What is Bitcoin ‘pairs trading’?

This is for anybody who wants to sell some Bitcoin but is still bullish crypto.

It’s also if you’re neutral on crypto but think Bitcoin is overvalued vs other tokens.

It’s also just if you’re just interested to see a way to apply a pairs trading strategy.

In case you’ve been hiding under a rock, Bitcoin just broke over $100k - No more waiting for the HODLRS!!

Naturally after hitting this massive milestone, some traders are going to be thinking about taking profits. And if they’re thinking it, some of them are going to be doing it.

But let’s forget about selling for a moment, are you really buying more BTC when it just hit $100k and it's up ~150% this year?

So even if there is not more active selling interest, there’s probably less buying interest.

I think you’d be mad (or very brave) to bet against Bitcoin. BUT

Are these scenarios possible?

-

Bitcoin trades sideways for a while after hitting $100k.

-

Alt season kicks in and other cryptos play catchup.

If you think yes to at least one of these, my team and me have been looking at a pairs trade.

What is pairs trading?

Pairs trading in crypto is a market-neutral trading strategy that involves taking a long position in one cryptocurrency and a short position in another, based on the assumption that their historical price relationship will revert to the mean.

The point is to profit from the relative price movement between the two assets, i.e. not the absolute ups or downs of one asset like Bitcoin.

ETH/BTC

I put this crypto pair this way around - I’m not sure if you’re meant to - it just kind of reminds me of EUR/USD in forex trading.

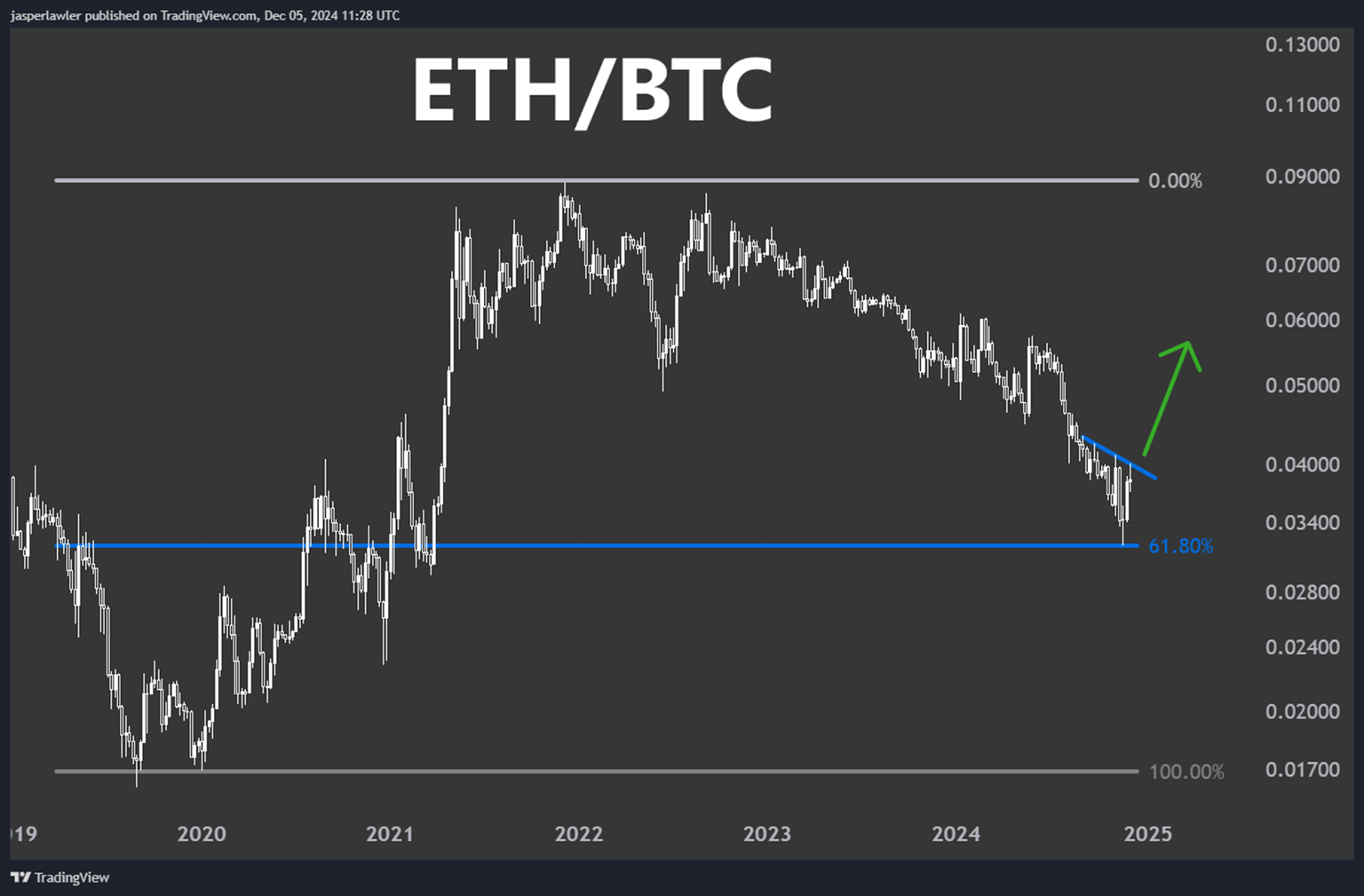

So as a reminder, ETH/BTC is Ethereum priced in Bitcoin. When Ethereum outperforms Bitcoin it goes up and when Etherium underperforms Bitcoin, it goes down.

So it doesn’t actually matter if Bitcoin goes up, down or sideways, if you’re trading ETH/BTC - what matters is what one does relative to the other.

Well this thing has been going down a lot! Until recently.

Going back to pairs trading - the thesis here is that the Ethereum/Bitcoin price ratio has dropped to bargain levels and could be about to recover.

I’m not going to lie to you - there are a lot of sore hands out there from trying to pick this falling knife!

But this rebound off the 61.8% Fibonacci retracement of the 2020-21 rally has caught our attention.

Dropping to the daily chart, can you see how 0.4000 has acted like a magnet to the price both from above and below?

0.4 is our line in the sand for long positions.

Equally, our risk is well defined here. A drop back under the 61.8% Fib level around 0.3200 means the idea isn’t working and it's time to get out and let Bitcoin do its thing!

How to trade it

Specific entries and exits depend on your personal risk tolerance, but broadly there are THREE methods here:

1. Crypto-to-crypto spot trading

Trade ETH directly for BTC (or vice versa) on a cryptocurrency exchange. This is straightforward and involves holding the actual assets.

2. CFD trading (contracts for difference)

Speculate on ETH/BTC price movements using CFDs without owning the underlying cryptocurrencies. This allows for leverage and the ability to short-sell.

3. Spread trading

Buy ETH and simultaneously short BTC (or vice versa) with equal dollar value to profit from their relative price movement while minimizing exposure to overall market trends.

Author

Jasper Lawler

Trading Writers

With 18 years of trading experience, Jasper began his career as a stockbroker on Wall Street in New York City before sharpening his analytical skills at top trading firms in the City of London.