- Bitcoin price trades heavy at $28,695.13, with the risk of saying goodbye to $30,000.00

- BTC price could slip further to the downside as bearish elements outweigh bulls.

- Expect some more pain to come with one significant area marked up to enter before a rally jumpstarts.

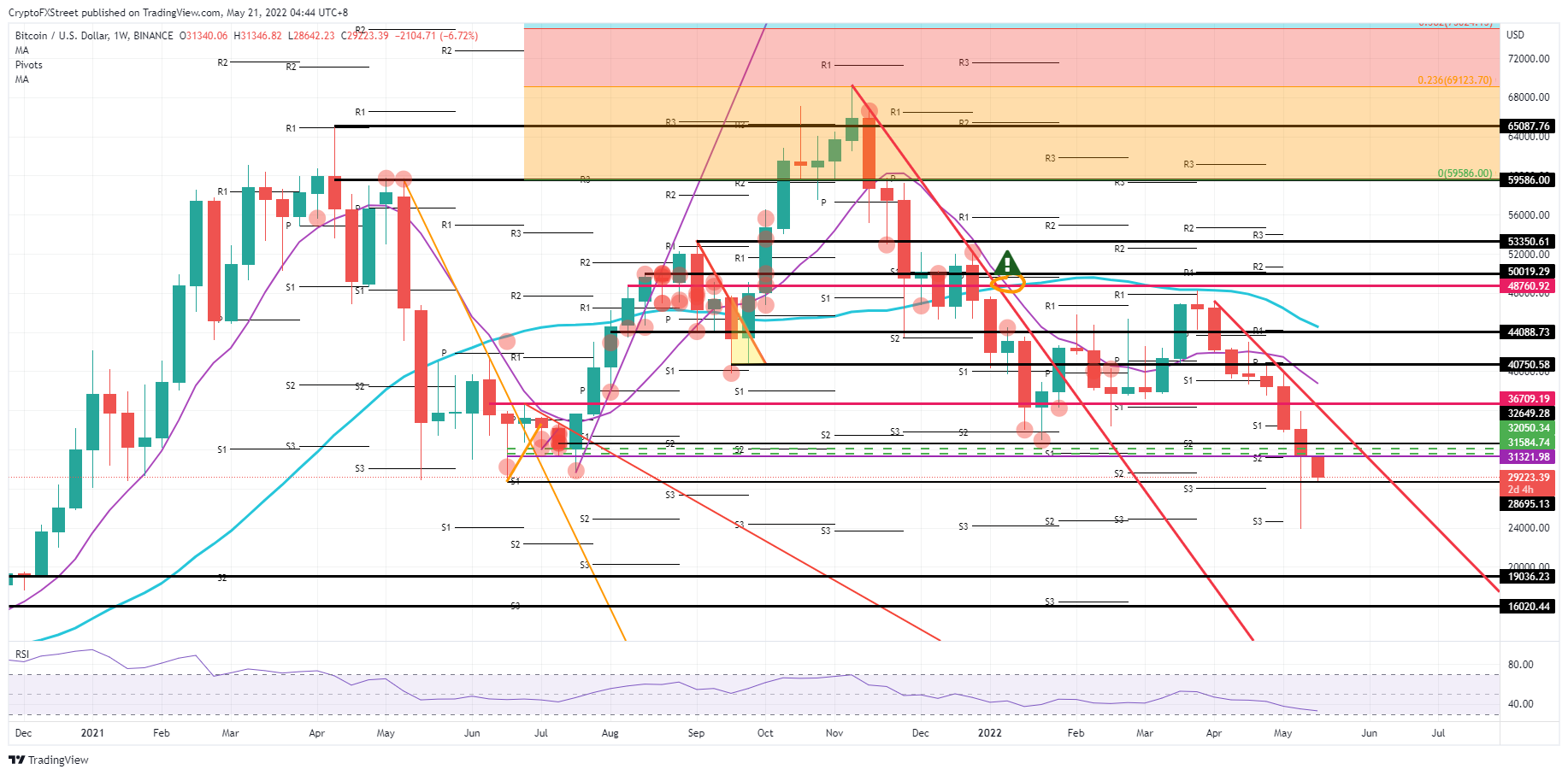

Bitcoin (BTC) price is on the cusp of slipping further to the downside as a firm rejection unfolded at the opening of the trading week at $31,321.98. With the distribution zone just above and the break below, Bitcoin price is set to shed more value as bears are in the driving seat. But a turnaround is always in the cards, and certainly at lower levels, BTC price could be a steal with an identified zone between $19,036 and $ $16,020 as a new distribution area to enter for bulls.

BTC price can rip another 40% to 50% before a turnaround is initiated

Bitcoin price is under several pressures as price tumbles week after week. Not only are significant macroeconomic and geopolitical issues hanging over the price action, as it does with global markets. There is as well the image issue as the push for ESG, and more green assets is exponentially growing, it is becoming harder for institutions, hedge funds, and pension funds to maintain a part in Bitcoin as the mining of it is not eco-friendly at all. The vast carbon footprint that flows out of the energy consumption of that mining creates a systemic issue for Bitcoin price in the long run as to when it will ever become sustainable to mine and be used as the principal cryptocurrency.

BTC price thus has plenty of elements going against it, which only means that more downside is to come. At one point, the price will have reached its fair value point, where bulls will want to engage. Looking at the charts, a zone can be identified from late 2020, between $16,020 and $19,036. That is an ideal distribution level for bulls to take it over from the bears. By then, Bitcoin investors might have found a greener solution to mine to brush off the negative image that is denting investor sentiment in the cryptocurrency.

BTC/USD weekly chart

An earlier turnaround is, of course, always possible as investors have their pick on several geopolitical themes where one headline could easily trigger a steep rally that breaks the back of these downward pressures. A turnaround would mean a weekly close back above $30,000, preferably above $32,650, which would pave the way for a rebound to $36,709. From there on, $40,000 comes back into play with $40,750.58 as the silver lining on the upside, translating into a 40% turnaround.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP Price Prediction: How Ripple's alignment with the $18.9T tokenization boom could impact XRP

Ripple (XRP) approached the critical $2.00 level during the Asian session on Friday after a minor correction the previous day reinforced higher support at $1.95.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH show weakness while XRP stabilizes

Bitcoin (BTC) and Ethereum (ETH) prices are hovering around $80,000 and $1,500 on Friday after facing rejection from their respective key levels, indicating signs of weakness. Meanwhile, Ripple (XRP) broke and found support around its critical level.

Can Trump's tariff pause and declining inflation keep Bitcoin afloat? Experts weigh in

Bitcoin (BTC) dived below $80,000 on Thursday despite US Consumer Price Index (CPI) data coming in lower than expected and President Donald Trump's 90-day reciprocal tariffs pause on 75 countries.

Bitcoin miners scurry to import mining equipment following Trump's China tariffs

Bitcoin (BTC) miners are reportedly scrambling to import mining equipment into the United States (US) following rising tariff tensions in the US-China trade war, according to a Blockspace report on Wednesday.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.