- Crypto.com price is attempting to break away from its recent lows.

- CRO must hold the crucial $0.20 in order to move higher.

- A major sell-off and capitulation move towards $0.08 could occur if $0.14 fails.

Crypto.com price continues to trade near the lows it suffered during last week's sell-off. While the great majority of major cryptocurrencies have made more than 40 to 50% moves from their flash crash lows. On the other hand, CRO may be positioned for another major drop.

Crypto.com price is sitting on top of a strong support zone; failure to hold could trigger another collapse

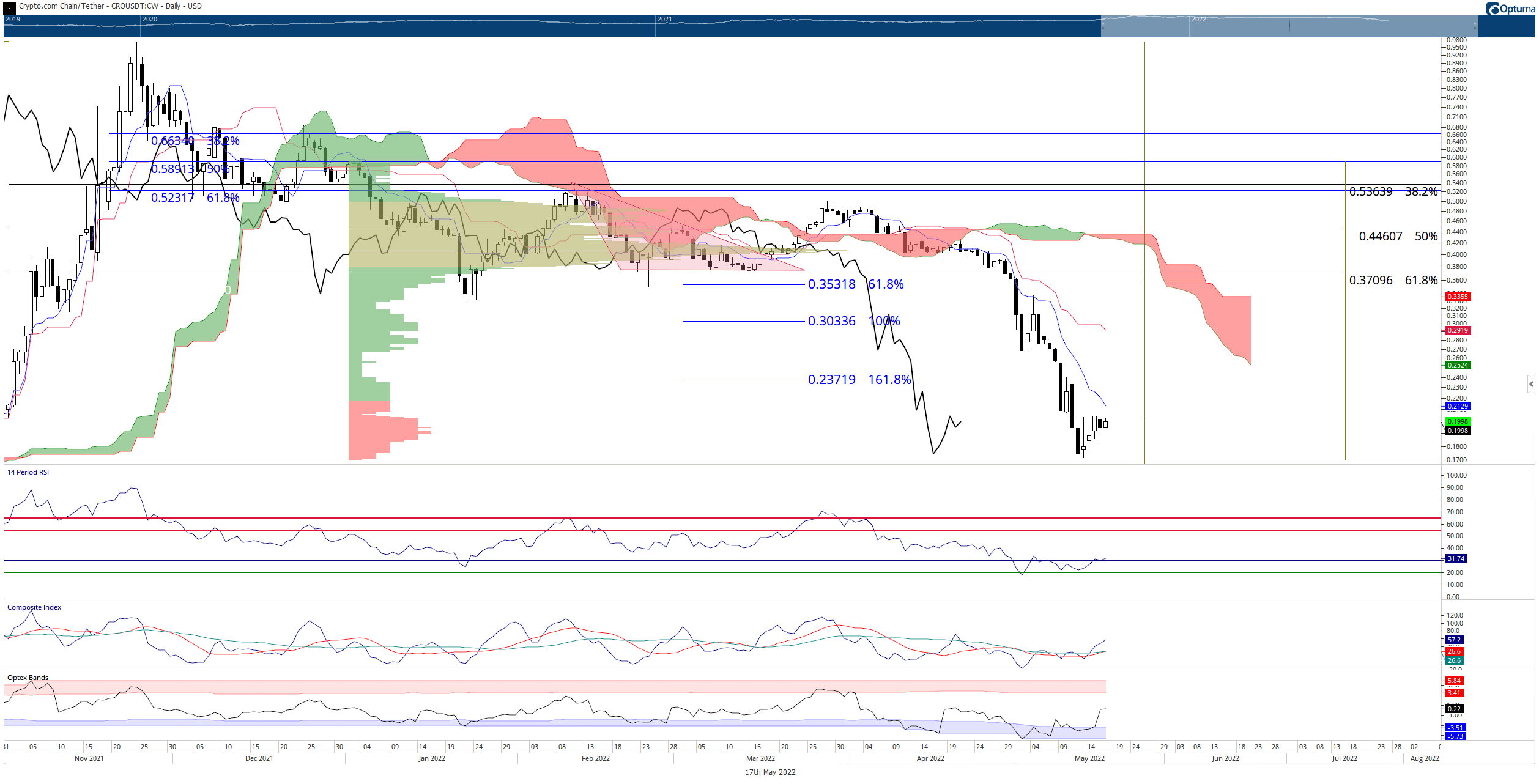

Crypto.com price is sitting right inside an extremely powerful Volume Profile support level. The $0.16 to $0.20 price range is the second-highest volume node in the 2022 Volume Profile and the second highest in the 2021 Volume Profile.

If support holds, then Crypto.com price would likely have enough of a support base to push towards the first resistance cluster near $0.40. $0.40 contains the 2022 Volume Point of Control, the Ichimoku Cloud, and the 50% Fibonacci retracement level.

CRO/USDT Daily Ichimoku Kinko Hyo Chart

The greatest threat to CRO is a close at or below $0.14. The 2021 Volume Profile has a significant gap between the Volume Point of Control at $0.075 and $0.14. The oscillators don't give a clear direction regarding the likelihood of any break. Oddly, there is a difference in extremes between the Relative Strength Index (at an extreme low) and the Composite Index (at a swing high).

Some fundamental considerations for anticipating CRO's next move is related to the continued frustration with changes to its staking rewards for its cardholders. Crypto.com price has historically shown extreme sensitivity to any changes in staking rewards.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

White House Crypto Summit could boost adoption across financial markets: Binance exec Rachel Conlan

Trump’s White House Crypto Summit is hours away, and executives maintain optimism and a positive outlook on crypto adoption. Rachel Conlan of Binance expects increased institutional and retail participation.

Bitcoin Weekly Forecast: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin (BTC) remains under pressure and continues its decline, trading around $88,900 at the time of writing on Friday and falling over 5% this week.

Solana’s co-founder says ‘No Reserve’ to SOL as a part of Trump’s Crypto Strategic Reserve

Solana price stabilizes and trades around $142.8 at the time of writing on Friday after falling nearly 20% this week. Solana co-founder Anatoly Yakovenko raised concern about SOL as part of the US Crypto Strategic Reserve on his social media X.

BTC, ETH and XRP struggle despite Trump’s Bitcoin Reserve order

Bitcoin price is extending its decline on Friday after falling more than 7% so far this week. Ethereum price is retesting its key support level at around $2,125; a close below would extend the correction.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin (BTC) remains under pressure and continues its decline, trading around $88,900 at the time of writing on Friday and falling over 5% this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.