What happened in crypto this weekend?

Debt Box case judge ‘not fucking having it’ with SEC conduct

A Utah federal judge’s threat to sanction the United States Securities and Exchange Commission over alleged deceptive statements about a crypto company it sued shows its conduct is “exceptionally bad,” according to one crypto executive.

On Nov. 30, District Judge Robert Shelby alleged the SEC lied about Debt Box moving funds outside of the United States so a court would grant a freeze on its assets. The SEC sued the company in August, accusing it of running a $50 million fraudulent enterprise.

“This sort of conduct is exceptionally bad, even by SEC standards,” crypto consulting firm Zero Knowledge founder Austin Campbell said in a Dec. 1 X (Twitter) post. “The judge is absolutely, completely, and totally not fucking having it.”

“The most insulting part of this is that in the process of being mustache-twirling villains, the SEC couldn’t even be competent at it,” Campbell added. “Conduct like this is making me come around to the view that they actually should be disbanded.”

Crypto-focused lawyer John Deaton posted to X that anyone “surprised a federal judge is considering sanctions against the SEC for lying to the Court, in a case involving crypto, has not been paying attention during the last 3 years.”

Any person surprised a federal judge is considering sanctions against the SEC for lying to the Court, in a case involving crypto, has not been paying attention during the last 3 years.

— John E Deaton (@JohnEDeaton1) December 2, 2023

It appears the Lawyers at the SEC have made it personal when it comes to crypto cases. SEC… https://t.co/1rjLjiTvF3

Deaton claimed the SEC had “made it personal when it comes to crypto cases” and named its lawyers Jorge Tenreiro and SEC Division of Enforcement director Gurbir Grewal as examples who “don’t hesitate to intentionally mislead the Court.”

As for the SEC, Campbell said it now faces a “rather brutal set of questions to answer to show they should not be sanctioned for their conduct.”

Brothers behind $8.5M Platypus exploit walk free

A French court has reportedly cleared the criminal charges of the brothers behind the $8.5 million hack of decentralized finance protocol Platypus Finance.

The brothers, identified only as “Mohammed M” and “Benamar M,” argued they were “ethical hackers” and were subsequently acquitted, according to a Dec. 1 report by local news outlet Le Monde.

They were said to have exploited the Avalanche-based automated market maker (AMM) protocol on Feb. 16 and were arrested eight days later on Feb. 24.

Mohammad was initially charged with access to and retention in an automated data processing, fraud and laundering system, while Benamar was accused of concealment. Prosecutors initially sought a five-year prison sentence for Mohammad.

Mohammad claimed to be an “ethical hacker” as he intended to extract the funds and then return them to Platypus in hopes of receiving a 10% bounty.

The court said the charges relating to unauthorized access to a computer system did not apply because Mohammad only ever accessed a publicly available smart contract.

It also ruled that Mohammed’s use of Platypus’ “emergency withdrawal” smart contract, the one which had the vulnerability he was able to exploit, did not constitute fraud.

Hi @zachxbt

— Victor Charpiat (,) (@VCharpiat) December 1, 2023

The Paris criminal court has just dismissed the charges against the hackers of Platypus. They walked out of court free.

The judge basically said “French criminal law doesn’t technically forbid hacks of protocol”.

Very disappointing.https://t.co/sVV7hoa3LX https://t.co/tYDy0nB1Dg

During the flash loan attack, Mohammad mistakenly locked the majority of the funds away and was only able to retrieve $270,000.

The two were caught by Binance and on-chain sleuth ZachXBT, who passed relevant information to French authorities.

The court informed Platypus it can still pursue a case in a civil court.

Yet-to-launch L2 blast hiring two engineers

Blast, an upcoming Ethereum layer-2 network slammed by one of its own investors for opening deposits before its mainnet launch, is expanding its team with at least two engineers.

Blast is hiring a Senior DevOps Engineer and a Senior Protocol Engineer with experience at a small startup, according to its website.

The DevOps Engineer needs Amazon Web Services and blockchain node software experience, while the Protocol Engineer should understand the Ethereum Virtual Machine and the programming language Go.

Paradigm, a venture capital firm that backed Blast, criticized the project in November over its move to launch a bridge before its network and not allow withdrawals for three months.

Blast has locked over $700 million locked in its protocol despite a mainnet launch date slated for February.

Spain arrests man alleged of helping North Korea build crypto empire

Spanish authorities have arrested Alejandro Cao de Benos, a local wanted by the U.S. for allegedly helping North Korea use crypto to evade sanctions.

In a Dec. 1 statement, the Spanish National Police said it arrested a man in the nation’s capital of Madrid on Nov. 30 after learning he was using fake identity documents to travel from Barcelona.

The U.S. Justice Department charged Cao De Benos in April 2022 for conspiring to violate U.S. sanctions on North Korea for planning and organizing the 2019 Pyongyang Blockchain and Cryptocurrency Conference.

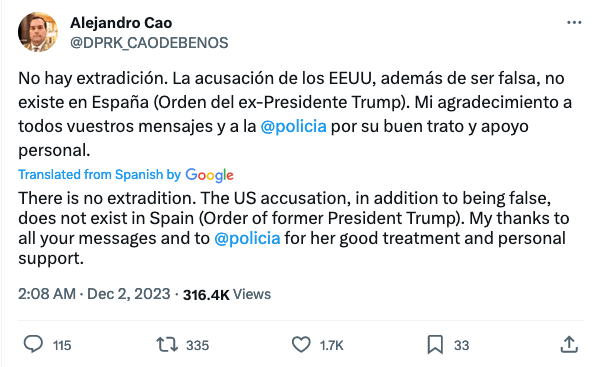

In a Dec. 2 statement posted on X, Cao de Benos said the accusation was “totally false” and “purely political.”

A separate X post from Cao de Benos claims the U.S. allegations against him are false. Source: X

He denied ever using false documents and claimed he spent 24 hours in custody before he was released.

A judicial source told Reuters that he appeared before a High Court judge on Dec. 1, who released him without conditions pending extradition to the U.S.

He faces 20 years in prison if convicted.

On Nov. 30, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) joined its peers from Australia, Japan and South Korea in sanctioning North Korea’s cyber espionage group Kimsuky, which has mined crypto to fund its operations and launder funds.

Other news

Binance’s new CEO Richard Teng told Cointelegraph the crypto exchange is now “totally different” and no longer has “gaps in compliance” after it settled criminal charges with the U.S. for over $4 billion and former CEO Changpang “CZ” Zhao faces 18 months in jail.

British legislators have urged caution on a retail digital pound, questioning if it is a “solution in search of a problem” and stressing the importance of balancing technological advancements and potential drawbacks.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.