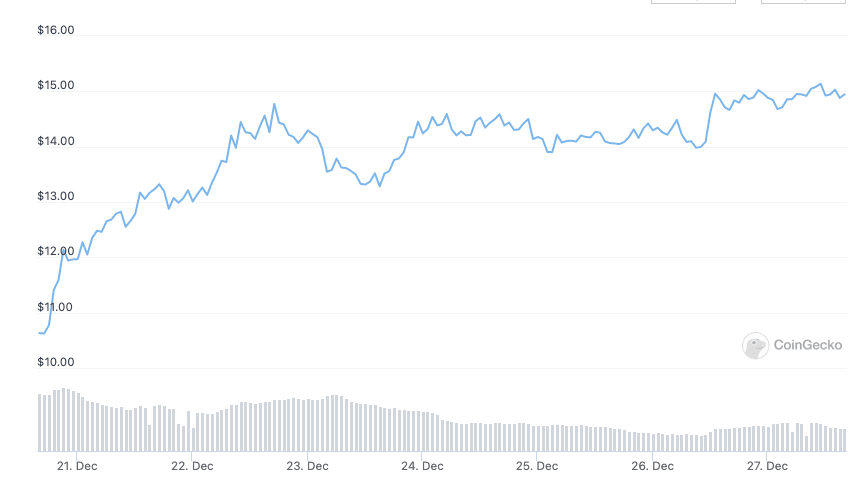

DeFi Kingdoms (JEWEL)

DeFi Kingdoms is a game, DEX, liquidity pool, and a market for rare utility-driven NFTs, all done in nostalgia-inducing fantasy pixel art.

The number of unique wallet addresses interacting with DeFi Kingdom's smart contracts over the past 30 days reached 286,539, a whopping 439% increase from the previous month.

Its JEWEL token traded at $14.95 at the time of writing, up 21% for the past 7 days, and posting a 94% rise month-on-month.

Source: CoinGecko

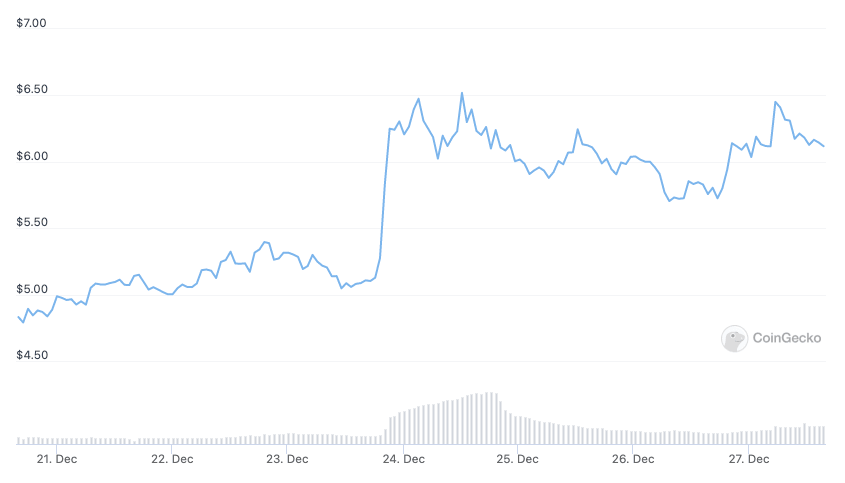

MOBOX: NFT farmer (MBOX)

This gaming platform combines yield farming and farming NFTs to create a free-to-play and play-to-earn model. The game had 200,916 unique wallet addresses in the past 30 days, up 30% from the previous month, and a balance of $175,456,016.93

As of last check, MBOX token was trading at $6.12, up 6.3% over the past 24 hours and up 19% over the past 7 days.

Source: CoinGecko

X World Games (XWG)

X World Games is a themed gaming DApp on the BSC network that has an NFT marketplace. In addition to enhanced gameplay and earning mechanisms, players can acquire NFT assets which is expected to benefit them with long-term revenues generated through the game's playing volume.

Its user base has increased by 159.72% over the past 30 days to 180,112 and the total value of assets in the DApp's smart contracts came in at $2,909,449.32.

The project’s XWG token traded at $0.0969 at the time of writing.

Source: CoinGecko

Author

Mike Ermolaev

Independent Analyst

Mike Ermolaev is the founder of Outset PR. The agency helps tech companies, especially blockchain and Web3 projects, get the desired recognition thanks to its wealth of media connections.