What Ethereum price needs for a sustained rebound

- Ethereum price is using a little bit of room to book some gains.

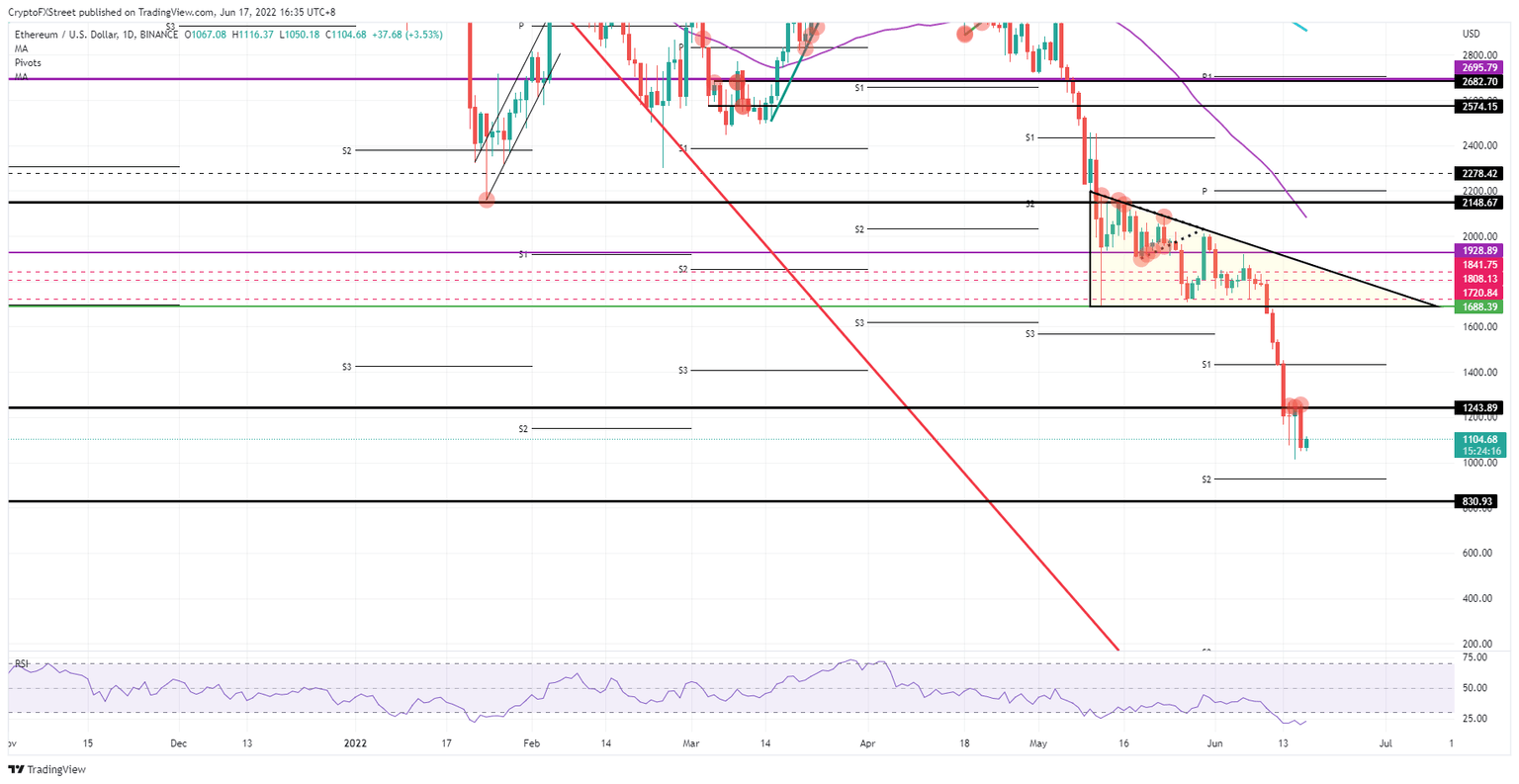

- ETH price could rally back to $1,243.89 as it already did for the rest of this week.

- A daily close above could provide a sign of a recovery next week.

Ethereum (ETH) price could be showing some relief as investors and traders are readjusting and getting accustomed to the new backdrop of inflation woes in global markets. Although it is felt that there is less disposable cash to spend on cryptocurrencies, that does not mean that bulls cannot shift the needle to the upside, but expect those moves to not be that substantial in the longer term. ETH price is thus looking for equilibrium, searching for direction in a possible, sideways patch for a breakout either way.

ETH price in a sideway patch looking for conviction

Ethereum price is in an atypical pattern, with bulls using a lot of juice to push price-action back up to near $1,243.89. The question is whether bulls have not already burned too much cash in trying to reach that level instead of letting price action dip and scoop up below $1,000. The situation is now becoming unsustainable for both parties, and a breakout is due.

ETH price could rally steadily back towards the aforementioned $1,243.89 hurdle again. With the dollar trading sideways and backing off a bit, a small pop above could even materialise. Going into the weekend and with fewer restraints, a test of $1,400 could be in the making but bear in mind that the background has not changed fundamentally, and any profit needs to be treated with caution.

ETH/USD daily chart

There is a risk, of course, that headwinds could flare up and the ferocious dollar’s strength could return, squeezing out bulls from their positions. This push could be proven one too many and lead to a break of $1,000, which could then trigger, in turn, an exodus of investors to get out of the way of the bearish steamroller that will squash price action towards $830.93. Which means a 25% decline added to the descent.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.