- Weiss Ratings has dethroned Bitcoin to place Ethereum as the top cryptocurrency.

- Ethereum is followed by Bitcoin, Cardano, Litecoin and Stellar.

- The rating firm noted that Cardano has the best technology.

Weiss Ratings has dethroned Bitcoin to place Ethereum as the top cryptocurrency. The rating firm updated its overall digital asset rankings, which factors in adoption, technology, market momentum and investment risk.

Weiss has placed Ethereum in the first spot, followed by (BTC), Cardano (ADA), Litecoin (LTC), and Stellar (XLM). The rating firm singled out Cardano for having the best technology. Pointing to the fact that Shelley hard fork is a success, Weiss analyst Juan Villaverde said that the firm has already factored in Cardano’s highly-anticipated upgrade in the coin rankings.

Shelley is already reflected in our technology model because we had full confidence that it would come out with this (fork). We’re also reflecting on that same model that Cardano is capable of running smart contracts and dApps because we think these things will come out eventually so when Cardano pushes a code update, it doesn’t really reflect on our ratings, unless it’s something new on the roadmap that wasn’t there before…As the fundamentals for the blockchain, that is Cardano, improve over time, it will be reflected in our ratings.

In terms of technology, Weiss also placed Cosmos (ATOM), Fantom (FTM), Tezos (XTZ) and Ethereum as the top coins.

Speaking of Ethereum, read up on how Grayscale is looking to register its Ethereum-based trust with the SEC right here.

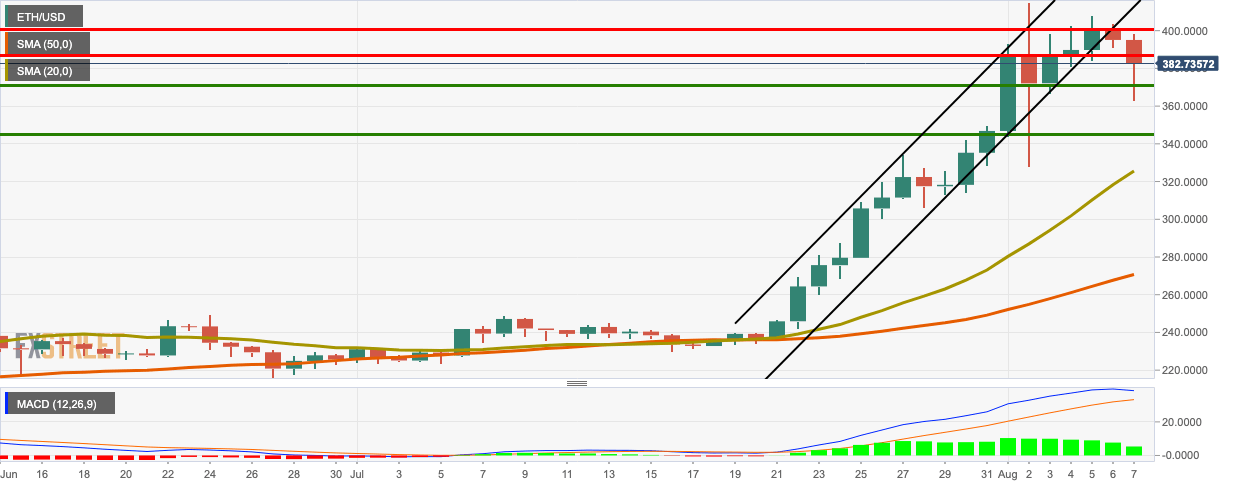

ETH/USD daily chart

ETH/USD bears remained in control for the second straight day after failing at the $400 resistance level. The price fell from $395 to $382.60 this Friday. The MACD shows decreasing bullish momentum.

Strong resistance lies at $400 and $387.10. On the downside, we have healthy support levels at $371.70 and $345.75.

Key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto Today: Metaplanet raises $10M to buy BTC, ETH price moves below $1,600 as Tron gains signals panic

The cryptocurrency aggregate market capitalization stabilized around $2.7 trillion on Wednesday, with Bitcoin’s $84,000 support momentarily anchoring the market against external bearish discourses.

Chainlink active addresses drop as whale selling spikes, could LINK crash below $10?

Chainlink active addresses slide dramatically to 3,200 from February’s peak of 9,400. The downtrend in network activity coincides with increasing selling activity among whales with between 10 million and 100 million LINK.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin is stabilizing around $83,500 at the time of writing on Wednesday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. A breakout of this strong level would indicate a bullish trend ahead.

Binance Chain completes $914M BNB token burn, hinting at a potential rally

Binance Chain has finalized its programmed 31st quarterly BNB token burn, potentially setting the stage for the world’s fifth-largest cryptocurrency, with a market capitalization of $81.45 billion, to rally in the coming weeks.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.