Where Ethereum price will go as it prepares for bullish breakout

- Ethereum price has consolidated further in a pennant structure since mid-May.

- ETH price is set to perform a bullish breakout as an ascending trend line supports.

- Expect a jump above $2,148.67 and rally up towards $2,300.

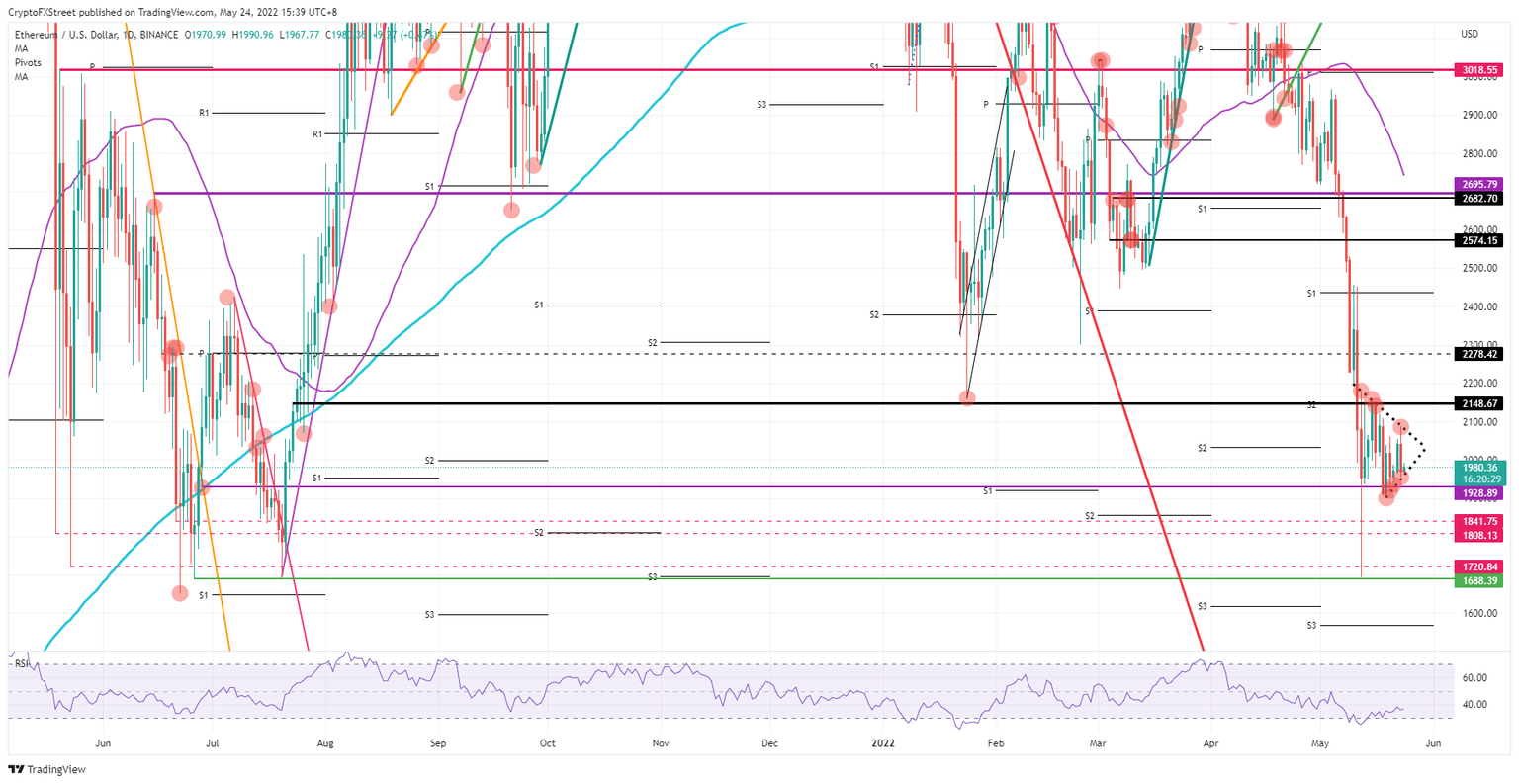

Ethereum (ETH) price is set to jump 18% in value if a tailwind persists throughout the trading day. Although the ASIA PAC session saw some dark clouds forming over disappointment at the Chinese government’s support package and this pushed Asian shares to the downside, cryptocurrencies saw traders locking in gains after the sudden drop on the Snapchat earnings warning after the US close. Investors can now expect to see another leg higher with a break above $2,148.67 and a rally towards the end of the week to $2,300, returning 18% in value.

ETH price sees bulls fretting about a comeback

Ethereum price sees bulls fed up with the current downtrend that has been unfolding over a couple of months now. The Relative Strength Index (RSI) is slowly but surely trading away from the oversold barrier as bulls and investors return to cryptocurrencies, an asset class where you want to be when a rise in risk assets is announcing itself. It looks like it will be a hot summer for cryptocurrencies as markets are getting accustomed to the current market elements driving prices and, as this coincides with the waning dollar strength seen over recent days.

ETH price is therefore set to cover quite a lot of ground and could rally towards $3,000, but for now, the focus in the short-term will be on a pennant breakout set to happen in the coming days with a pop towards $2,148.67 on the cards, which is the first nearby resistance to be taken into account. With the RSI still low, expect more upside room to be opened towards $2,300, which is above an interesting intermediary level above $2,278.42 from June of last year.

ETH/USD daily chart

Risk to the downside may materialise if the break to the upside proves false, and traps bulls between $2,148.67 and the pennant. That could then lead to bulls being squashed against $1,928.89, triggering a possible flash crash towards $1,688.39, the low of May 12. That push would probably be a synchronised move with most cryptocurrencies showing the same pattern.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.