When can Bitcoin (BTC) keep up with the sharp growth of altcoins?

The cryptocurrency market keeps rising; however, not all coins are in the green zone. Binance Coin (BNB), DOGE and Litecoin (LTC) are under bearish influence today.

Top coins by CoinMarketCap

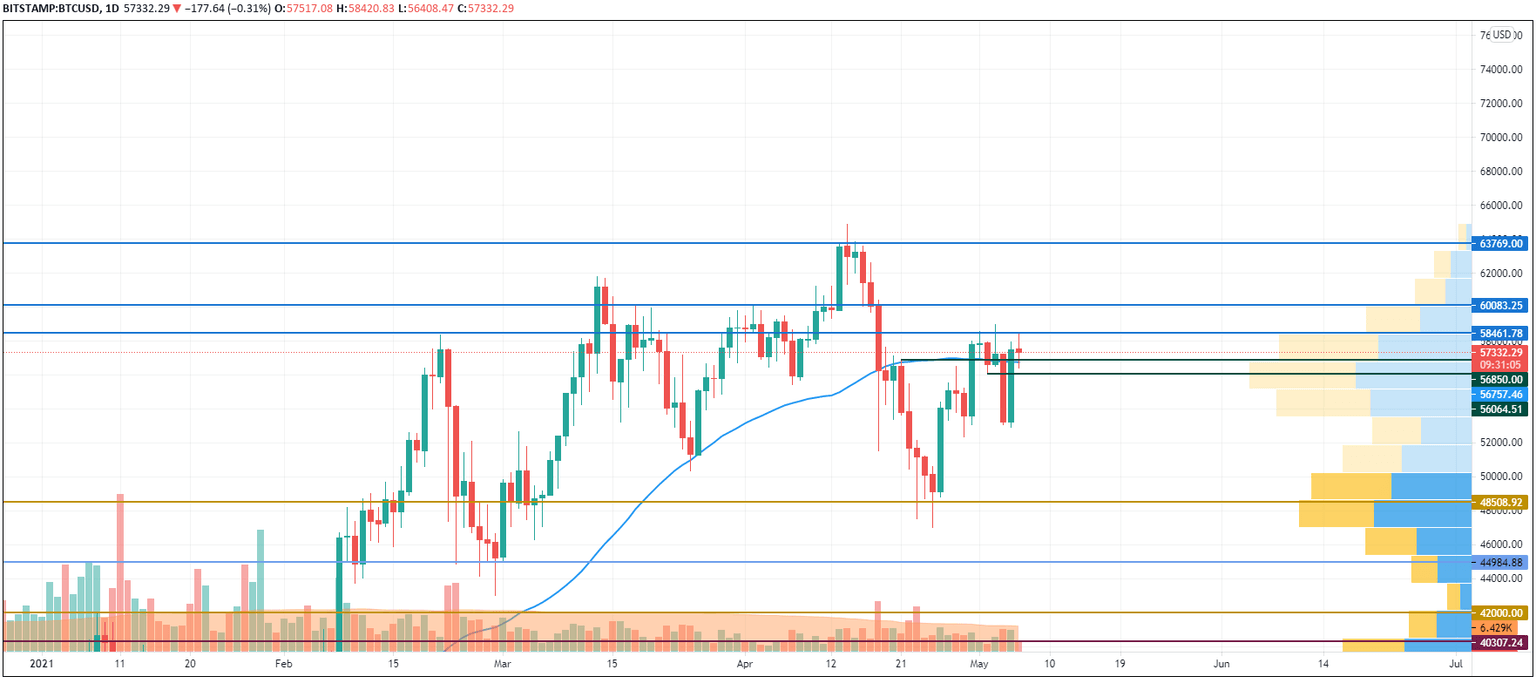

BTC/USD

Bitcoin (BTC) keeps rising slower than most of the altcoins as the rate of the chief crypto has increased by only 2% since yesterday.

BTC/USD chart by TradingView

Even though the price of Bitcoin (BTC) has not risen so much today, the long-term potential remains bullish. The selling trading volume keeps going down which means that fewer bears are on the market at the moment.

In this case, there are chances to expect the price of BTC at the resistance at $60,000 shortly.

Bitcoin is trading at $57,342 at press time.

ETH/USD

Ethereum (ETH) is growing faster than Bitcoin (BTC) as the rise over the last day is 6.77%.

ETH/USD chart by TradingView

The growth might not have ended yet as Ethereum (ETH) keeps rising higher after a false breakout of the 50% Fibonacci retracement. Respectively, the next target at which bears might seize the initiative is the 61.8% level, which refers to the $4,100 mark.

Ethereum is trading at $3,560 at press time.

BNB/USD

The rate of Binance Coin (BNB) has remained the same since yesterday. The price change has constituted -0.73%.

BNB/USD chart by TradingView

Binance Coin (BNB) keeps looking bullish as it remains above the vital level of $638. The selling volume is low, which means that buyers continue dominating. That is why bulls might get back the rate of the native exchange coin to the resistance at $680 within the next few days.

BNB is trading at $640.28 at press time.

1inch/USD

1inch is the top gainer today as the rate of the coin has blasted by more than 20%.

1inch/USD chart by TradingView

Even though the growth may not have finished yet, traders may expect a short-term correction to the mirror level at $6.65. Such a move could be considered to be gathering liquidity for a future rise.

1inch is trading at $7.03 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.