What to do before Cardano price enters the next rough patch?

- Cardano price still has room to move to the upside as dollar strength backs off.

- ADA price sees supportive tailwinds from the stock markets booking gains after positive measures out of China.

- Expect to see an 18% rally possible, but then a rough patch could unfold with a sharp drop back to $0.40.

Cardano (ADA) price is breathing a sigh of relief after the slaughter from the past weekend, when Bitcoin price plummeted like a falling knife and ADA price reached the cusp of slipping below $0.40. In the end, price action backed away from that lower level and started to move upwards, with an accelerated move today as Asian stocks are firing up global stock markets on supportive language from the PBOC. Expect this to be a soft patch for ADA to move in as the dollar backs off, opening up 18% room to the upside.

ADA set to pop in limited time frame

Cardano price has had a very bumpy ride these past few days but is now starting to enter a calm phase as markets are decompressing. Traders will want to jump on some long positions but must be aware that they might be in the eye of the hurricane, which tends to be very calm and gives a false impression that the worst is over. Nothing could be further from the truth, as traders are not aware that this moment is a soft patch for some short-term gains, but nothing fundamentally has changed to create the conditions for a longer-term uptrend play.

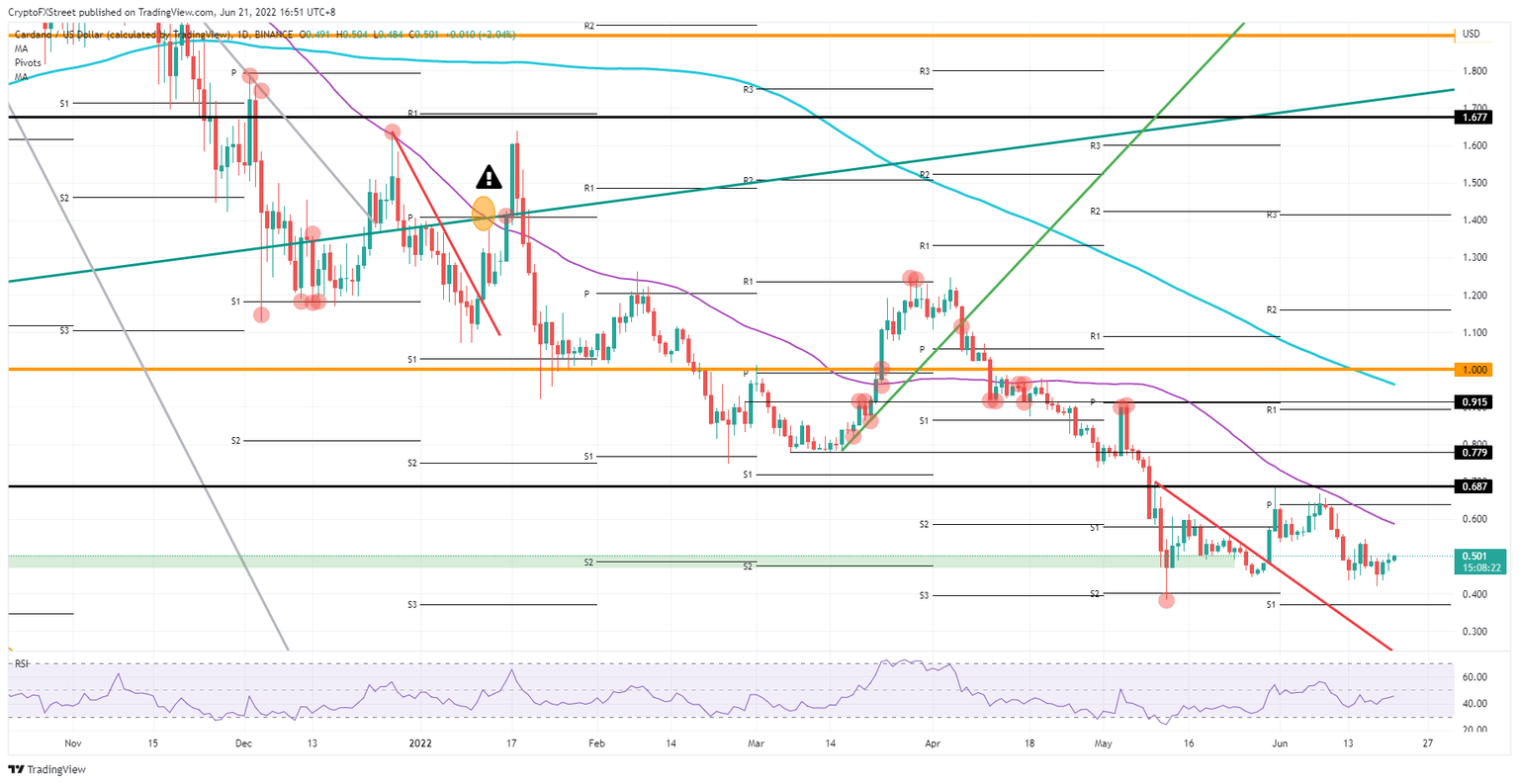

ADA price looks to be on its way to $0.600, where the 55-day Simple Moving Average (SMA) is lingering. With the Relative Strength Index (RSI) room and potential are there for roughly 18% gains. Traders who manage that position well and take profit around those levels will be able to get out with fair gains.

ADA/USD daily chart

Some analysts are already looking to the next pain point in the markets, and with rising rates, the obvious next choice is the housing market. Should there be another housing crash, people will not only lose money because of rising inflation but also see their most significant investment lose value as house prices plummet. That could spark the second significant tailwind for cryptocurrencies – another run on cash – with ADA price tumbling towards $0.400 and looking for support near $0.300 with a bounce possible off that still-well-respected red descending trend line.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.