- Paris Hilton endorsed the Shiba Inu coin last week.

- Influencers like Matt Damon, Reese Witherspoon, Kim Kardashian or Floyd Mayweather, have been criticized for hyping virtual currencies without highlighting the risks.

- Other celebrities like Logan Paul or Paul Pierce could be facing legal issues for promoting cryptos.

Paris Hilton’s endorsement of Shiba Inu through her Twitter account didn’t stop the meme coin from plummeting lower. Analysts believe Shiba Inu price downtrend could continue and the meme token could suffer further losses.

Also read: Why Shiba Inu price is back where it traded one year ago

Influencers in Australia face up to five years in jail for this

Influencers that target financial investors, popularly known as “finfleuncers”, now risk five years of jail time if they break laws on financial advice in Australia. The Australian Securities and Investments Commission (ASIC) says that influencers may need a license to give advice on investments.

A survey conducted by ASIC revealed that 33% of investors between 18 and 21 years of age follow finfluencers. The survey revealed that the behavior of 64% of young people in Australia is influenced by influencers and their endorsements.

Cathie Armour, ASIC commissioner, was quoted as saying,

Influencers who discuss financial products and services online comply with the financial services laws. If they don't, they risk substantial penalties and put investors at risk.

The ASIC has circulated an information sheet to guide influencers. The sheet gives a number of examples of statements that qualify as financial advice and warns against making misleading or deceptive remarks about financial products. A violation of the guidelines could count as an event where the influencer broke the law.

Aleks Nikolic, a financial investment influencer on Instagram, TikTok and Twitter, found the document useful for guiding content creation.

Nikolic said,

I think it's some of their clearest and best comms they've ever put out, potentially ever. Obviously everyone will now madly scramble to become compliant, but that was the point.

Interestingly, ASIC pointed out that sharing affiliate links that send investors to online brokers could count as financial advice and this could require a license.

UK Financial Conduct Authority urges caution over influencers

The Financial Conduct Authority (FCA) is the conduct regulator of around 51,000 financial services firms and markets in the UK. In February 2022, the authority urged caution over the use of influencers in marketing of financial products, sharing financial advice.

The watchdog was quoted as saying,

Retail investments' use of social media influencers on various platforms to market investments is becoming a concern for us. Firms should ensure they have taken appropriate legal advice to understand their responsibilities prior to using influencers.

Charles Randell, FCA Chairman, accused influencers who promote cryptocurrency by accusing them of fueling a “delusion of quick riches.”

The UK Treasury dealt with the menace of crypto-asset promotions and misleading financial advice by proposing new laws in January 2022. These laws make “qualifying crypto-assets" subject to the same rules as other financial promotions, applied to stocks, shares and insurance products.

Spain revealed new rules for advertising crypto-assets

In January 2022, Spain’s National Securities Market Commission, also known as the CNMV, unveiled plans to implement new rules for the advertising of cryptocurrencies. This includes the promotion of crypto assets on social media platforms by influencers.

Spain has therefore tasked its stock market watchdog with the authorization of mass campaigns and the responsibility of ensuring that investors are aware of associated risks.

The Spanish government had issued an official bulletin for advertisers asking them to inform the CNMV at least 10 days in advance and share the content of campaigns targeting more than 100,000 people.

The volatility in cryptocurrency assets has garnered the attention of regulators worldwide, and financial authorities fear the financial system is at risk if crypto assets and their marketing activities by influencers are not monitored.

Logan Paul and Dink Doink collapse

Logan Paul is the influencer behind the wipeout of his followers’ investments in an asset called Dink Doink. Paul told his six million followers on Twitter that he was all in on a new cryptocurrency called Dink Doink.

this is the dumbest, most ridiculous shitcoin I’ve ever seen. And that’s why I’m all in https://t.co/NwD0pTO4dQ

— Logan Paul (@LoganPaul) June 28, 2021

Paul failed to reveal that he was friends with the project’s creator. Dink Doink was actually their idea together and he received a large allocation of the cryptocurrency at its launch. While investors poured in capital expecting to receive shares of a cartoon character that would entitle them to a portion of the proceeds when it featured in a TV show or a movie, Dink Doink’s price plummeted to a fraction of a cent, wiping out nearly all of its market value. Paul faced backlash and criticism from his followers.

Matt Damon criticized for Crypto.com ad

Matt Damon, a popular Hollywood star, convinced investors to buy Bitcoin or other cryptocurrencies through his Crypto.com ad that said, ”fortune favors the brave.” Investors that purchased Bitcoin at its near-record high are currently under water and have substantially less funds than their initial investment.

When Damon featured in the advertisement that was aired on television and online, it was a turning point for the crypto community, mass euphoria since Bitcoin price crossed $58,000 in October 2021.

Matt Damon in a Crypto.com ad

Crypto influencers dig gold, looking for the next Dogecoin

Kim Kardashian, Floyd Mayweather and Paul Pierce are other celebrity influencers known to have made millions of dollars endorsing dubious cryptocurrencies. These celebrities have urged their followers to pour money into obscure coins that crash overnight or less-popular collections of NFTs.

There have been instances of failure in disclosing personal and financial ties to projects advertised on their social media handles, and this is considered a potential violation of federal marketing regulations.

John Reed Stark, former chief of the internet enforcement branch at the Securities and Exchange Commission criticized such behavior by influencers and said,

You have this shameless profiteering from celebrities and others, who aren’t at all disinterested or impartial. There is a lot of potential for harm.

Reese Witherspoon recently confused her followers with a bizarre tweet regarding “crypto wallets”, “digital identities”.

The Hollywood star tweeted on January 11, 2022:

In the (near) future, every person will have a parallel digital identity. Avatars, crypto wallets, digital goods will be the norm.

In the (near) future, every person will have a parallel digital identity. Avatars, crypto wallets, digital goods will be the norm. Are you planning for this?

— Reese Witherspoon (@ReeseW) January 11, 2022

Witherspoon asked her followers if they were planning for this, and there was no specific reason for sending out the tweet. However, soon Witherspoon was hit for “scam artistry” slammed for misleading crypto advertising, lack of disclosures.

Lawsuits on wrongful advertising and financial advice

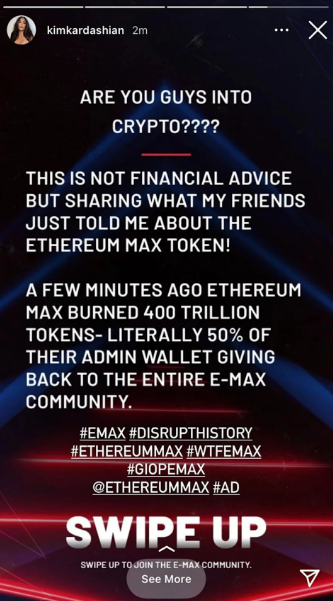

There have been instances of celebrity influencers getting slammed with lawsuits from investors. Kim Kardashian, Floyd Mayweather and Paul Pierce are currently facing a lawsuit for the marketing of EthereumMax, an obscure cryptocurrency project.

Kim, Floyd and Paul are among seven celebrities hit by the lawsuit. The popular star from “The Kardashians” show had asked over 200 million followers on her Instagram,

Are you guys into crypto???? This is not financial advice but sharing what my friends just told me about the Ethereum Max token!

Kim Kardashian’s promotion of EthereumMax

EthereumMax lost 97% of its value within seven months and celebrities that promoted the token are now in hot water. Ryan Huegerich filed the class action lawsuit on January 7 in the US District Court for the Central District of California and accuses these celebrities of making

false or misleading statements to investors about EthereumMax through social media advertisements and other promotional activities.

An EthereumMax representative told the Wall Street Journal that Kim Kardashian’s post was simply intended to raise awareness of the project and its utility.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Whale grabs 16,000 ETH as Ethereum Foundation vows support for L1, RWA and stablecoins

Ethereum Foundation's Co-Executive Director Tomasz K. Stańczak highlights simplified roadmap scaling blobs and improving L1 performance. Ethereum whale scoops 16,000 ETH, emphasizing growing interest in the token as the price recovers.

Bitcoin retests key resistance at $85K, breakout to $90K or rejection to $78K?

Bitcoin (BTC) price edges higher and approaches its key resistance at $85,000 on Monday, with a breakout indicating a bullish trend ahead. Metaplanet announced Monday that it purchased an additional 319 BTC, bringing its total holdings to 4,525 BTC.

XRP price teases breakout, bulls defend $2 support

Ripple (XRP) price grinds higher and trades at $2.15 during the early European session on Monday. The token sustained a bullish outlook throughout the weekend supported by bullish sentiment from the 90-day tariff suspension in the United States.

Senator Elizabeth Warren launches fresh offensive on crypto

Senators Elizabeth Warren, Mazie K. Hirono, and Dick Durbin want the DoJ’s decision to terminate crypto investigations reversed. The Senators raise concerns over the DoJ’s shift in priorities, terming it a “grave mistake.”

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.