Ethereum 2.0 is going to be one of the most significant and monumental changes in the crypto space. By going through this transition, Ethereum is going to incorporate these three major innovations:

- Proof-of-stake (POS)

- Sharding

- Layer-2 integration

By combining proof-of-stake, sharding, Raiden, and plasma, Ethereum 2.0 plans on scaling up operations to a whole new level for the cryptocurrency created by Vitalik Buterin. Theoretically, we are looking at a system that can conduct hundreds of thousands of transactions per second! Since there are so many changes, Ethereum 2.0 will be bringing them along in stages, which we explain in this article. As such, definitely keep an eye out for Ethereum’s price action, which you can do so right here in our cryptocurrency news section.

The current problems of Ethereum

The main problem with blockchain-based cryptocurrencies is that they are not scalable at all. Bitcoin and Ethereum can only execute 7 and 25 transactions per second, respectively. To understand how slow this is, consider that PayPal can conduct a little short of 200 transactions per second. This lack of scalability has affected cryptocurrencies in multiple ways:

- The low scalability ensures that they are not practical for real-time usage.

- This is doubly true for Ethereum. Remember, unlike Bitcoin, Ethereum is not just a simple cryptocurrency. It is a decentralized application (dAPP) platform as well. This is why it needs to be as scalable as possible to support bulky business logic.

- Finally, cryptocurrencies will never gain mainstream acceptance if they can resolve the scalability issue. You can’t have a monetary system that slows down as more people use it.

Now, let’s go through the innovations that Ethereum 2.0 will bring in to resolve these problems.

Innovation #1: Proof-of-stake

Cryptocurrencies, like Bitcoin and Ethereum, are decentralized in nature. As such, they can't have a centralized governing body that dictates the project's ebb and flow. The way they do so is by integrating an algorithm called “consensus mechanism.” A consensus mechanism empowers a network to come to an agreement without the need for a central entity. Bitcoin and Ethereum (pre 2.0 upgrade) managed to do this with a process called proof-of-work.

What is proof-of-work?

The idea behind proof-of-work (POW) is pretty simple:

- Nodes called “miners” own specialized equipment and solve cryptographically hard puzzles.

- These puzzles are challenging to solve, but the solution is very simple to verify.

- The miners rinse and repeat their calculations until they finally solve the puzzle.

- The moment the miner successfully solves the puzzle, they immediately send their solution to the next of the network.

- If more than two-thirds of the network approves the solution, the miner gets awarded a “block reward.”

While the system is pretty straightforward and has a proven track record, it is not without its faults.

The problems with POW

The complex calculations force miners to spend a lot of computational resources and energy. As such, POW can be extremely wasteful and expensive. As per a July 2019 study, bitcoin consumes more energy than Switzerland!

Larger corporations can simply hoard all the expensive mining equipment and create a Bitcoin mining monopoly. This goes against the very spirit of decentralization.

Finally, POW is just extremely slow and not scalable enough. After all, the more the network grows, the longer it takes to validate an operation.

Because of these limitations, several modern blockchain projects, including Ethereum 2.0, have started opting for more virtual consensus algorithms like POS.

How does POS work?

In a POS system, we have validators instead of miners. Here is how it works:

- Instead of hoarding mining equipment, the validators lock up a portion of their tokens within the ecosystem as stake.

- Depending upon the size of the stake, they get more opportunities to bet on the validity of a potential block.

- If the block they place their bet on happens to be correct, they receive a reward that’s directly proportional to their bet.

Advantages of POS

Unlike POW, POS doesn’t waste real-life resources like computational power, making it a more environmentally-friendly alternative. Being less wasteful makes it a lot more scalable than POW.

Casper – Ethereum’s POS implementation

As you may have figured out, the validators in a POS system have a lot of power and influence over the direction that the protocol takes. This is why their interests must be aligned with those of the supermajority of the network (>2/3rd). Ethereum wants to ensure the optimal and honest participation of their validators, which it achieves by implementing a special type of POS called “Casper.”

Casper primarily works like your standard POS, but it comes with an in-built slashing mechanism. The moment the validators act maliciously, or not up to their usual standards, they get their stake slashed off. This gives them a substantial economic incentive to work in the best interests of the system.

To participate in Ethereum’s POS, validators will need to lock up at least 32 ETH in the ecosystem.

Innovation #2: Sharding

The next great innovation that Ethereum 2.0 is bringing in is “sharding.” If you have experience working with large databases, then you must already be pretty familiar with the term. The idea is to horizontally partition a large database into smaller, more manageable chunks called shards. To understand what we mean by that, consider the following example:

| Name | Age | Place |

|---|---|---|

| Raj | 31 | India |

| Alex | 19 | USA |

| David | 51 | England |

| Foley | 46 | Canada |

Now, if we horizontally partition the database, we get the following chunks:

| Name | Age | Place |

|---|---|---|

| Raj | 31 | India |

| Alex | 19 | USA |

and...

| Name | Age | Place |

|---|---|---|

| David | 51 | England |

| Foley | 46 | Canada |

As you can see, these smaller shards are easier to handle than the larger database. Do note that this partition has to be horizontal since if we did vertical partitioning, we would end up with tables that are entirely different from the original one.

| Name | Age |

|---|---|

| Raj | 31 |

| Alex | 19 |

| David | 51 |

| Foley | 46 |

and...

| Place |

|---|

| India |

| USA |

| England |

| Canada |

How is this relevant to Ethereum 2.0?

Blockchain-based cryptocurrencies tend to perform their operations sequentially rather than parallelly.

Think of how a simple transaction works. In this case, we are only looking at a POW system.

- Alice sends 1 ETH to Bob’s public address and signs it off with their digital signature.

- The transaction then goes and waits in a place called the “mempool.”

- The miners pick up the transaction and verify the validity of the signature.

- Following that, they add the transaction to their block.

- Bob will receive the 1 ETH only when one of these miners successfully solves the puzzle and adds the block to the main chain. Ethereum block time is around 15 seconds, while for Bitcoin, it can go up to as much as 10 mins.

With sharding, it will be possible to horizontally partition the state of the blockchain itself into small shards and random assign validator sets to each individual shard, who then process the shards in parallel.

To visualize this, consider the following example. Suppose your task is to get your friends to finish one pizza. What is the more economical solution?

- Get a pizza for each of your friends and make them eat the whole thing?

- Cut the pizza into smaller slices and give one to each of your friends.

While we would personally like to be in the former group (more pizza!), but the obvious solution is the second. This is pretty much how a sharded blockchain works as opposed to a traditional blockchain.

Innovation #3: Layer-2 solutions

Layer-2 can be thought of as a piece of architecture on top of the underlying protocol, which the latter can use to offload more complex computations and achieve faster operations, as a whole. In other words, they allow you to conduct operations that would normally take place on the blockchain, off the blockchain. This is why layer-2 solutions are also called “off-chain” solutions.

Now, you must be probably thinking, Ethereum 2.0 will already be implementing sharding. So, why do we need layer-2 protocols as well?

The reasoning is pretty simple. Sharding works in the base blockchain layer or layer-1. However, layer-2 can reduce congestion in the main chain by diverting some of the more complex and highly-frequent operations. It’s pretty similar to how a flyover eases traffic on the main road by redirecting a significant chunk of it away.

The blockchain bloat problem

Full nodes are crucial to the survival of a decentralized network. These nodes download and maintain the whole blockchain and take care of all governance duties. However, with the blockchains growing significantly in size, it is becoming increasingly challenging to store them efficiently. Plus, the current system isn’t practical if we want to conduct fast microtransactions.

So, to solve these problems, Ethereum will execute the following layer-2 solutions:

- Raiden

- Plasma

Raiden

Before we get into Raiden, let’s understand what state channels are.

Think of state channels as two-way communication channels between users, wherein they can directly interact with each other, without having to go through the whole “mempool -> miners -> block” process.

This state channel is a segment of the blockchain state that’s locked off and isolated from the rest of the main chain. Raiden is Ethereum’s version of state channels. With Raiden, Ethereum 2.0 will be able to:

- Conduct microtransactions.

- Enable faster and smoother transactions.

- Decreases the overall stress on the Ethereum blockchain.

The opening and closing of these Raiden state channels are dictated by predetermined conditions that have been laid down by the participants.

Plasma

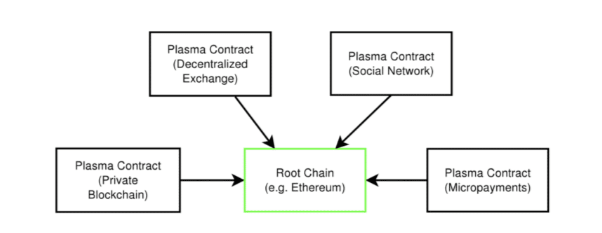

Plasma is an exciting layer-2 innovation that brings a whole new dimension to Ethereum 2.0. The idea is to treat Ethereum as a root chain, from which several new plasma chains can sprout out like branches.

What this structure does is that it exponentially reduces the strain on the root chain, keeping it as devoid of calculations as possible. Every single plasma chain can be dictated by its own consensus protocol and token. They must routinely commit the results of their operations to the root Ethereum chain to finalize it for eternity.

The different phases of Ethereum 2.0

All these innovations will need to be implemented in phases to ensure proper execution. The phases detailed are – phase 0, phase 1, phase 1.5 and phase 2.

Phase 0 – Initiating POS

The phase will begin in 2020 and launch the “beacon chain,” which will trigger the initiation of proof-of-stake implementation. This chain will be in charge of managing the registration of POS validators. When the following conditions are met, the beacon chain will launch its first block:

- At least 524,288 ETH has been staked on the network.

- The number of registered validators has crossed 16,384.

During this phase, the original Ethereum POW chain continues to co-exist with the beacon chain and takes care of all the main operations.

The beacon chain's creation should be a bullish signal since it will trigger bulls to go on complete accumulation mode to become a validator in the network.

Phase 1 – Initiating sharding

This is the phase that triggers sharding implementation and should take place around 2021. During this phase, the Ethereum blockchain will get partitioned into 64 shard chains and run parallel to each other. Ethereum should be able to process multiple transactions across the 64 shard chains simultaneously.

Will this be a bullish signal? Well, it will ultimately depend on how well Ethereum executes its sharding. If there is a noticeable change in overall throughput, then it will trigger a bull run.

Phase 1.5 – Merging POW and POS

Phase 1.5 should take place in late 2021. In this phase, the original POW chain will be merged with the beacon chain to create the new Ethereum POS chain. Post-merging, Ethereum POW will function as one of the 64 shard chains of the Ethereum system.

This gradual transition from Phase 0 -> Phase 1-> Phase 1.5 ensures the following:

- There is no break in continuity.

- Current holders won’t need to swap their ETH 1.0 for ETH 2.0.

- The original POW chain will no longer run its consensus algorithm.

This should be hugely bullish for Ethereum’s price. This is the exact moment where Ethereum finally transitions to a proof-of-stake protocol. As such, there will be a lot of hype in the market.

Phase 2

This phase will happen somewhere beyond 2021 and bring in some cool features like roll-ups and other layer-2 fine-tuning. This phase's impact on the price action will be directly related to the effectiveness of the implementations.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto trading volume declines further, signaling waning trader enthusiasm and market momentum

The total crypto market capitalization lost $1.01 trillion since January, while Santiment data shows that crypto-wide trading volume has dropped since February’s peak. For a healthier and more sustainable recovery, bulls look for rising prices accompanied by increasing volumes; until trading activity picks up, cautious market sentiment is likely to prevail.

BNB price tops $570 as Binance receives $2 billion investment from Dubai

BNB price rose as high as $574 on Thursday as markets reacted to news that Binance received major investments from an Abu Dhabi based firm. Derivative markets analysis shows how BNB traders are repositioning amid the latest swings in market sentiment.

PEPE price outperforming DOGE and SHIB as US CPI boosts Crypto markets

PEPE price crossed the $0.00007 for the first time this week as markets reacted to positive macro market signals. Early insights show crypto traders are displaying high risk appetite at the onset of the current market rally. Could this sustain PEPE price uptrend along with the rest of the memecoin market.

XRP records slight gains as Ripple's battle with SEC nears end

Ripple's XRP recorded a 2% gain on Wednesday following rumors of the company nearing an agreement with the Securities & Exchange Commission (SEC) to end their four-year legal battle.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.