What’s next for Ethereum if Coinbase bans staking?

- JP Morgan analysts believe Coinbase will “meaningfully benefit” from Ethereum’s Merge upgrade.

- The bank argues Coinbase’s Ethereum staking offering will drive revenue for crypto exchanges.

- Coinbase CEO argues that the exchange is ready to shut down Ethereum staking if threatened by regulators.

Coinbase CEO responded to crypto Twitter’s speculation as to what the exchange will do in the event of the regulatory threats. Brian Armstrong argued that Coinbase would shut down Ethereum staking to preserve integrity of the blockchain network.

Also read: Why analysts expect wild rally in Ethereum killer Cardano price

Coinbase could shut down Ethereum staking

Earlier this month, the US Treasury Department sanctioned the coin mixer Tornado Cash. As the Ethereum Merge approaches, crypto Twitter is abuzz with narratives surrounding ETH staking. The Merge, a transition from proof-of-work to proof-of-stake consensus mechanism is a make or break event for Ethereum. Government regulations could negatively impact the fundamental operation of Ethereum and its post-merge proof-of-stake consensus mechanism.

Brain Armstrong, CEO of Coinbase responded to hypothetical scenarios on Twitter, informing the crypto community that the exchange would shut down Ethereum staking if required to preserve the integrity of the blockchain network. In the event of a regulatory threat or an inconsistency in the Merge, Coinbase will rollback its Ethereum staking service.

Interestingly, leading investment bank JP Morgan estimated that Coinbase has a 15% market share in Ethereum assets and this trumps the exchange’s 7% share of the overall crypto ecosystem. JP Morgan’s conclusion implies that Coinbase can generate $600 million from Ethereum’s staking as incremental annual staking revenue. This estimate assumes Ethereum price is $2,000 and yield is 5%.

The bank was quoted:

Coinbase is bigger in [Ether] than was intuitive to us, thus leading directly to a bigger revenue opportunity.

Coinbase has therefore been singled out as a beneficiary of the Ethereum’s Merge, and the CEO’s latest statement on rolling back ETH staking is fueling a negative sentiment among COIN holders.

COIN suffered a decline, and the tokenized stock on FTX plummeted after news of a likelihood of ETH staking rollback by the exchange. Armstrong responded to a question on crypto Twitter, and addressed the exchange’s plan of action in case a regulator censors the Ethereum protocol.

The Coinbase CEO argued that the scenario is hypothetical and hopefully one that the exchange won’t face, but if it does, Coinbase will shut down the staking service and preserve the network’s integrity.

It's a hypothetical we hopefully won't actually face. But if we did we'd go with B i think. Got to focus on the bigger picture. There may be some better option (C) or a legal challenge as well that could help reach a better outcome.

— Brian Armstrong - barmstrong.eth (@brian_armstrong) August 17, 2022

What’s next for Ethereum if ETH staking service is rolled back?

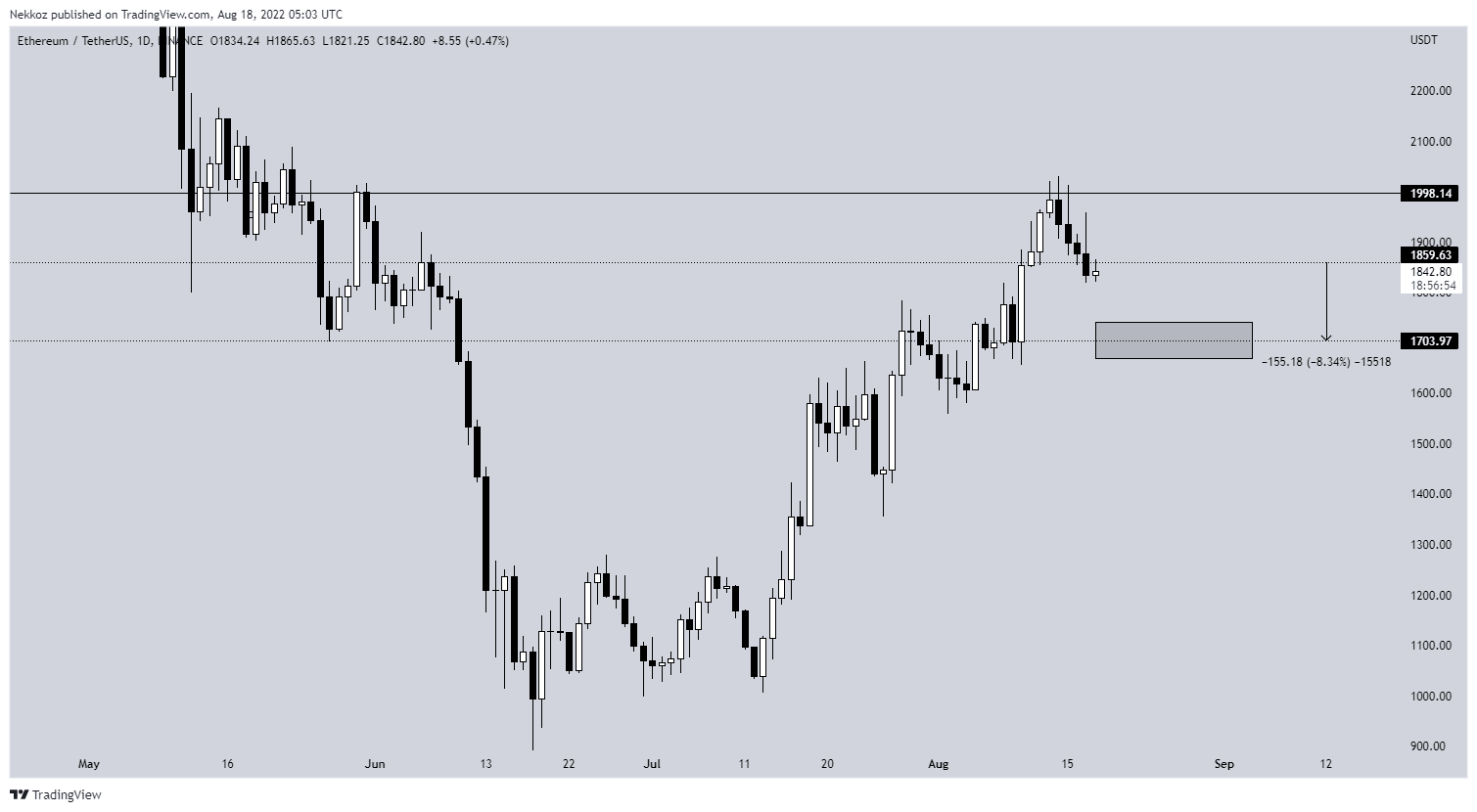

Analysts have evaluated the Ethereum price trend and predicted a decline to the $1,700 level. Ethereum is currently trading around $1,873 and a decline to $1,700 is likely. @NekoZ, a leading analyst, has a bearish outlook on Ethereum.

ETH-USDT 1-day price chart

Analysts at FXStreet believe Ethereum price consolidation is likely. The Merge narrative fueled initial bearish sentiment among holders, however a decline in ETH price is likely. For more information, watch the video below:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.