What’s next for crypto after $1 billion in liquidations?

- Bitcoin price slid 14% on Tuesday, triggering $1 billion in liquidations across the market.

- This massive liquidation event came after BTC swept the previous all-time high at $69,000 and set a new one at $69,387.

- Many altcoins have recovered from the recent crash, setting new higher highs.

Bitcoin (BTC) price action on Tuesday created a new all-time high at $69,387, but it was soon followed by a steep correction that triggered one of the biggest liquidation events. Despite such a fallout, BTC is very close to reaching the pre-crash levels. Surprisingly, the crypto market and its participants remain bullish.

Also read: Bitcoin Price Outlook: Almost $521 million in total liquidations as BTC hits new ATH

Bitcoin’s double whammy and what comes next

When Bitcoin's price dropped nearly 6% on Monday, many investors saw this as a sign of a potential correction or a lower low setup. But on Tuesday, BTC bulls swept the previous ATH at $69,000 and set a new one at $69,387, cleaning out the bears. Quickly following this move, BTC crashed violently, shedding nearly 15% of its value in less than five hours, rinsing the late bulls. This price action was a classic example of a double whammy, where market participants on both sides were rinsed.

BTC/USDT 15-minute chart

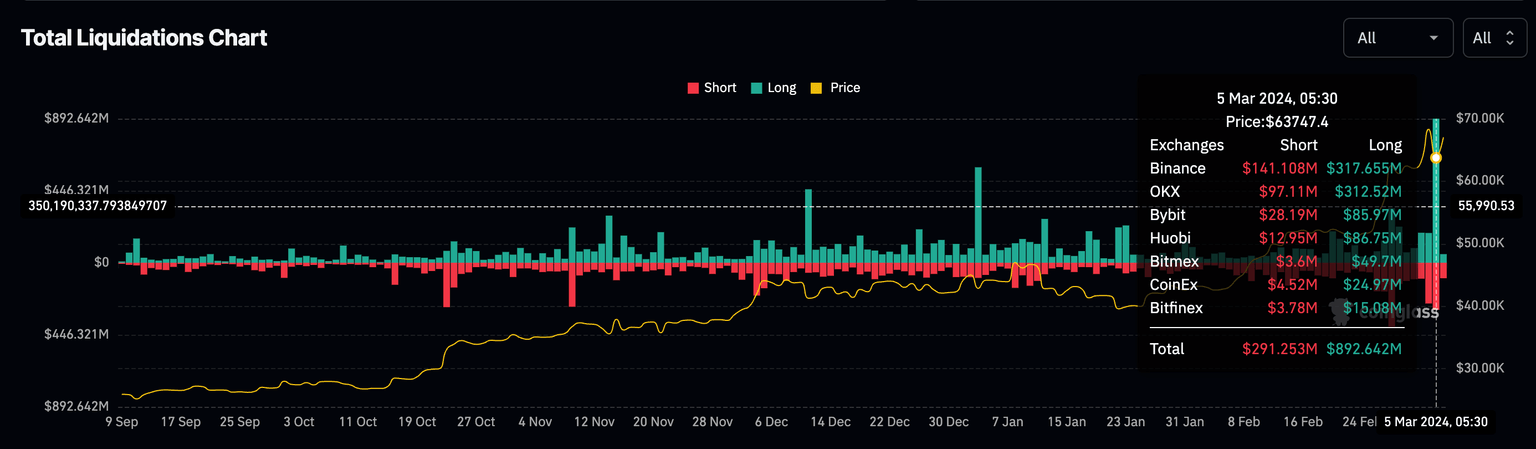

The result? More than $1 billion worth of positions were liquidated, according to CoinGlass data.

Total liquidations chart

Also read: Bitcoin peaks at $69,324 with BTC fourth halving around the corner

Typically, in uptrending markets, especially in crypto, there is a “flush” or a liquidation event where both the leverage and the funding rates are reset. This event, as the name suggests, clears out sidelined participants who entered the markets late and mostly based on the so-called FOMO.

Experienced traders leverage such events to catch the knife. While this is a risky move, if executed correctly, the rewards are skewed in their favor.

Here’s an example of a trader who used this liquidation event opportunity to open long positions on Solana (SOL).

May thy knife chip and shatter ~ pic.twitter.com/hZmwC9W5r8

— Eugene Ng Ah Sio (@0xENAS) March 5, 2024

Hansolar, another crypto analyst, perfectly executed the knife-catching trade during Tuesday’s crash.

who bought the dip? pic.twitter.com/MEaS17xggz

— hansolar (@hansolar21) March 6, 2024

What’s next for crypto?

Typically, liquidations like the one experienced on Tuesday often take time to pare the losses and gain traction before they fully recover. However, the current situation is different, especially considering that Bitcoin price has climbed roughly by $8.300 in the last 12 hours and currently trades below $68,000.

Ethereum (ETH) price has also soared up 12% since the crash and is currently sitting just below the $4,000 psychological level.

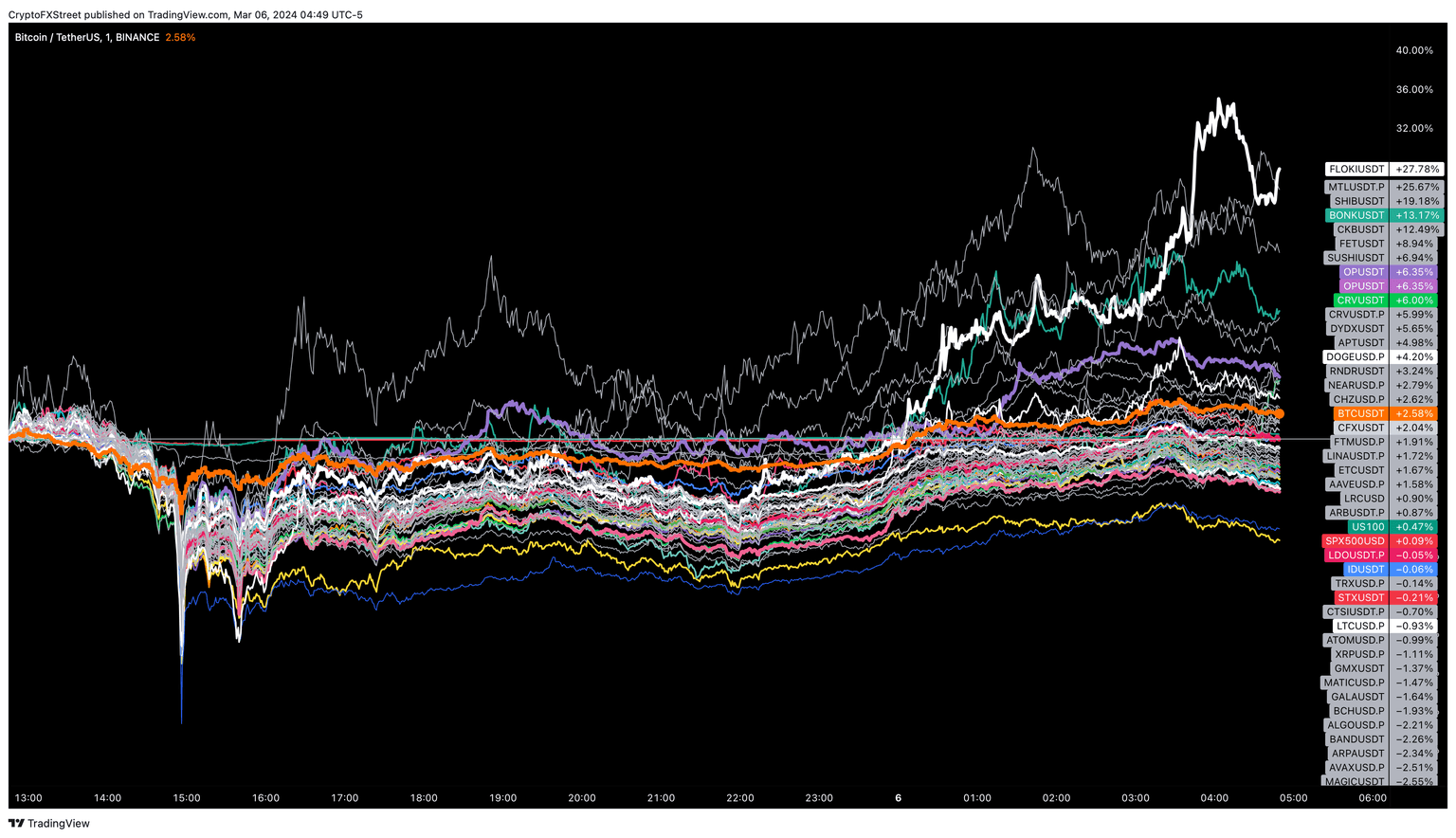

Altcoins, mostly meme coins, have seen an impressive recovery. Dogwifhat (WIF) has more than doubled in the past 14 hours. Floki Inu (FLOKI) price has shot up 80%, and Solana-based meme coin Myro (MYRO) has also registered a 161% gain in the last 12 hours.

Altcoin recovery post-crash

The chances of crypto markets retaining their bullishness are very high. Altcoins, in general, will not have massive returns. If Ethereum price establishes itself above $4,000 in a stable fashion, chances are the Decentralized Finance (DeFi) sector will make a huge comeback, especially after the altcoins in this sector noted a brief rally after Uniswap’s fee proposal decision in late February and early March.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.