Whales abandon Shiba Inu for this hot altcoin, earn 150% in profits

- Chiliz (CHZ), a leading fintech service provider, yielded nearly 150% profits to holders over the past 30 days.

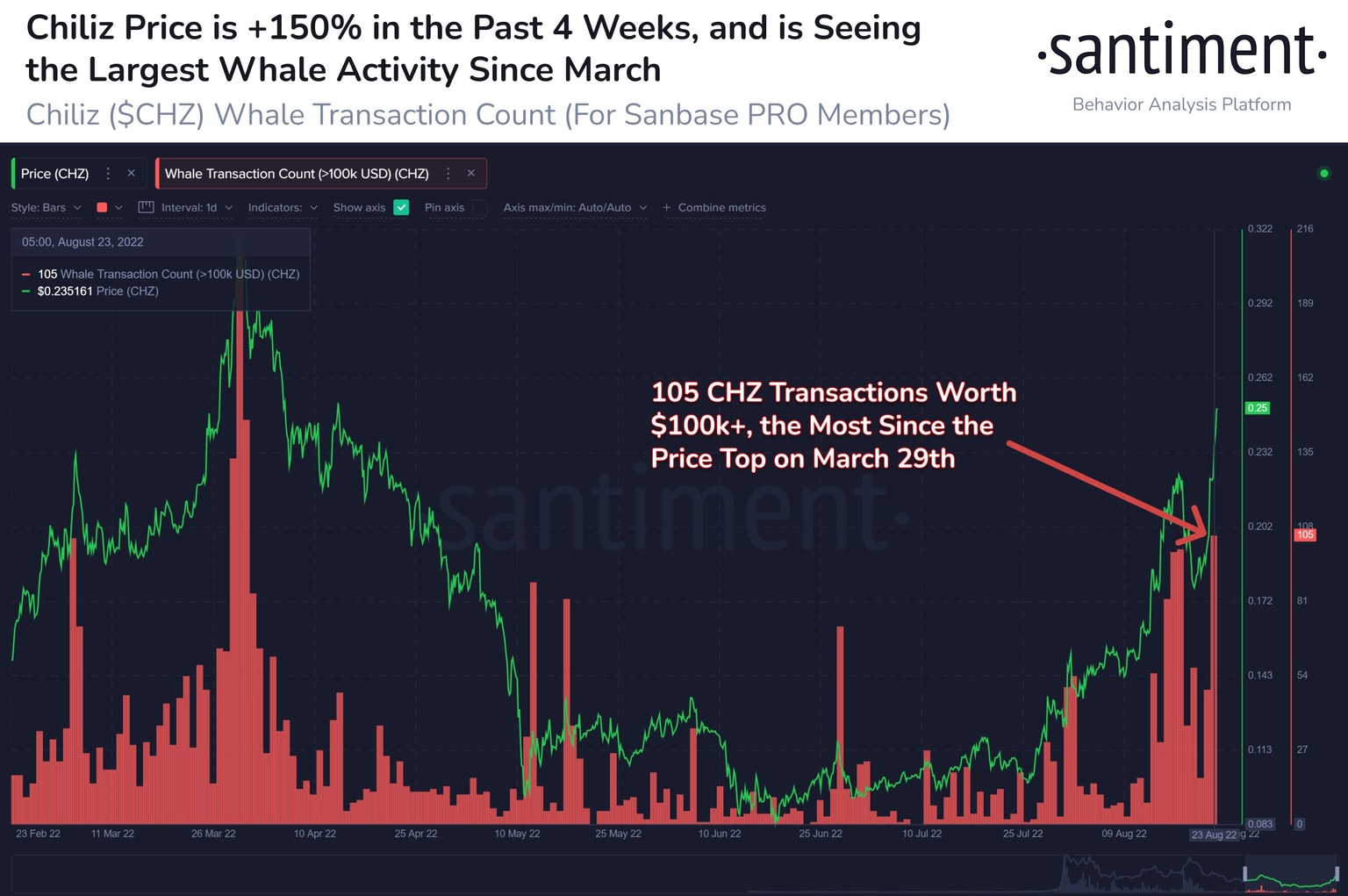

- Whale activity in Chiliz hit its highest level since the end of March as large wallet investors poured capital into the altcoin.

- While large wallet transactions in Shiba Inu have decreased, Chiliz has witnessed a spike in transactions valued $100,000 and higher.

Chiliz Chain 2.0, a layer-2, has announced the releases of its public testnet, fueling a rally in CHZ price. The Chiliz network upgrade is divided into several phases that have their own significance. The fifth rollout has fueled bullish sentiment among whales.

Also read: Shiba Inu price: Is this the bullish signal for 85% rally in SHIB

Chiliz offers consistent gains to whales, massive bull run in CHZ

Chiliz is the 46th largest cryptocurrency by market capitalization and a trending altcoin among whales. Large wallet investors increased their activity in the altcoin, CHZ, with transactions valued at $100,000 and more hitting a peak since March.

Chiliz announced the launch of its layer-2 scaling solution Chiliz Chain 2.0, a semi-decentralized blockchain for sports and media organizations. The launch of the scaling solution’s public testnet, “The Scoville”, has triggered a bullish sentiment among holders. Over the past 30 days, CHZ has yielded nearly 150% gains for Chiliz holders.

Shiba Inu, the second largest meme coin in the crypto community, was marked as a favorite of whales on the Ethereum network. However, of late, whales have shed their Shiba Inu holdings and pulled capital out of the meme coin.

Shiba Inu has dropped to fifth place among altcoins in the holdings of top 500 Ethereum whales.

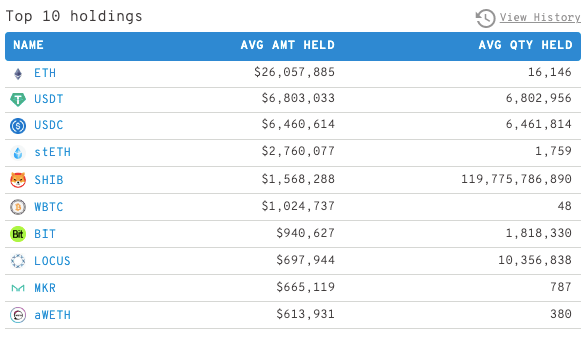

Top 10 crypto holdings of 500 largest Ethereum whales

As whales reallocate this capital to other cryptocurrencies, CHZ has emerged as an obvious choice with “The Scoville” around the corner. Chiliz’s network upgrade, double-digit weekly yield and massive price rally have fueled the bullish sentiment in the crypto community. Crypto intelligence tracker Santiment marked the uptick in whale activity in the chart below.

Chiliz whale activity and price action for past four weeks

Chiliz price could explode, 400% rally by 2023?

Christian, a leading crypto analyst and trader evaluated the Chiliz price chart and predicted a large fifth wave on a large timeframe. Christian applied the Elliott Wave Theory to the Chiliz price chart and noted that the first four waves are complete. Subwaves of the fifth wave are hard to predict; however, it is likely that the first two subwaves are complete.

CHZ-USD price chart

According to Christian, a 400% rally is in the charts for CHZ by 2023. Subwaves of the fifth wave target the $1.2 level, a massive spike from $0.24.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.