What's next for Ethereum Classic price after tripling in value to $40

- Ethereum Classic’s price wakes up from slumber as miners prepare for the upcoming Ethereum (ETH) merge.

- Major mining platforms like Antpool have pledged support for Ethereum Classic with a $10 million investment.

- The Ethereum merge will continue fueling the ETC rally, with the climb to $40 likely to be the beginning of a bull run.

Ethereum classic price is one of the biggest gainers of the cryptocurrency market, having rallied by more than 23% in the last 24 hours. The market has generally been bullish as investors make sense of the interest rate hike that took place on Wednesday. Ethereum Classic price's positive outlook stems from several macro and fundamental factors, including the Ethereum merge in September and a new investor.

Ethereum's merge drives the Ethereum Classic price rally

The skyrocketing price has everything to do with the upcoming Ethereum merge planned to take place in September. The Ethereum merge is a much-anticipated upgrade designed to form the foundation of the Ethereum blockchain transition from its proof-of-work (PoW) to a proof-of-stake (PoS) consensus.

The Ethereum Organization states that the process entails "joining the existing execution layer of Ethereum (the Mainnet we use today) with its new proof-of-stake consensus layer, the Beacon Chain."

This transition to a PoS protocol will see mining abolished in the Ethereum ecosystem, with the network's security maintained through staking. As drums beat for the merge, some miners feel threatened and are in a rush to find alternative ways to put their equipment to use, and Ethereum Classic seems to be presenting the perfect option.

"ETC is being driven by speculation that ETH miners will go to ETC, and potentially, there could be another hard fork benefiting them," IntoTheBlock's Head Of Research, Lucas Outumuro, agreed with the sentiment.

A Bitmain-affiliated mining platform, Antpool recently invested $10 million into the Ethereum Classic ecosystem. According to Motley Fool, a financial news website, Antpool's CEO, Lv Lei, promised to continue providing support to Ethereum Classic.

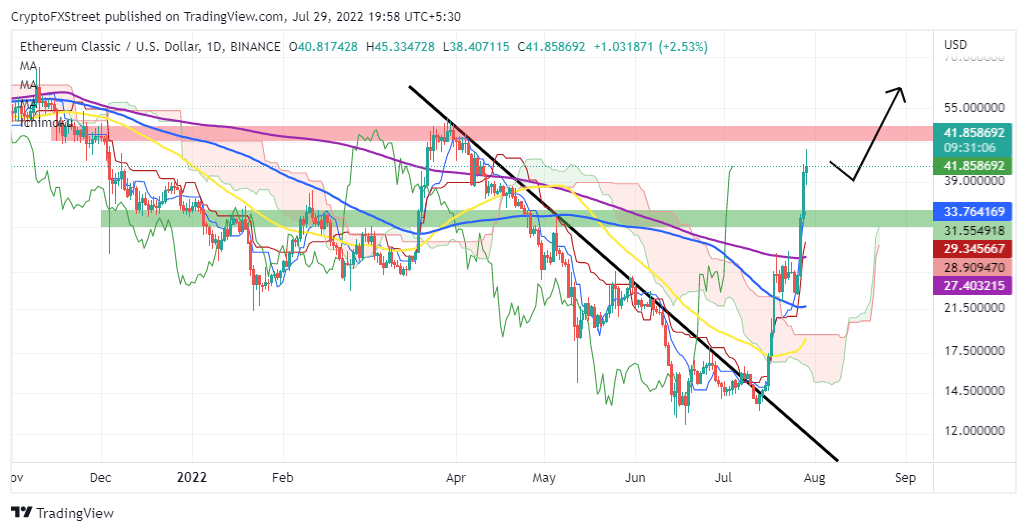

In the wake of the sharp rise from $13 to highs slightly above $40, Ethereum Classic price has cleared the recovery path, with the following targets at $52 and $80, respectively. The daily chart below shows ETC trading above the Ichimoku Cloud. It indicates the possibility of further price movement in the coming weeks.

ETC/USD Daily Chart

If a correction occurs from the current market level, support is expected between $30 and $35. It is worth mentioning that a daily close above $40 may propel Ethereum Classic price to tag $52 over the weekend and cement the bulls' presence in the market for gains to $80.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren