What are the environmental concerns around Bitcoin?

The recent sharp falls in Bitcoin have happened as Tesla’s CEO Elon Musk highlighted his environmental concern about Bitcoin. So here is what all the fuss is about.

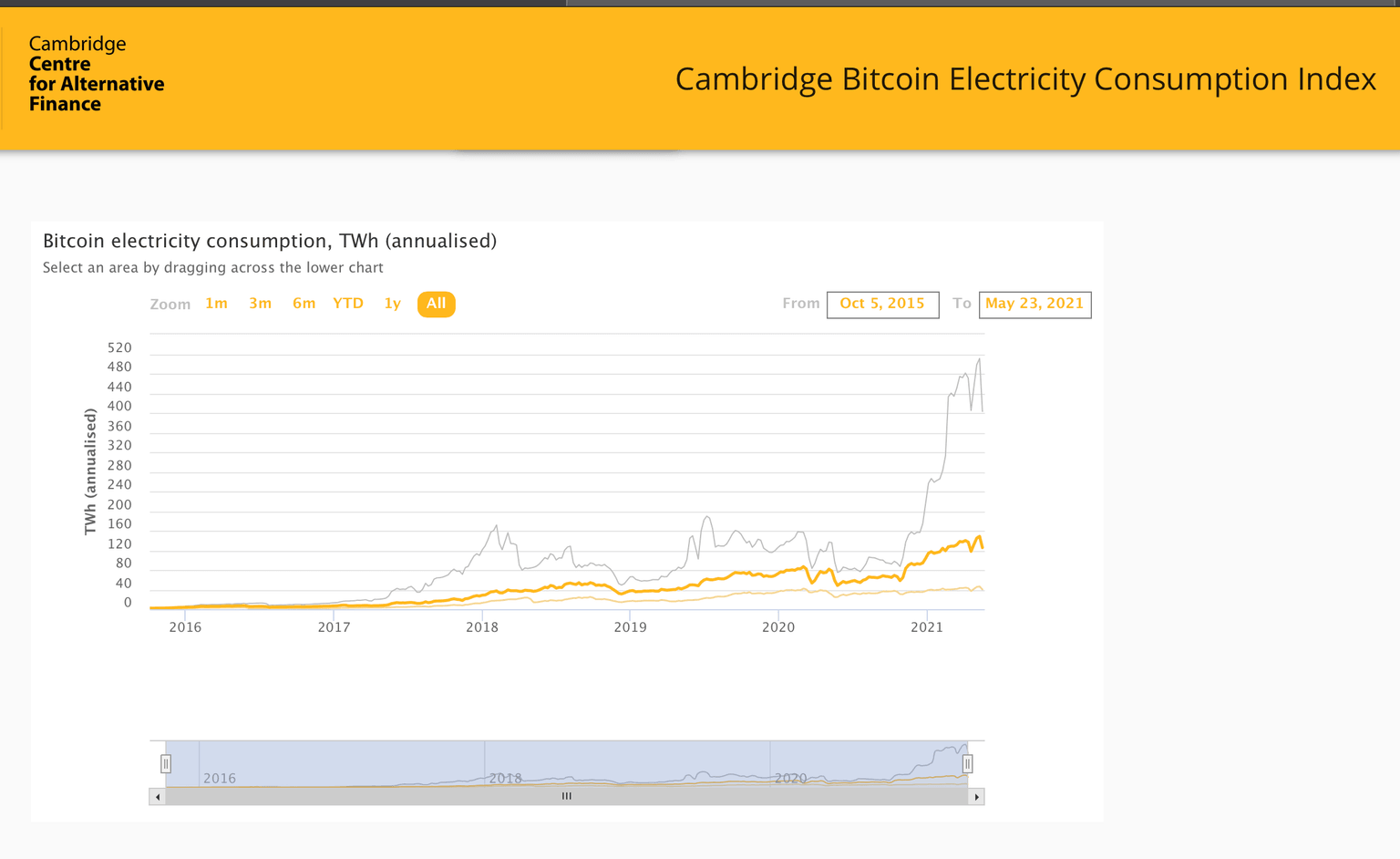

Bitcoin mining is very ‘dirty. The amount of electricity consumed to mine bitcoin is about the same as a medium-sized country taking more electricity than Sweden, Ukraine, & Norway. Here is the FT chart showing that based on research from Cambridge University’s Bitcoin Electricity Consumption Index:

The estimate on electric use is an estimate that could be wrong. An upper-end estimate eclipses the 133 terawatt estimate and looks for a figure closer to 500 terawatts. This would mean that Bitcoin could in fact be using more electricity than the UK.

About 65% of Bitcoin mining is thought to come from China where around 60% of the energy mix comes from coal.

The basic argument about Bitcoin’s energy consumption has meant Greenpeace has now scrapped their facility accepting Bitcoin’s which they started in 2014. Greenpeace state that their policy was no longer ‘tenable’ as ‘the amount of energy needed to run Bitcoin became clearer’.

This is now a political agenda

Nigel Topping who was appointed by the UK Gov’t to coordinate with businesses over climate goals in light of the COP26 talks says Bitcoin is not on the agenda but it is becoming one of the ‘climate baddies’.

So, this is the heart of the issue.

Bitcoin advocates say that renewable energy sources will come in time and that Bitcoin mining could even accelerate this process.

The takeaway

Any other high-profile company or Gov’t that rejects Bitcoin on its environmental impact will cause further selling. It is one headline to watch out for.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.