What the recent meme coin pump means for Bitcoin and Ethereum

- Meme coin price rallies typically signal a top in Bitcoin and Ethereum prices in close.

- Experts believe if PEPE and other meme coins in the ecosystem rally again, it could fuel capital rotation in Bitcoin and Ethereum.

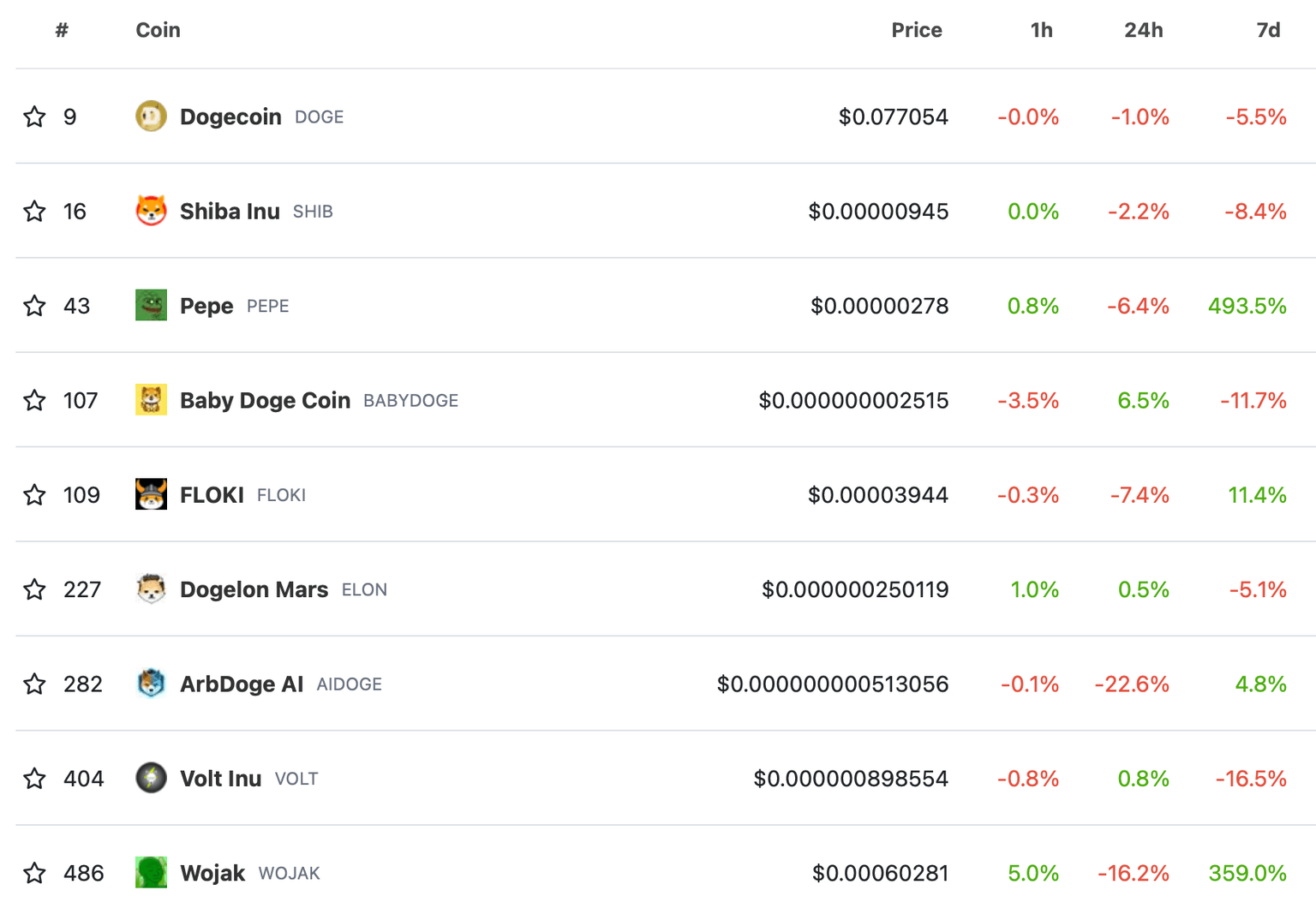

- Baby Doge Coin, Dogelon Mars, and Wojak are among the top 10 meme coins by market cap currently rallying.

Meme coins inspired by internet memes and Shiba-Inu-themed coins are currently rallying. After PEPE’s three-digit price rally over the past week, most meme coins have started yielding gains for holders.

Also read: Ethereum battles intense selling pressure from spike in ETH deposits to crypto exchanges

Meme coin price rallies and what it means for BTC and ETH

@00forrest, a crypto expert and trader, argues that meme coin price rallies typically precede a cycle peak in Bitcoin and Ethereum. PEPE, the meme coin inspired by PEPE the frog meme, recently yielded three-digit gains for holders over the past week before its recent pullback.

Alongside PEPE, Shiba-Inu-themed meme coins like Baby Doge Coin (BabyDoge), Dogelon Mars (ELON), and Wojak (WOJAK) started their price rallies. The two meme coins rank in the top 10 in the category by market capitalization.

Top 10 meme coins in the category by market capitalization

PEPE’s trade volume exceeded that of Dogecoin, Shiba Inu and Baby Doge Coin over the past week with its massive price rally. The expert noted that meme coin peaks are correlated with Bitcoin and Ethereum peaks, as seen in the chart below:

ETH/USD 1W price chart

The analyst believes market participants are in the denial phase, and this could be the start of a brutal bear market. The meme coin price rally will likely catalyze capital rotation into other assets like Bitcoin and Ethereum.

So the data would suggest that the top is either in or near.

— forrest.y00tstreet.eth (@00forrest) May 6, 2023

Maybe $PEPE rallies again, and we get one last leg to $2400 - $2800 ETH.

Maybe... pic.twitter.com/9MTNoyye1m

With the Bitcoin and Ethereum cycle tops, analysts believe that meme coin profits could rotate into cryptocurrencies in the top 10 crypto projects, blockchain gaming and NFTs.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.