- Quant QNT yielded 100.6% gains for holders over the past thirty days, hitting a high of $224.60.

- Quant’s Market Value to Realized Value (MVRV) hit its highest point in six months, indicating that QNT is overvalued.

- Large wallet investors across top exchanges shed their QNT holdings in the past two days, QNT price retracement is likely.

Quant (QNT) has decoupled from the broader crypto market and yielded 450% gains in four months. The altcoin has garnered attention from crypto traders for its massive rally and is currently “oversold” according to market indicators.

Also read: Chainlink ready to break the internet, is CCIP a global open-source standard?

Ranked in top 30, Quant yields massive returns for holders

In the ongoing crypto bear market, Quant QNT has decoupled from Bitcoin, Ethereum and the broader crypto ecosystem. The interoperability-focused Quant Network has yielded 65.6% gains in the last two weeks.

The native token of the interoperability focused Quant Network has witnessed a spike in its popularity in the last few weeks. The call for Central Bank Digital Currencies (CBDCs) and their increasing mention has made Quant QNT more relevant than ever.

Gilbert Verdian, CEO of Quant is a well-connected member of the crypto and financial world. Verdian took a seat at the European Central Bank alongside the Central Bank of Italy, the Central Bank of Lithuania, and the London Stock Exchange. The project has emerged as a leading one offering holders double-digit profit in the last two weeks,

Quant QNT skyrocketed, hitting a high of $224.60

Analysts believe Quant QNT is carried by an extremely large hype, reflected in the Relative Strength Index (RSI) which is currently close to 75. An RSI above 70 indicates an overheated market and that price has increased too high, too quickly. Jake Simmons, a crypto analyst and trader believes Quant QNT price could fall to the $133 level.

Based on data from TradingView.com, Quant QNT is currently writing its fifth weekly green candle and the asset is 49.5% away from it's all-time high of $427.42. QNT price yielded nearly 17% gains to holders overnight and ranks among the top cryptocurrencies outperforming Bitcoin.

Quant QNT enters overbought zone, signals distress?

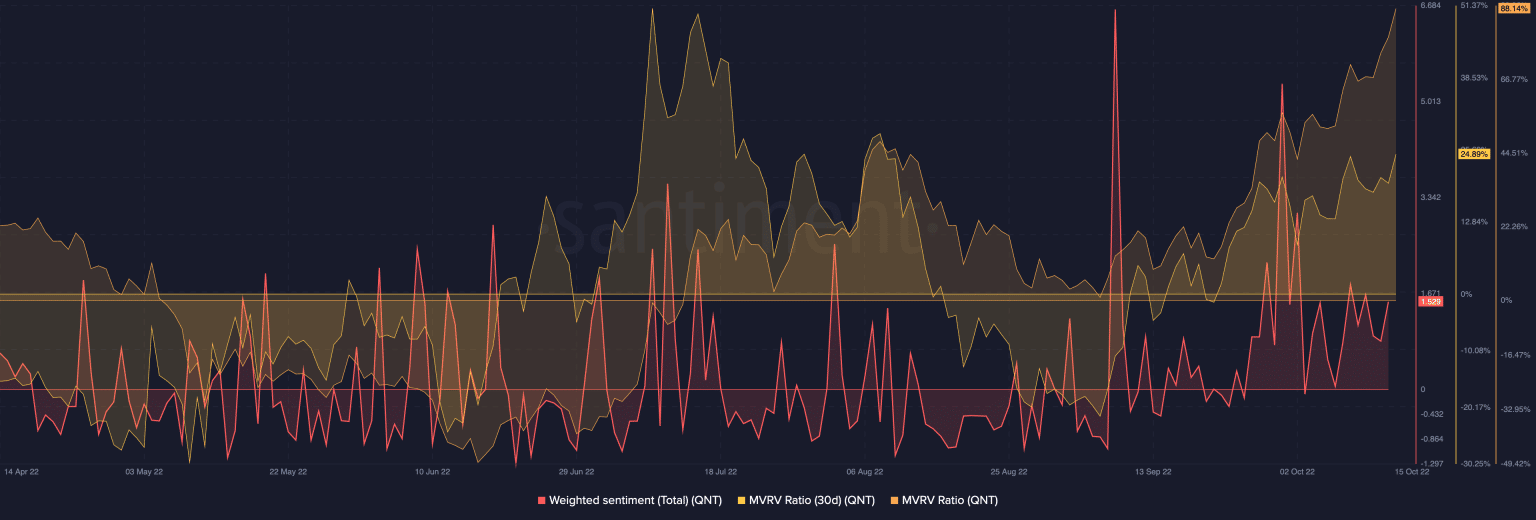

Quant’s massive price rally has resulted in many holders taking profits on their gains. Data from on-chain analytics platform Santiment indicated that Quant’s Market Value to Realized Value (MVRV) is at its highest point in the last six months.

At press time, MVRV is 88.14% and this indicates several holders have registered gains on their investments. A 30-day moving average of the indicator reveals 24.89%. QNT has enjoyed a positive bias among crypto traders over the past four weeks.

Quant (QNT) MVRV

Over the past two days, QNT holdings in whale wallets across exchanges have declined. This indicates profit-taking by large wallet investors and proponents believe a retracement in Quant price is likely in the short-term.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Cardano Price Forecast: Sign of robust bullish reversal emerges despite dwindling DeFi TVL volume

Cardano rebounds to test resistance at $0.69 as technical indicator flashes a buy signal. A minor increase in the derivative Open Interest to $831 million suggests growing trader interest in ADA.

Crypto Today: Bitcoin's downside risks escalate as BTC spot ETF outflows extend

The cryptocurrency market is consolidating losses after starting the week amid high volatility. Bitcoin attempted to steady the uptrend above $106,000 but lost steam, resulting in a reversal to $105,204 at the time of writing on Tuesday.

Bitcoin falls below $106,000 as risk-off sentiment persists

Bitcoin price faces rejection around its $106,406 resistance level on Tuesday, hinting at a potential correction ahead. Market sentiment sours as growing Israel-Gaza tensions weigh on riskier assets, such as BTC.

Coinbase asset roadmap adds Ethena, ENA targets $0.34 breakout before listing

Ethena records its fourth consecutive positive day, signaling increased bullish momentum. Coinbase announces the addition of Ethena to the asset roadmap, making it tradable on the platform soon.

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.