What this 15% drop in Crypto.com price means for the future of CRO?

- Crypto.com price is struggling to move past the $0.122 barrier and establish a directional bias.

- Investors can expect a 13% drop if CRO breaks below the 34-four-hour EMA at $0.120.

- A four-hour candlestick close above the 200 four-hour EMA at $0.134 will invalidate the bearish thesis.

Crypto.com price has been trading inside a range that was formed around mid-June 2022. The recent attempt to retest the range high was unsuccessful and could lead to a steep correction, especially if the Bitcoin price also corrects.

Crypto.com price ready for its next move

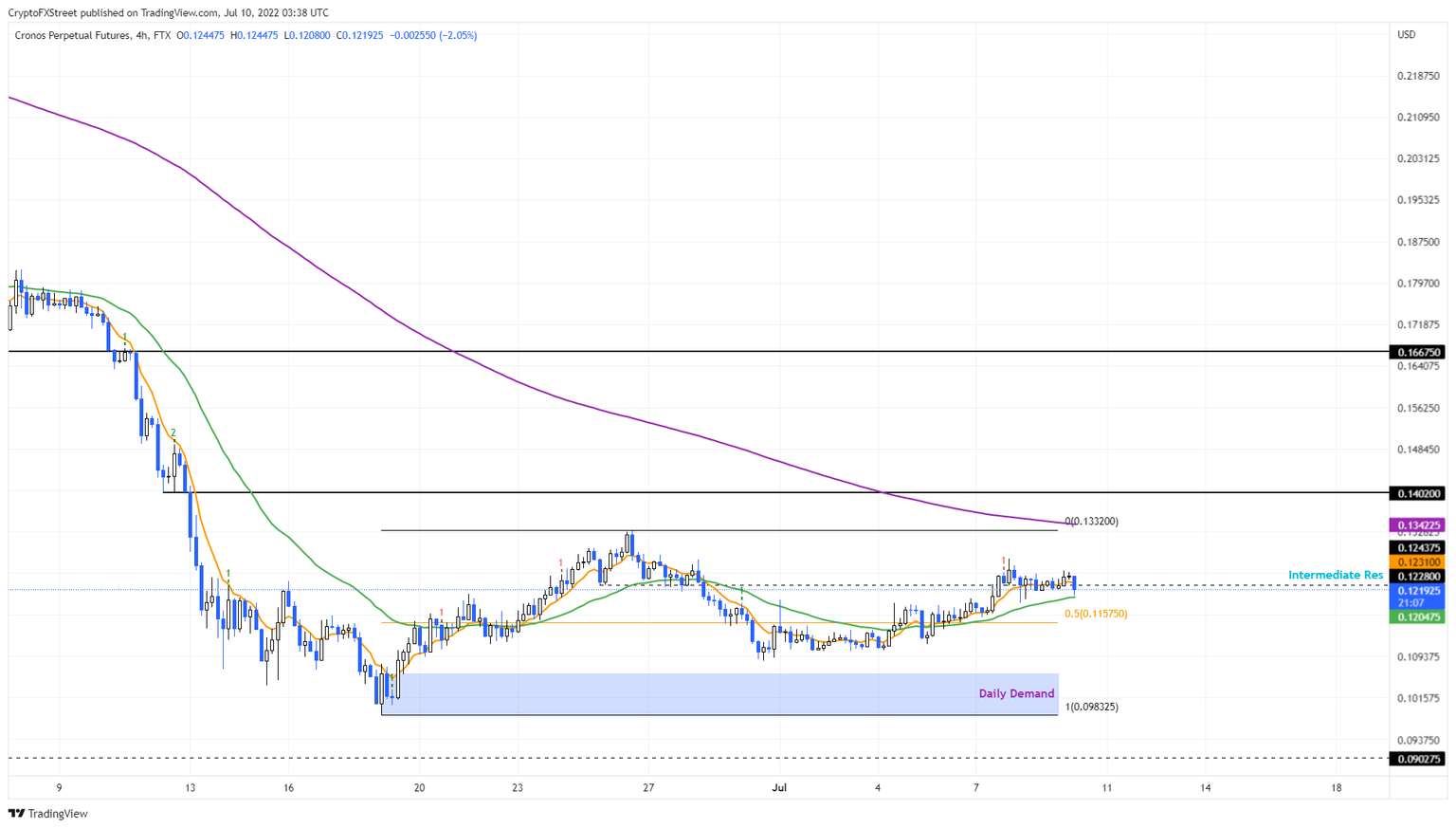

Crypto.com price rallied 35% between June 18 and June 26, setting up a range, extending from $0.098 to $0.133. After the initial recovery rally, CRO retraced 18% and slipped below the midpoint at $0.115 briefly.

However, bulls made a comeback and recovered Crypto.com price above it and attempted a run-up. The confluence of the intermediate resistance level at $0.122, 8 four-hour Exponential Moving Average (EMA) and the 34 four-hour EMA at roughly $0.121 prevented the altcoin from moving higher.

As a result, investors can expect this rejection to knock Crypto.com price down by 13% into the daily demand zone, ranging from $0.098 to $0.106. While the downtrend might seem bearish, a bounce off the demand zone is where bullish moves are likely to kick start.

CRO/USDT 4-hour chart

On the other hand, if Crypto.com price produces a four-hour candlestick close above the 200 four-hour EMA at $0.134, it will indicate that the bullish momentum is back. This development will essentially flip major hurdles into a support level.

Such a development will invalidate the bearish thesis for CRO, but it will not end the problems for bulls. A successful flip of the $0.140 will indicate that Crypto.com price is ready for more gains.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.