Where will Cardano price go next as ADA bulls arrive at the first target?

- Cardano price is trading at $0.525, just below its first target at $0.550.

- Investors should note that ADA might undergo a retracement before a continuation of the trend.

- A four-hour candlestick close below $0.442 will invalidate the bullish thesis.

Cardano price has come close to retesting a resistance level or its first target. As impressive as this rally is, ADA seems to be facing exhaustion and is likely to retrace to stable support levels before embarking on a new leg-up to the second target.

Cardano price prepares for its next journey

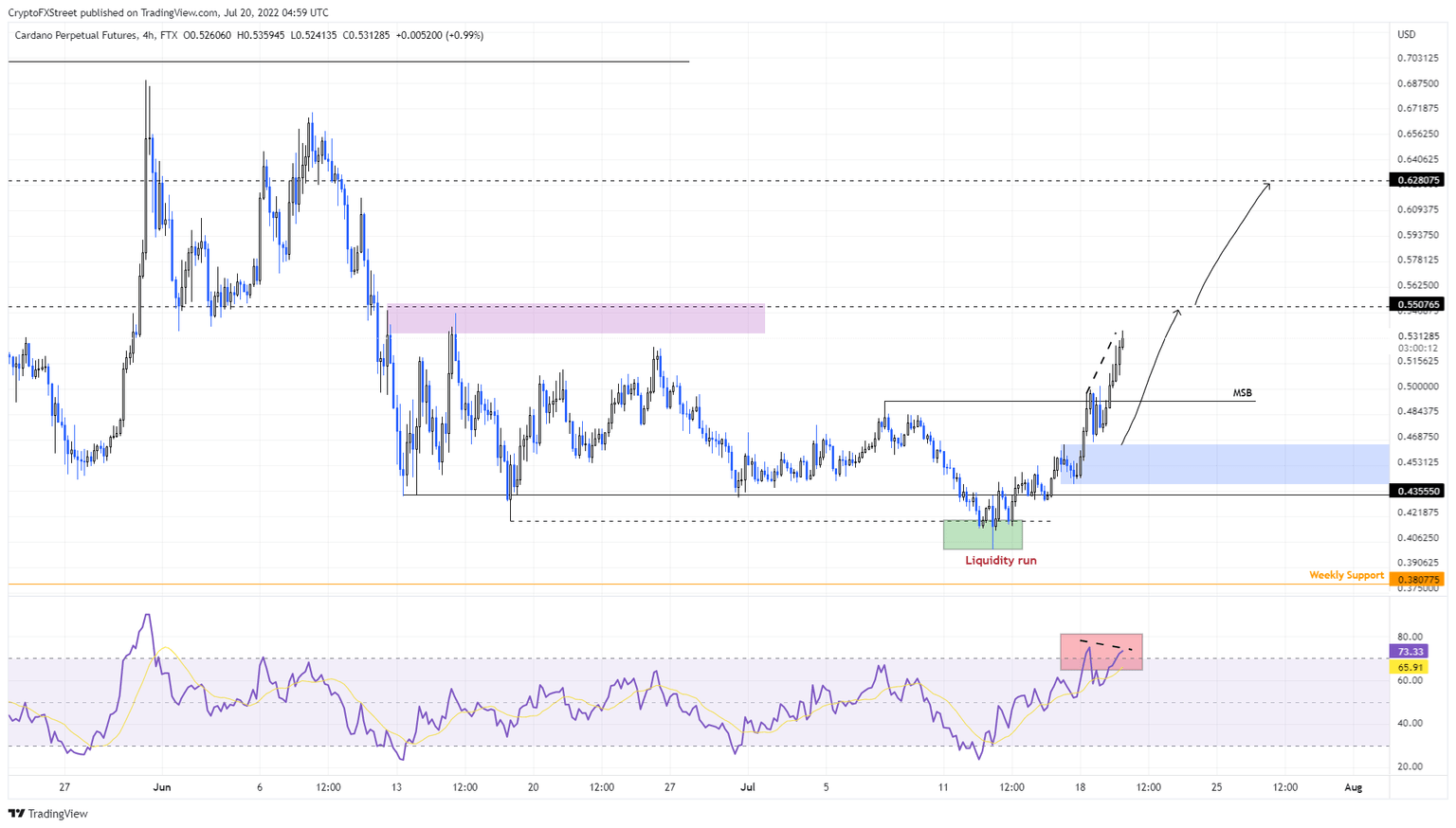

Cardano price produced a lower low relative to the swing low from June 18 at $0.419 and recovered quickly, suggesting that this was a liquidity run. As a result, ADA embarked on an upswing that is aiming to retest the $0.550 hurdle.

If ADA bulls manage to overcome this level, there is a high chance it could also revisit the $0.628 barrier.

So far, Cardano price has rallied 31% and is close to retesting the $0.550 hurdle. However, there are a few kinks that could prevent ADA from scaling higher.

- The Relative Strength Index (RSI) is already hovering in the overbought zone, aka above 70. This development indicates that investors could be looking to book profits, which could result in a pullback or correction.

- Furthermore, the latest peaks formed by RSI in the overbought zone are lower highs, while Cardano price has set higher highs. This directional imbalance is known as bearish divergence, which reveals that the momentum is waning and the asset is rising on fumes and is likely to undergo a sell-off soon.

So, even if Cardano price manages to reach the $0.550 hurdle, investors should be cautious of a retracement. As long as ADA stays above the $0.442 to $0.466 demand zone, things are going to remain bullish.

After the aforementioned pullback to either $0.492 or the said demand zone, Cardano price has a high chance of reaching the $0.628 barrier or the second target.

ADA/USDT 4-hour chart

On the other hand, if Cardano price witnesses a massive spike in selling pressure that pierces the $0.442 to $0.466 demand zone, investors should be extremely cautious. If Cardano price produces a four-hour candlestick close below $0.442, it will invalidate the demand zone and hence the bullish thesis.

Such a development could see ADA return to $0.435 or the weekly support level at $0.380.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.