Whales accumulate DYDX, GMT ahead of upcoming token unlocks

- Whales are withdrawing large quantities of DYDX and GMT tokens from Binance on Tuesday.

- Around $114 million worth of DYDX tokens, or 11.35% of the asset’s circulating supply, will be unlocked on April 1.

- GMT token has a scheduled linear unlock of 3.32 million tokens on April 1.

The amount of dYdX (DYDX) and GMT (GMT) tokens in exchanges has been declining for the last few days, with several large-wallet investors moving large quantities of these coins out from Binance on Tuesday. These outflows come ahead of the upcoming token unlock event on April 1.

Token unlocks generally lead to a price decline as the release of more supply tends to increase the selling pressure on the asset. This could be a reason for the increasing outflows from exchanges.

DYDX and GMT withdrawn in large volumes

On-chain data from Spotonchain shows that large wallet investors are pulling DYDX and GMT tokens in large volumes off Binance, accumulating the assets in their portfolio, outside of the exchange. A whale wallet address that currently holds $13.9 million worth of DYDX tokens withdrew 1.86 million DYDX from Binance at an average price of $3.578 early on Tuesday.

After the move, the whale has $1.12 million in unrealized gains on their DYDX holdings.

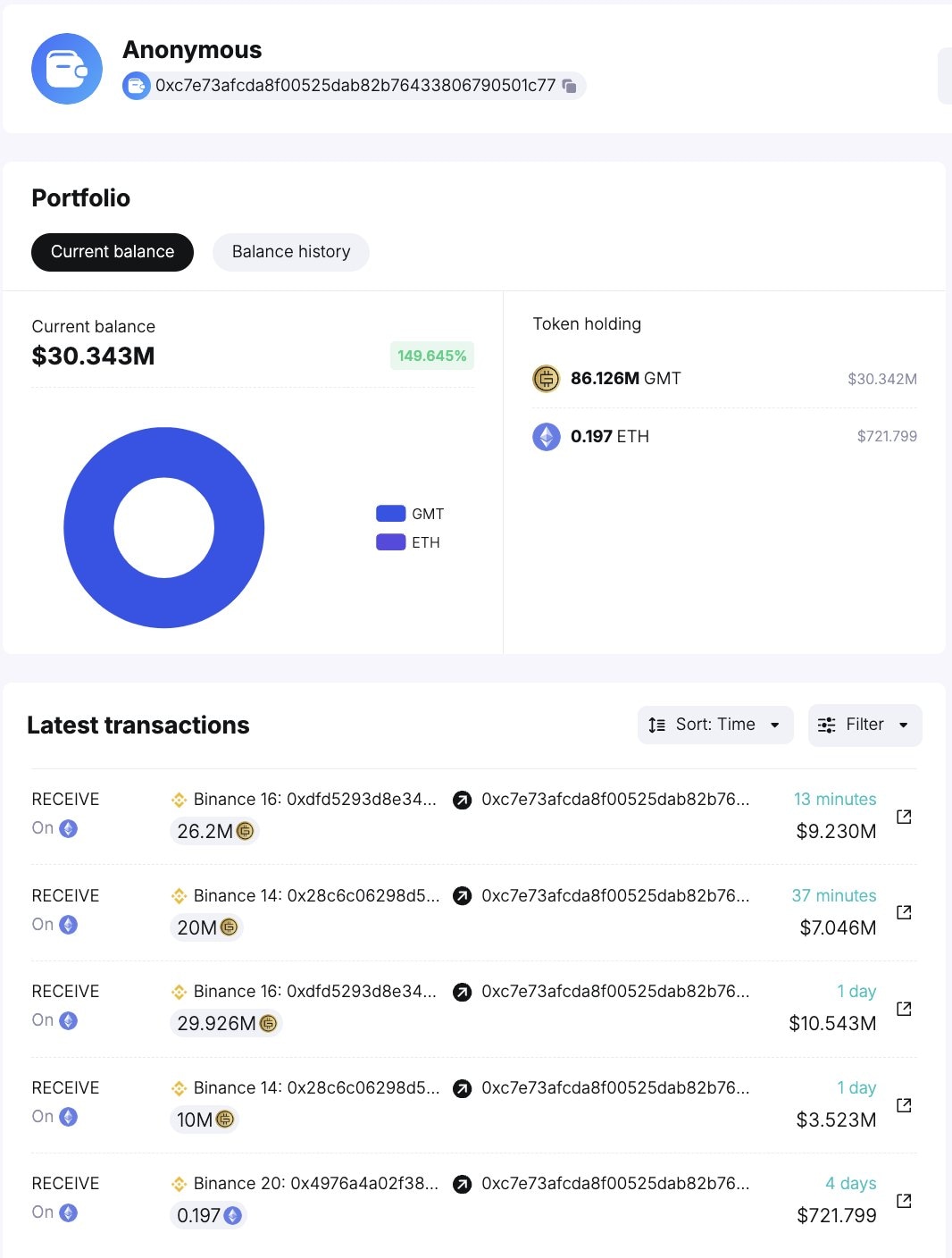

Also on Tuesday, another big wallet withdrew 46.2 million GMT tokens from Binance at an average price of $0.346, worth around $16 million in total.. The wallet address holds a total of $30.3 million worth of GMT tokens and is sitting on $2.2 million in unrealized gains, according to Spotonchain data.

In the past two days, two other whales have withdrawn a total of 98.95 million GMT tokens worth nearly $32 million from Binance.

GMT transactions by whales

DYDX and GMT supply on exchanges has consistently dropped in the last two weeks. Since March 9, DYDX supply is down by 5.5 million, while 2.06 million GMT tokens left exchanges.

These declines occurred ahead of the upcoming unlock event for both tokens. Generally, a drop in the token’s supply reduces the selling pressure on an asset and paves the way for price gains. In the case of DYDX and GMT, declining supply on exchanges combined with whale accumulation is a sign that large wallet addresses expect an increase in price.

DYDX Supply on Exchanges. Source: Santiment

GMT token Supply on Exchanges. Source: Santiment

Tokenunlocks data shows DYDX will unlock over 11% of its circulating supply worth $114 million on April 1, the same day when GMT begins its linear token unlock of 3.32 million tokens, worth $994,280 every day.

Combining the on-chain data with the upcoming token unlock, it is likely that DYDX and GMT token prices sustain their recent gains despite the unlock event. Whale movements are known to influence asset prices, since whales are pulling DYDX and GMT off exchanges, they are likely to ease the selling pressure and support the tokens’ price against a steep correction in the coming days and weeks.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B14.01.54%2C%252026%2520Mar%2C%25202024%5D-638470442994181847.png&w=1536&q=95)

%2520%5B14.11.39%2C%252026%2520Mar%2C%25202024%5D-638470443258029142.png&w=1536&q=95)