Where is Litecoin price headed after LTC dominates crypto payment processor BitPay transactions

- Litecoin transactions with the world’s largest crypto processor BitPay climbed to 27.6%.

- Litecoin was second to Bitcoin in volume of transactions according to BitPay stats, LTC outperformed other cryptocurrencies post the FTX collapse.

- Analysts’ outlook on Litecoin remains bullish with a target of $101.50 before the end of 2022.

Litecoin transaction count explodes on the world’s largest crypto payment processor BitPay. The altcoin outperformed other cryptocurrencies in the aftermath of FTX exchange collapse and ranks second to BTC in transaction count according to BitPay statistics.

Also read: Bitcoin dominance stagnates after FTX bankruptcy as investors pull out of BTC

Litecoin beats other altcoins to rank second in BitPay transaction count

Litecoin, the 13th largest crypto by market capitalization witnessed a massive spike in its transaction count on payment processor BitPay. One of the world’s largest crypto payments processors, BitPay released its statistics for the last six months.

Based on data from the crypto payment provider, Litecoin ranks second to Bitcoin in transaction count.

Transaction count for last six months on BitPay

Litecoin ranks first among all other cryptocurrencies sans Bitcoin, Ethereum (ETH), Dogecoin (DOGE), Bitcoin Cash (BCH), USD Coin (USDC) and XRP. Litecoin’s increasing popularity is coupled by higher accumulation of the altcoin by large wallet investors in the network.

Whale scoops up $65.5 million in Litecoin from Binance

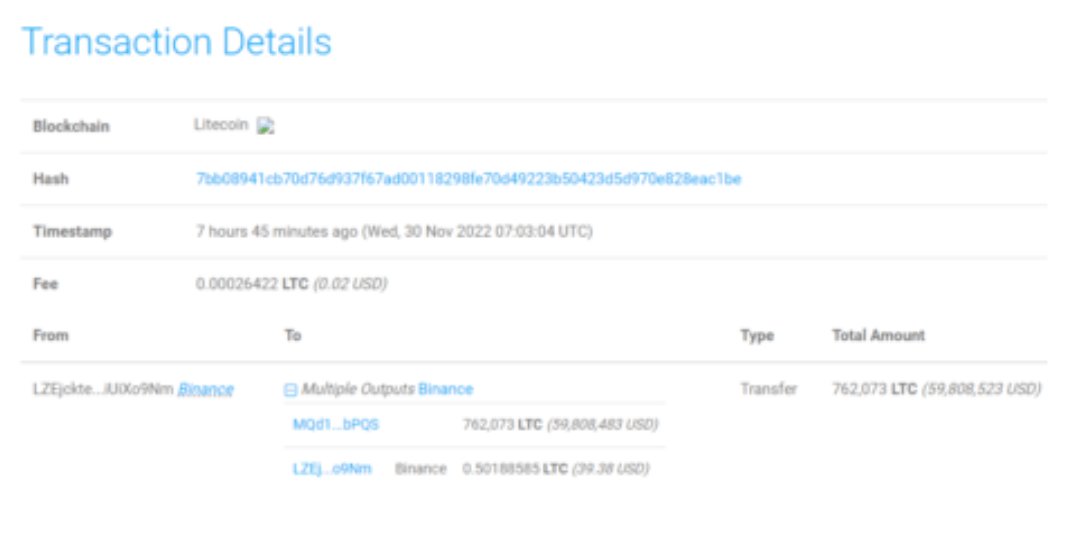

As per data from a large wallet tracker service Whale Alert, there were two large LTC transfers recently. The first accounted for $5.8 million in LTC and the second was worth $59.8 million. Find details of the second transaction below:

$59.8 million in Litecoin transferred by whale

Both transfers have the same sending and receiving addresses, implying that the same large wallet investor made both transfers. Exchange outflows are considered bullish for assets. Litecoin’s exchange outflow is therefore a bullish indicator for the asset.

Litecoin price could breakout soon

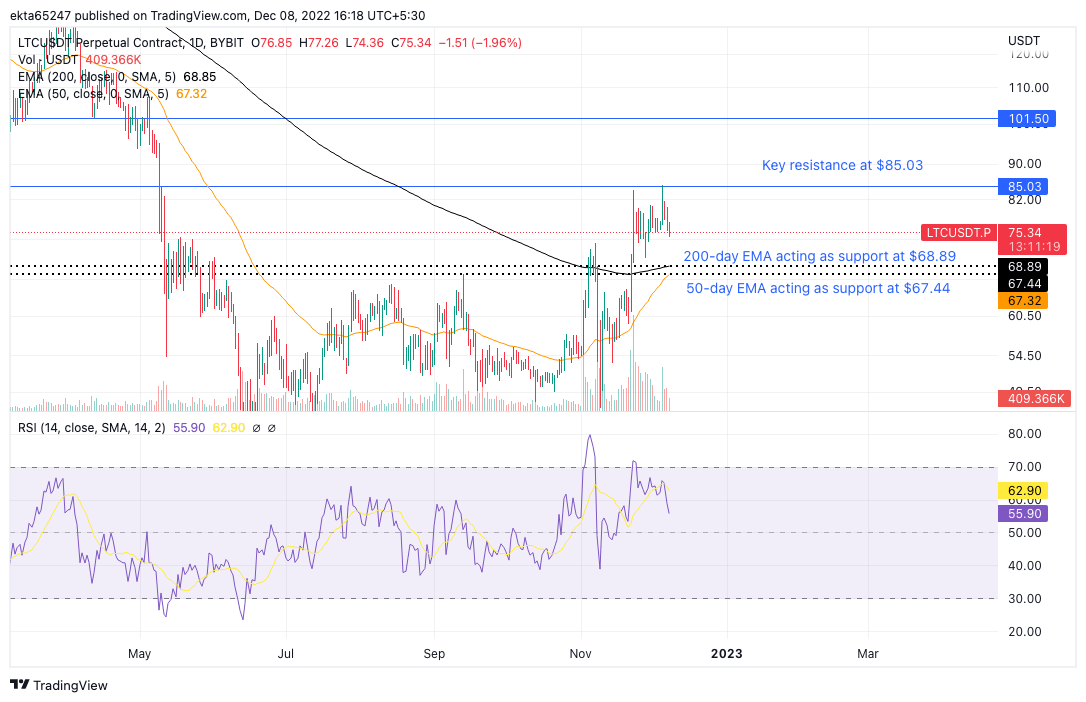

Litecoin yielded 11.5% gains over the past month, outperforming other altcoins post the FTX exchange collapse. Based on the chart below, the 200-day Exponential Moving Average (EMA) at $68.89 and 50-day EMA at $67.44 are acting as support for altcoin.

Litecoin price is likely to face resistance at $85.03 in its uptrend and the target for the altcoin is $101.50.

LTC/USDT price chart

A decline below support at $68.89 could invalidate the bullish thesis for altcoin.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.