Whales chase AAVE for massive gains, the Ethereum-based protocol token could rally on one condition

- AAVE network witnesses an increase in the number of whales since January 18, as large wallet investors scoop up the DeFi token.

- Aave’s total value locked decreased over the past month, dropping from $5.4 billion to $3.7 billion within a 30-day period.

- The launch of V3 on the Ethereum mainnet and Lemon App deal bullish catalysts for DeFi token.

Whale count on the Aave network has increased over the past week. Large wallet investors are buying the dip, while the Aave price drops 7% since January 18. While users on the Aave network declined by 25% over the past month, a spike in user adoption could act as a bullish catalyst for the asset.

Also read: Here's why Ethereum price could witness a bullish breakout after mass profit taking by ETH holders

AAVE’s large-wallet-holder count increases during recent dip

AAVE supply held by large wallet investors on the network has increased substantially since January 18. Based on data from crypto intelligence tracker Santiment, the percentage supply of AAVE held by top addresses on the network hit a high.

AAVE Supply held by top addresses(as % of total supply AAVE)

AAVE price declined 6.3% over the past week and whales continued scooping up the DeFi token throughout the dip. The reason why may be because whales have identified bullish catalysts in the AAVE ecosystem that could fuel a bullish narrative in the DeFi token.

Aave V3 launch on the Ethereum mainnet marks positive development in the DeFi ecosystem

While Aave V3’s launch on the Ethereum mainnet in March 2022 did not have an immediate impact on the DeFi token’s price, the development is a positive one for the protocol. The launch of the protocol on Ethereum could drive adoption and usage of the Aave protocol higher. These are potential long-term bullish catalysts for AAVE.

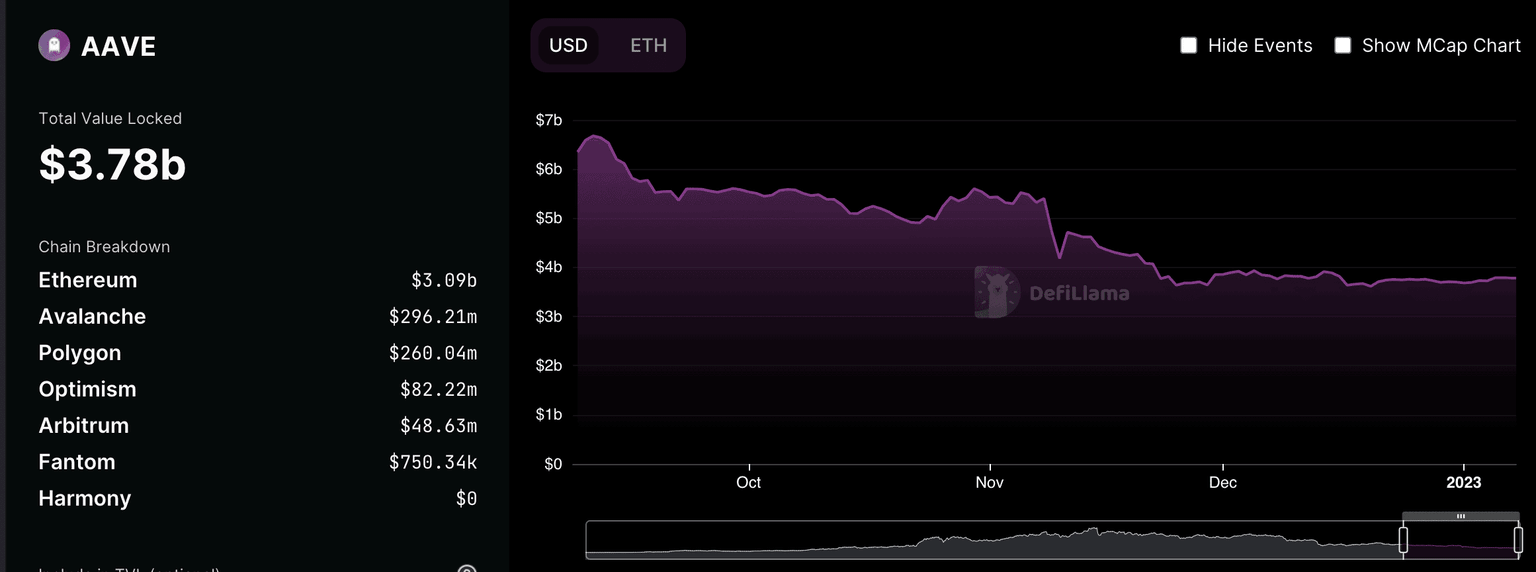

Total value locked on Aave Protocol

The Total Value Locked (TVL) metric in the Aave network, which measures the value of all the crypot funds held in smart contracts on the network and gives an indication of how active users are, declined from $5.4 billion to $3.7 billion. Despite the declining TVL, whale adoption could push AAVE price higher.

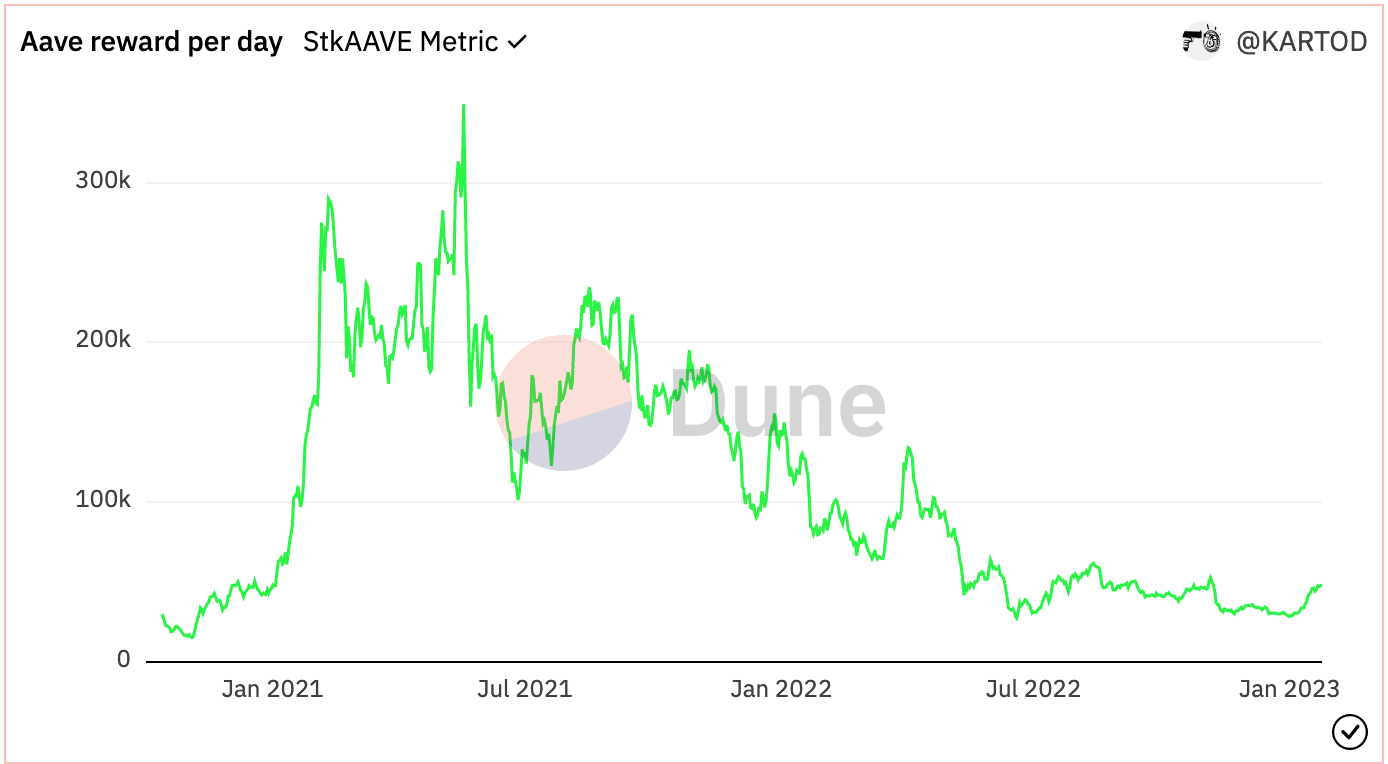

One of the factors negatively influencing Aave’s user adoption is the decline in staking rewards.

Aave staking rewards

Based on data from Dune Analytics, staking rewards dropped consistently since July 2021. While AAVE lost nearly 25% users over the past month, the DeFi protocol’s recent partnership with Lemon App, a crypto exchange with operations in Argentina and Brazil means 1.7 million users could soon gain access to Aave and supply liquidity to the platform. This is another bullish catalyst for the DeFi protocol.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.