Bitcoin (BTC $26,731) slipped from $27,000 on Sept. 21 as the dust settled on the latest United States macroeconomic events.

BTC/USD 1-hour chart. Source: TradingView

Bitcoin: “Rangebound until proven otherwise”

Data from Cointelegraph Markets Pro and TradingView showed BTC price strength waning prior to the Wall Street opening, down by around 1.5% on the day.

Bitcoin had delivered a cool reaction to the Federal Reserve’s interest rate pause, and Chair Jerome Powell’s speech and press conference likewise failed to spark major volatility.

Contrary to the expectations of many, BTC price action acted as if no catalysts were present at all. Later, news that payouts to creditors of defunct exchange Mt. Gox had been delayed by another year also went unnoticed by markets.

“The Fed’s announcement of a rate pause caught exactly no-one by surprise,” popular trader Jelle summarized to X (formerly Twitter) subscribers.

Price is still in the same spot, but at least now we don’t have FOMC hanging over our heads. Rangebound until proven otherwise.

BTC/USD annotated chart. Source: Jelle/X

Jelle’s underlying longer-term roadmap remained bullish, suggesting an exit higher from the current structure, in play for more than a year, was still possible.

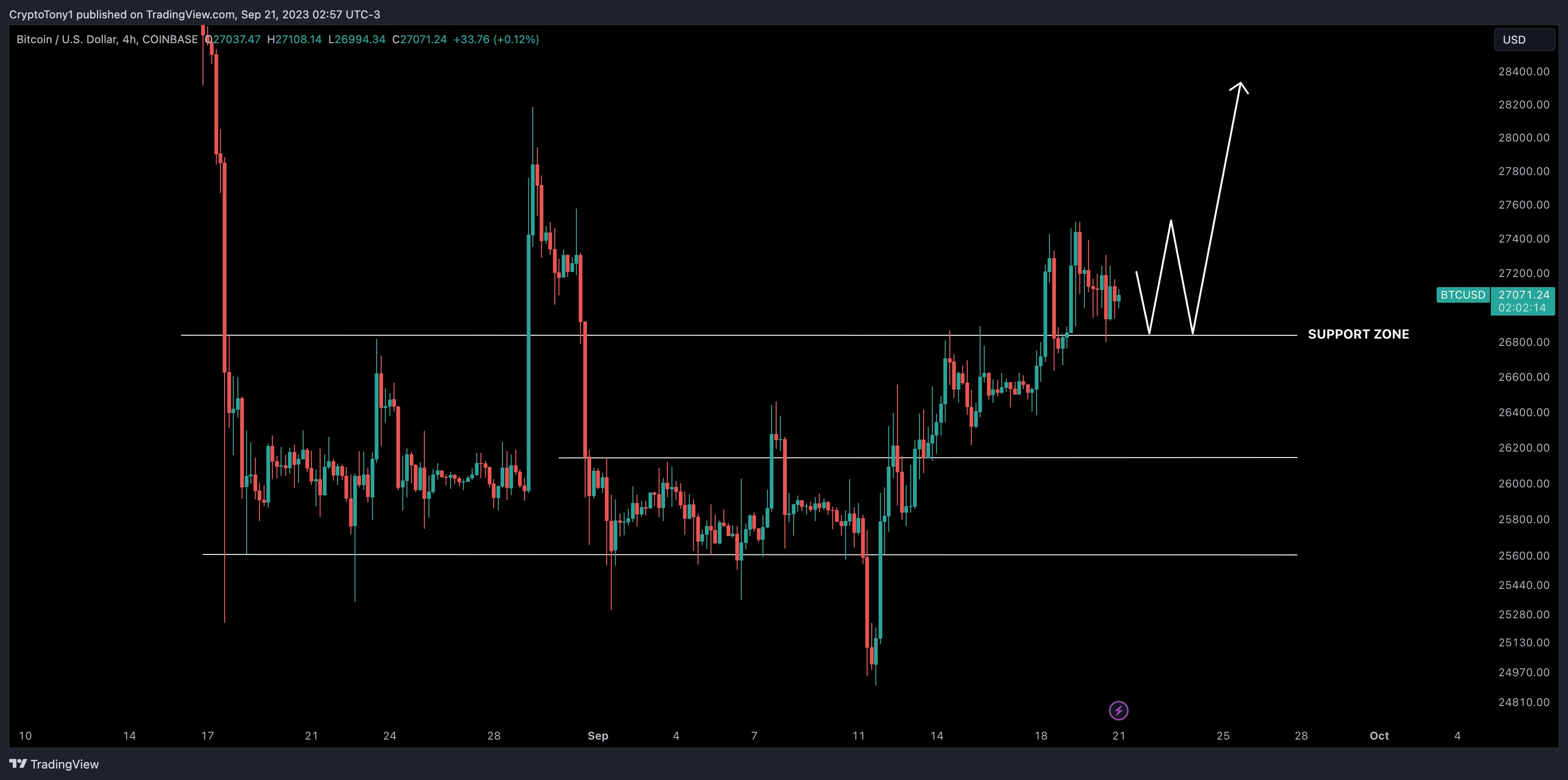

Continuing, fellow trader Crypto Tony reiterated the importance of maintaining $26,800 into the weekly close.

“So my plan was to long while we remained above $26,800 and thus far that is what we are doing,” he commented on the day.

Certainly came down a bit so up to the bulls now to end this week on a bullish high.

BTC/USD annotated chart. Source: Crypto Tony/X

BTC monthly close focus sharpens

Covering the impetus for the post-Fed drop, trader Crypto Ed suggested that the prior tap of month-to-date highs could be a cause for suspicion.

Related: Bitcoin all-time high in 2025? BTC price idea reveals ‘bull run launch’

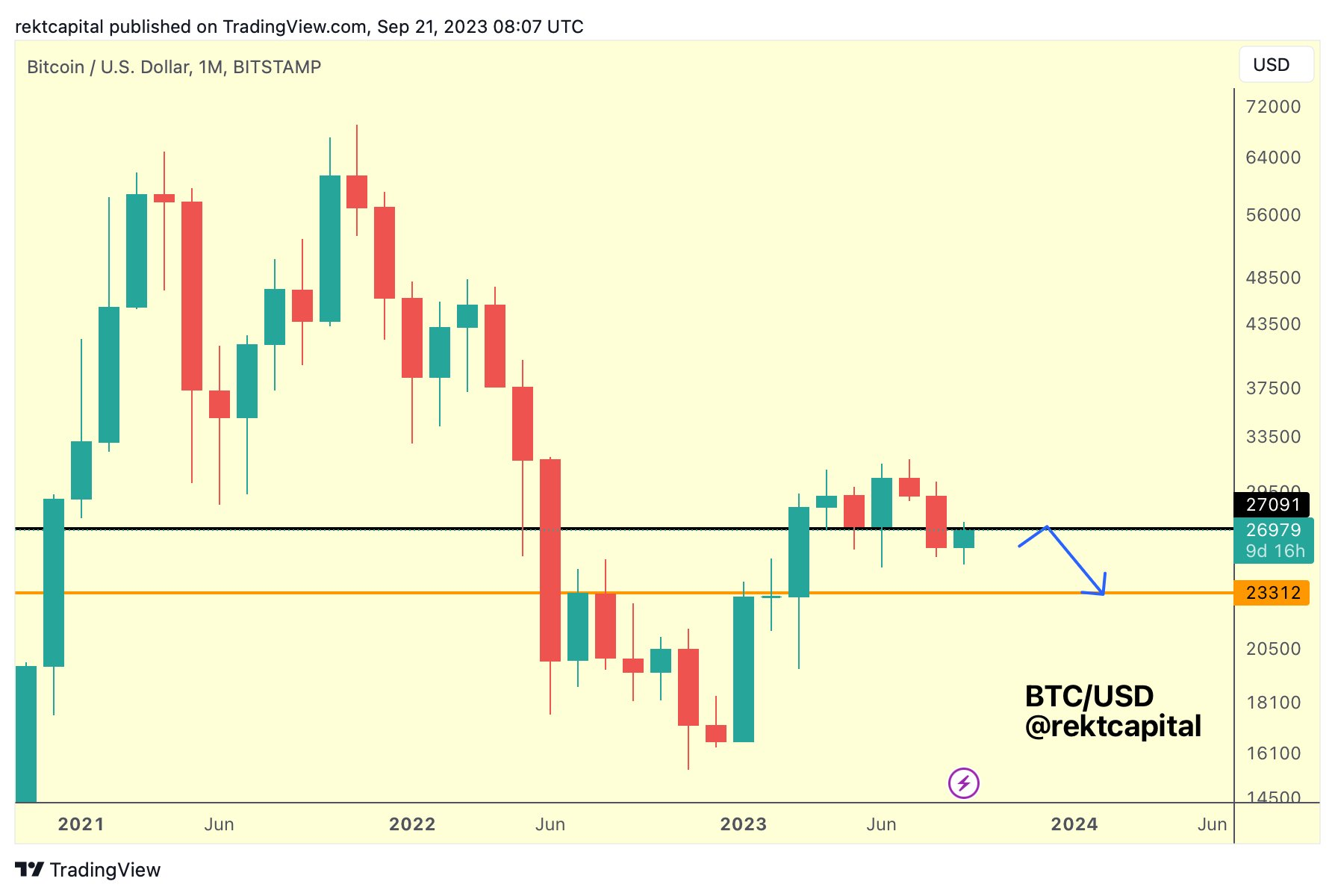

On longer timeframes, trader and analyst was also conservative, preserving his existing theory of BTC price downside to come.

On the monthly chart, he added, support at $27,150 had flipped to resistance.

“The BTC Monthly level of ~27150 was lost as support last month,” part of his commentary from the past 24 hours read.

Now $BTC is rejecting from the same level ~$27150 is acting as resistance for the time being.

BTC/USD annotated chart. Source: Rekt Capital/X

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.