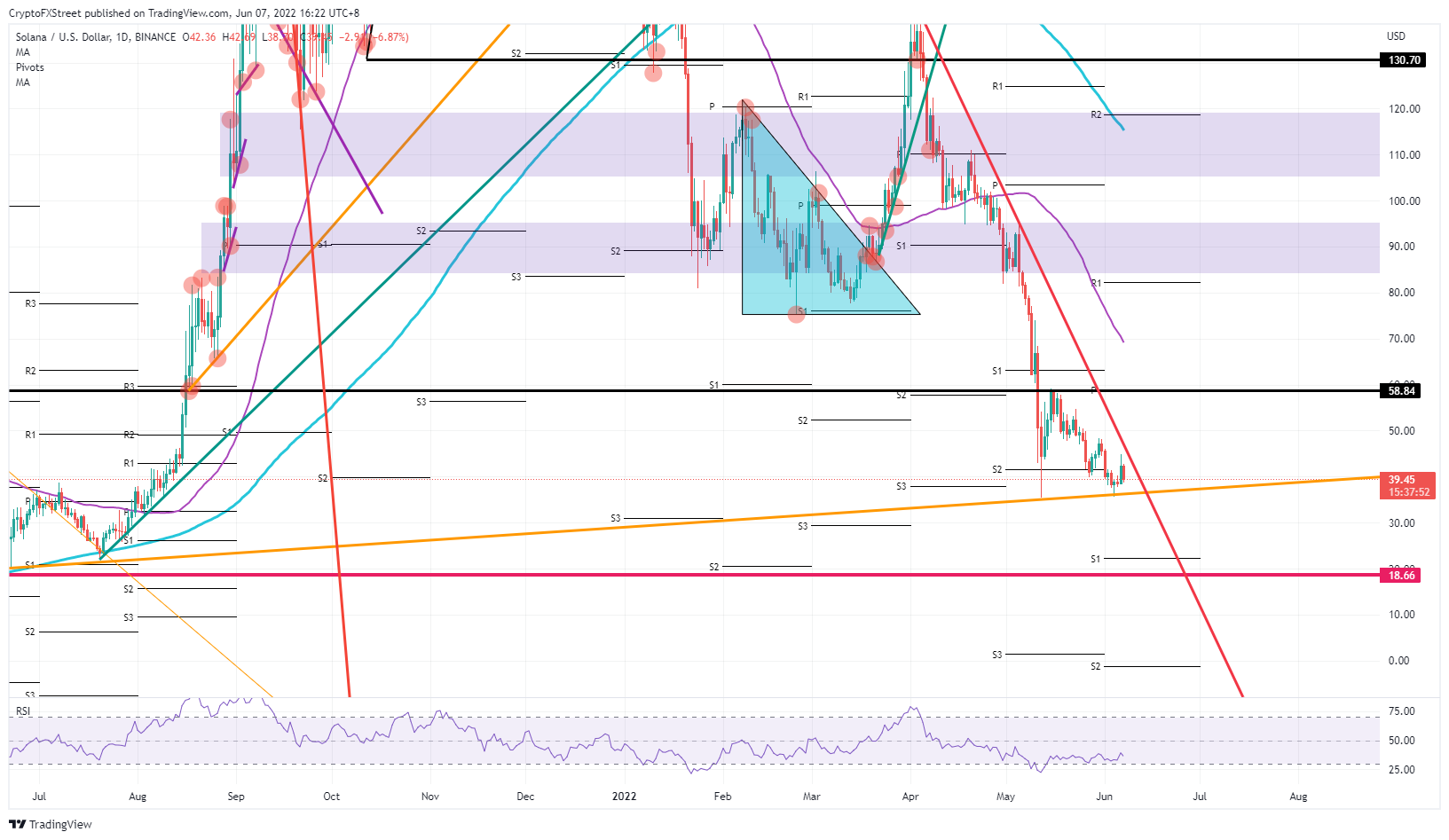

- Solana price sees its pennant formation morph into a bearish triangle.

- SOL price could dip below $35 and make new lows for the year.

- Expect to see a break towards either $30 or $18.66 before the bulls get involved.

Solana (SOL) price was in a pennant formation for most of May, but the pattern has shifted towards a bearish triangle as a support line has seen three tests already and pressure mounts with the dollar weighing in. Should the dollar rally further, expect a breakthrough that supports the level and a possible 15% to 26% price drop as more room gets opened to the downside. Expect to see the squeeze continuing until the bearish triangle completes and sees a break to the downside.

SOL price set to tank at least 15%

Solana price has surprised investors after a pennant formation that looked promising for a bullish breakout broke the other way. The Relative Strength Index (RSI), which is trading higher, away from the oversold area, appeared to confirm the pattern’s bullishness. Yet, instead, a bearish break materialised, which tested the bottom level of 2022 at $35 again. This level has held on three previous occasions but this time it is starting to weaken as pressure mounts, with lower highs and a downside squeeze.

SOL price could thus be set for another leg lower as some more dollar strength kicks in again. With the dollar weighing additionally on sentiment, it looks almost certain that SOL price could drop towards $18.66, with the monthly S1 support level just above at $22. Such a fall would constitute a 50% loss, while the earlier supportive level identified comes at the $30 equivalent to a 26% devaluation.

SOL/USD daily chart

Given the bank holiday in Europe yesterday, a turnaround could come today if the dollar weakens a bit instead and the sentiment in the global market gets to shift a bit with more positive morale. That would trigger another rebound of $35 and see bulls piercing through $58.84. At that level, $70 looks tempting, and bulls could charge ahead to test the 55-day Simple Moving Average, printing a 86% gain for the portfolio in the process.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto traders gear for President Trump’s plan to tackle inflation, Bitcoin eyes rally above $100,000

Bitcoin corrects below the $100,000 milestone on Monday, slipping nearly 10% from its all-time high of $109,558 reached on January 20. The largest cryptocurrency by market capitalization has declined to a low of $97,777, even as institutional investors remain bullish on Bitcoin.

Pepe Price Forecast: PEPE eyes for 20% crash

Pepe continues its decline, trading around $0.000012 and dipping nearly 10% at the time of writing on Monday after correcting more than 12% the previous week. PEPE’s long-to-short ratio trades below one, indicating more traders are betting on the frog-based meme coin to fall.

Dog-based meme coins DOGE and SHIB dip as bearish bets increase among traders

Dogecoin and Shiba Inu prices continue to decline on Monday after correcting more than 6% in the previous week. DOGE and SHIB long-to-short ratio trades are below one, indicating more traders are betting for dog-based meme coins to fall.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP momentum indicators hint at correction

Bitcoin (BTC) and Ethereum (ETH) are approaching their crucial support levels on Monday; a firm close below would lead to a correction. Ripple (XRP) price follows BTC and ETH as it nears its ascending trendline; a close below would lead to a pullback ahead.

Bitcoin: BTC holdings of large investors surges as Trump takes the Oval Office

Bitcoin (BTC) trades in the green and hovers above $105,000 on Friday after hitting a new all-time high of $109,588 on Monday. CryptoQuant’s weekly report highlights that the demand for BTC from large investors surges as US President Donald Trump takes the Oval Office.

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.