- Large wallet investors made major altcoin transactions in Lido DAO, Illuvium and Holo.

- Whale activity is considered a hint of upcoming volatility in the asset’s price.

- With LDO supply on exchanges just under 6%, the token is likely positioned for a price rally.

Crypto experts at Santiment observed a rise in large volume transactions across altcoins Lido DAO (LDO), Illuvium (ILV) and Holo (HOT). Typically, sudden whale moves on an asset’s network are indicative of outliers or upcoming volatility in crypto prices.

Also read: Justin Sun’s TRON scooped up by whales as TRX prepares to catch up with rising TVL

Whale activity in LDO, ILV and HOT signals incoming volatility

Brian Quinlivan, marketing specialist and crypto analyst at Santiment observed major altcoin transactions as crypto markets begin their recovery. Market participants are currently awaiting the US PCE release on Friday, Bitcoin, Ethereum and large market capitalization asset started their recovery on Thursday.

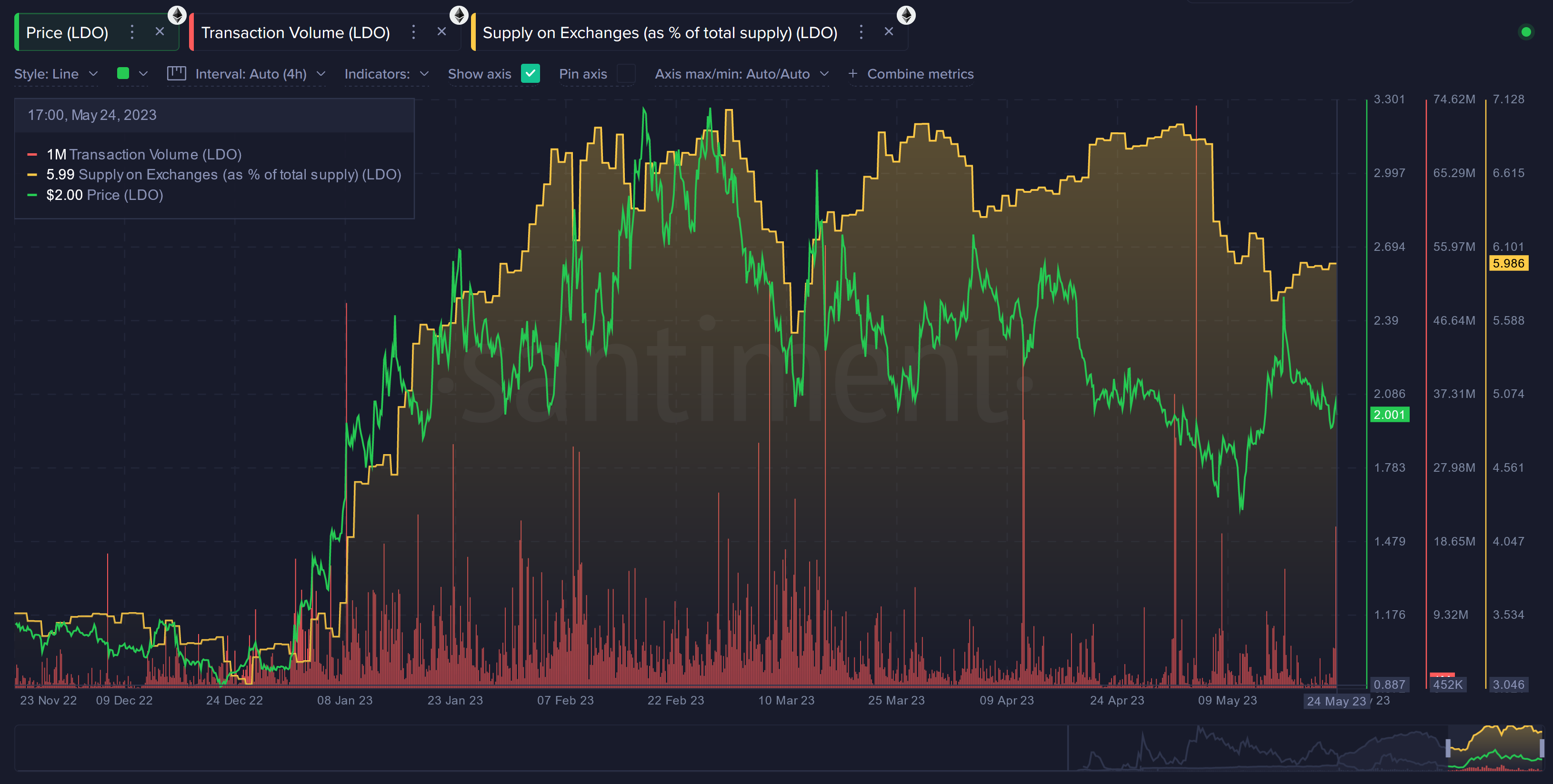

Three major altcoins that noted a spike in whale activity are LDO, ILV and HOT. Lido Dao noted several large value transfers on its network throughout 2023. Some of the value transfers can be attributed to movements among self custody LDO wallets.

Lido DAO transaction volume and supply on exchanges

Interestingly, the supply on exchanges, a key metric for LDO, is just under 6%, a relatively strong number for an altcoin. While the supply is below 6%, it implies a relatively low selling pressure on the asset.

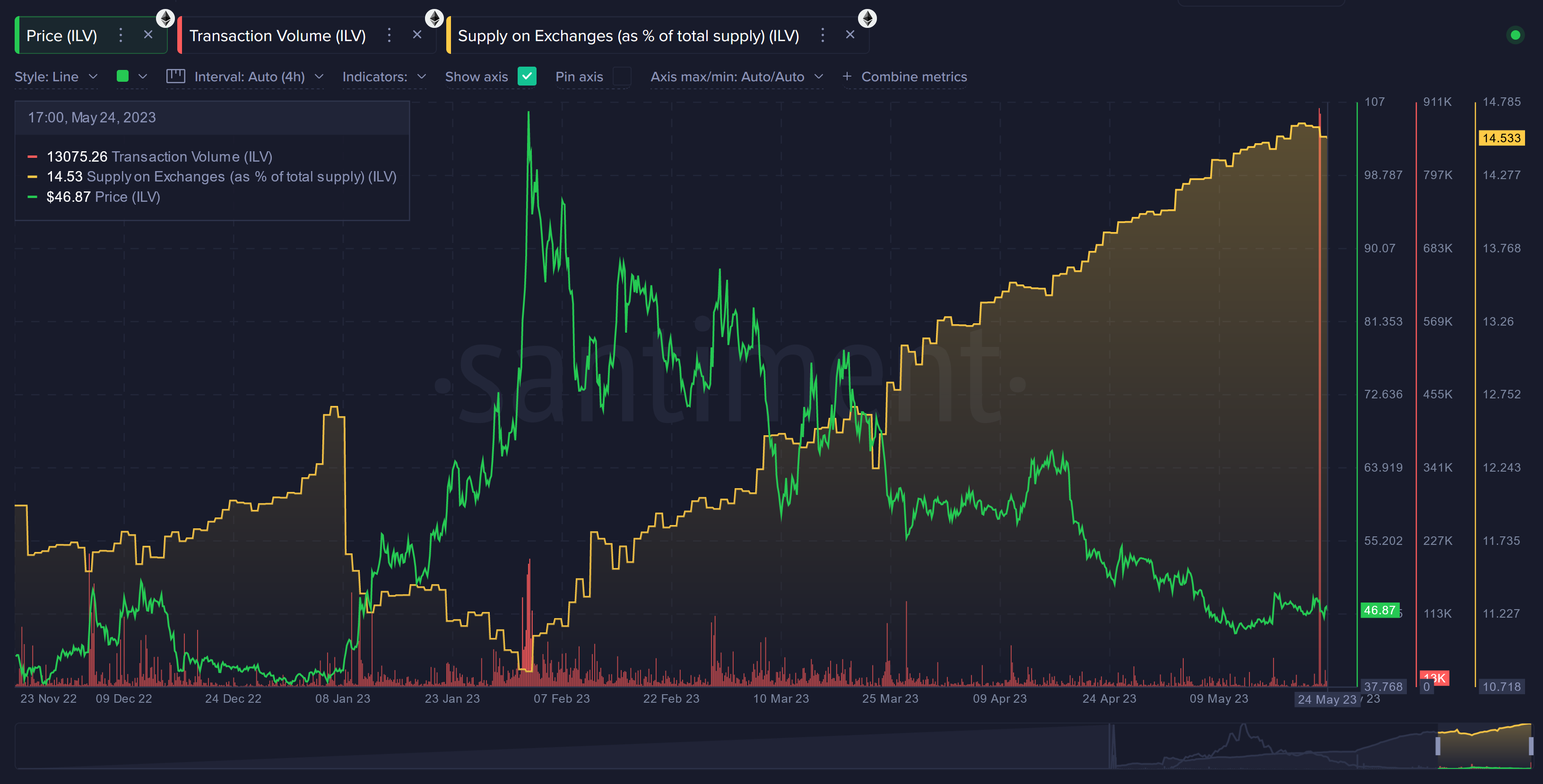

ILV, an ERC20 token on the Ethereum blockchain, noted a huge ascent above $106 in February 2023. Since then the asset’s price nosedived below $47 and the exchange supply steadily increased to hit 14.5% in May.

ILV transaction volume and supply on exchanges

Santiment’s experts consider the current price as a plausible bottom for ILV. The token is likely geared towards a recovery in its price.

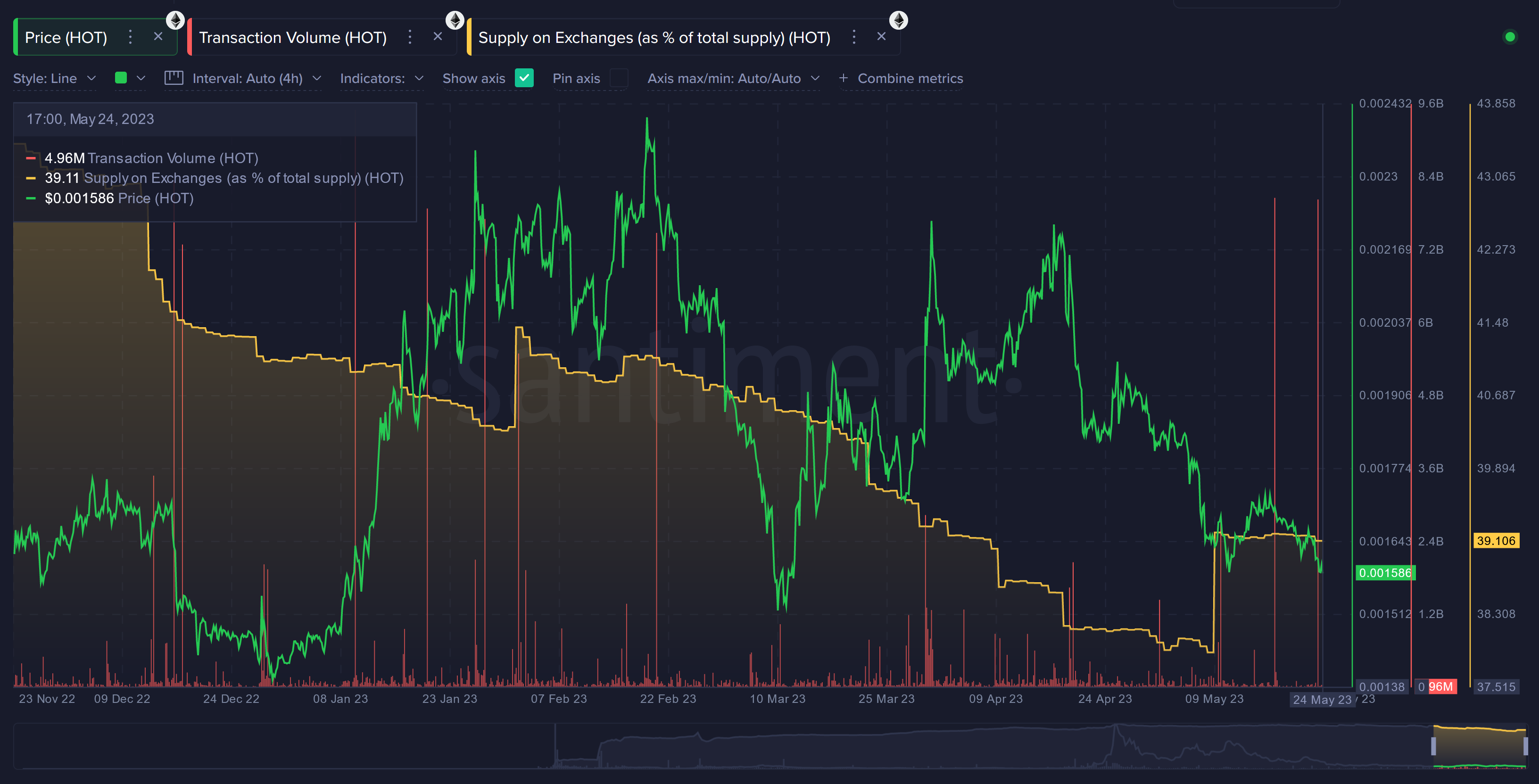

Similar to Illuvium, Holo observed large transfers on its network, with whale activity once or twice every month.

HOLO transaction volume and supply on exchanges

The recent spike in whale activity however had no significant impact on the supply of HOT across exchanges.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP Price Prediction: Bearish technicals, on-chain indicators signal 68% potential crash

XRP faces increasing bearish sentiment from macro, micro and fundamental factors in April. Weak on-chain indicators ranging from network growth, total supply and active addresses reinforce an impending crash.

Bitcoin Price Forecast: Tariff volatility sweeps over $200 billion from crypto markets

Bitcoin price hovers around $83,000 on Thursday after it failed to close above the $85,000 resistance level the previous day. Volatility fueled by Trump’s tariffs swept $200 billion from total market capitalization, liquidating over $178 million in BTC.

SOL is the winner as Solana chain turns into battleground for meme coin launchpad and DEX

Solana (SOL) gains nearly 2% in the last 24 hours and trades at 118.28 at the time of writing on Thursday. A Decentralized Exchange (DEX) and a meme coin launchpad built on the Solana blockchain have waged a war for users and compete for the trade volume on the chain.

Shibarium, built for the Shiba Inu blockchain, reaches 1 billion in transactions in 18 months after its launch

Shibarium, a Layer-2 blockchain for the Shiba Inu ecosystem, reaches 1 billion transactions 18 months after its launch. This milestone reflects growing adoption and Shibarium’s robust performance.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.