What would happen to Dogecoin price if bears lose control?

- Dogecoin price is at an inflection point, which could result in a 15% move in either direction.

- A swing high above $0.071 and a flip of this level into a support floor is likely to trigger a bullish move.

- Rejection at $0.071, followed by a breakdown of the low-time-frame support level at $0.062, could push DOGE lower.

Dogecoin price is consolidating within a range, which seems to have formed a smaller range of its own. Regardless of the coil up, DOGE is at an inflection point, suggesting its next move could be volatile.

Dogecoin price gets ready

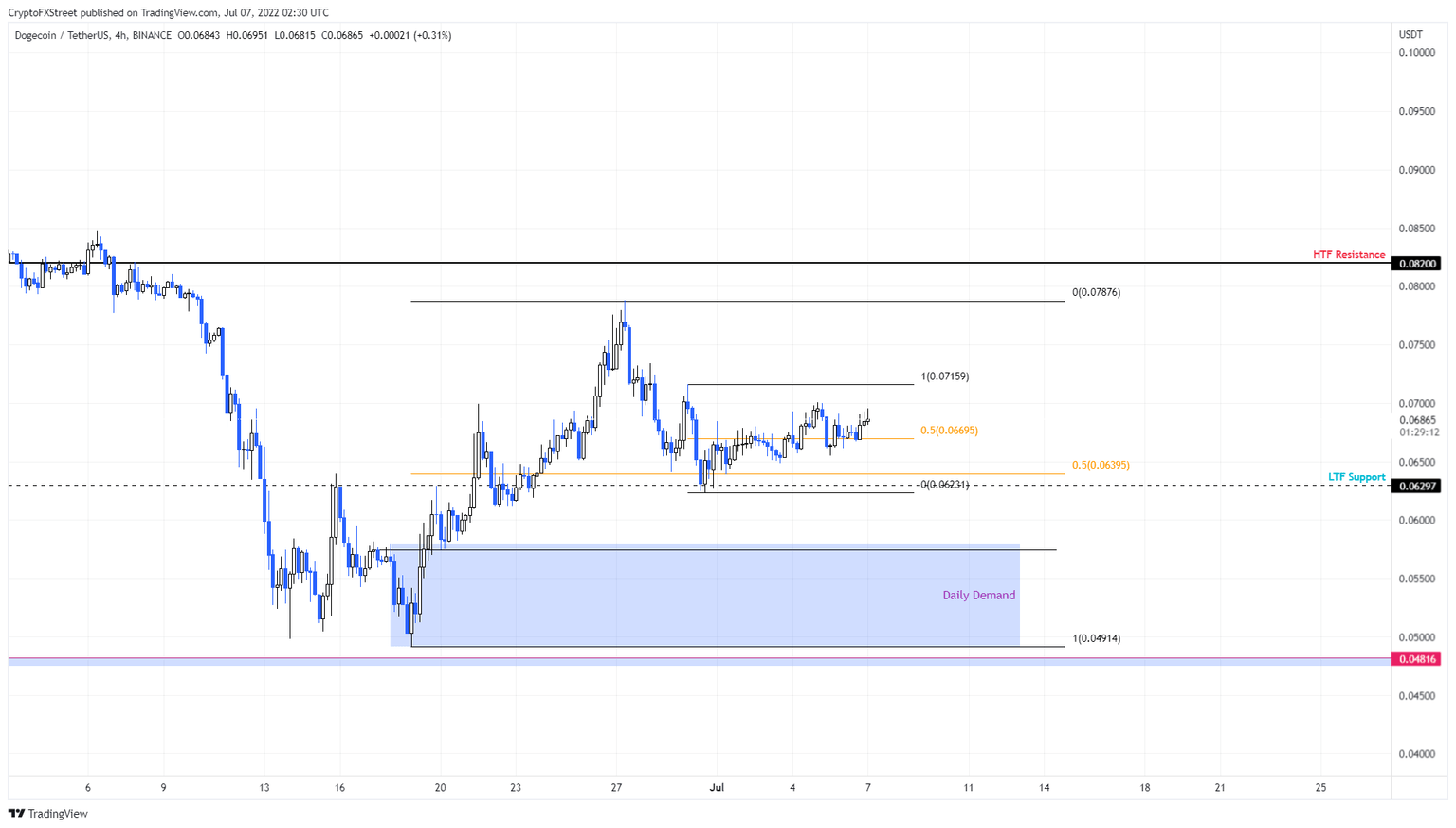

Dogecoin price rallied 60% between June 18 and June 27, setting up a range extending from $0.049 to $0.078. This impressive recovery bounce topped as the momentum was exhausted and investors started to book profits.

As a result, DOGE retraced 20% and tagged the midpoint of the range at $0.063, forming a smaller range, extending from $0.062 to $0.071. If Dogecoin price flips the $0.071 hurdle into a support level, there is a good chance for this initial move to continue.

In this case, DOGE could tag the range high at $0.078 after a 15% rally or the high-time-frame resistance barrier at $0.082 for a 20% ascent.

DOGE/USDT 1-day chart

Regardless, investors need to note that the directional bias depends on how Dogecoin price reacts to the $0.071 level. A rejection at this level will indicate that the buyers are not in control and could likely result in a 15% retracement to the $0.049 to $0.057 daily demand zone.

This move does not necessarily snub the bullish case, but it will provide Dogecoin price and its buyers another chance to attempt a run-up.

However, a four-hour candlestick close below $0.049 will invalidate the bullish thesis for DOGE and trigger a further correction to $0.048.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.