Weekend Wrap: Loopring $5M exploit, Bitcoin NFT weekly sales bump and more

Loopring suffers $5M hack via compromised 2FA

Ethereum zero knowledge-rollup protocol Loopring said on Sunday that it suffered a $5 million security breach of its two-factor authentication service “Guardian” for its smart wallets application.

In a June 9 X post, Loopring said the attacker compromised the project’s 2FA service, which allowed them to initiate a recovery process that reset wallet ownership and allowed the withdrawal of assets.

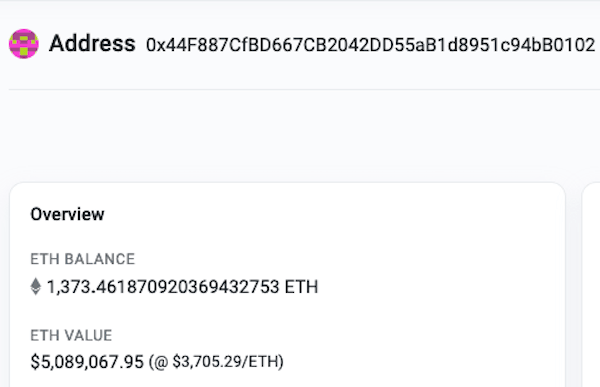

It shared two wallet addresses it alleged were involved with the exploit. Etherscan data shows one wallet holding over $5 million worth of cryptocurrencies.

Etherscan screenshot of one of the alleged exploiter wallets with an over $5 million balance. Source: Etherscan

Loopring’s Guardian service allows users to choose wallets they trust to help restore seed phrases or lock hacked wallets.

The project said the exploiter somehow compromised Loopring’s “Official Guardian” and started the recovery process on wallets using only that guardian.

“We are actively collaborating with Mist security experts to determine how our 2FA service was compromised,” Loopring said. It’s also working with law enforcement “to track down the perpetrator.”

It temporarily suspended Guardian and 2FA-related operations, which it said halted the compromise.

Bitcoin carries weekly rise in NFT sales volumes

Nonfungible token (NFT) sales volumes have notched an 18.9% weekly rise, bolstered by sales of the NFT-like Bitcoin Ordinals.

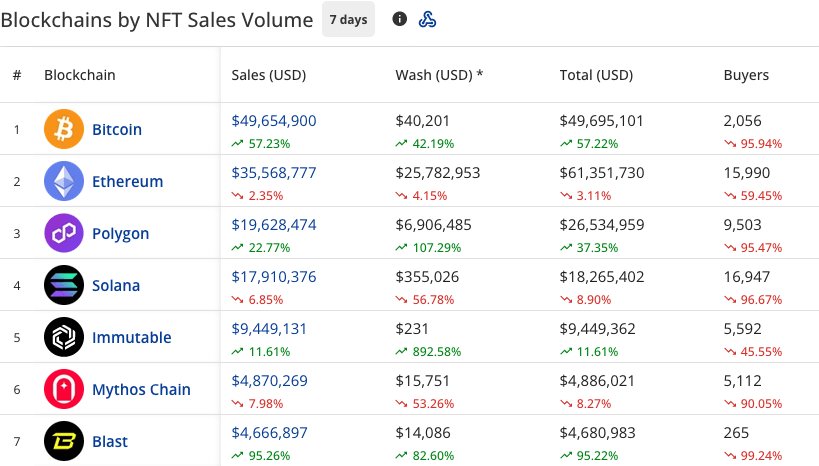

Seven-day NFT sales volumes hit $147.3 million, with Bitcoin-based NFT sales rising over 57% to nearly $49.7 million, CryptoSlam! data shows.

Ethereum NFTs had the second-most sales volumes at nearly $35.6 million but saw a slight 2.35% on the week.

Polygon, Immutable and Blast were among the top ten blockchains by weekly sales volume that saw double-digit percentage growth.

The top seven blockchains by seven-day NFT sales volume. Source: CryptoSlam!

Blast saw an over 95% bump to over $4.6 million in volume largely due to the crypto influencer NFT trading card game fantasy.top — which doubled its volumes from the week prior to $3.85 million.

Other big movers were Polygon’s Milady-reminiscent Moon Girl NFTs which bumped 643% to nearly $5.8 million and Immutable’s Guild of Guardians game 22% bump to $7 million.

The biggest seller for the week was a new BRC-20 token with the ticker PIZZA that saw $19.3 million in sales.

Ethereum L2s “shouldn’t be immutable” – Uniswap founder

Ethereum scaling layer-2 blockchains should not focus on immutability — their ability to retain an unchanged and unalterable ledger of transactions — until the Ethereum blockchain is ready, says Uniswap founder Hayden Adams.

“Ethereum L2s shouldn’t be immutable. It’s been 10 years and L1 is not ready to be immutable,” Adams wrote in a June 9 X post.

He added it “makes zero sense” to expect layer 2 networks “to never upgrade again or force mass migrations.”

“The interconnected nature of the users and apps on the L2 chain breaks composability if some migrate and some don’t,” Adams wrote.

The Ethereum Foundation has said layer 2 blockchains are its scalability plan, which led NFT marketplace Rarible’s ecosystem lead Jonathan Colón to call layer 2 networks a “money grab.”

“The entire plan for scaling Ethereum is ‘L2s,’” Adams responded. “We either have to make them work or change the roadmap (I favor the former).”

Source: Hayden Adams

“Calling them cash grabs [or] saying they need to be immutable doesn’t change this. They’re expensive to build and the work is not being funded by the L1,” he added.

Other news

Friend.tech — the crypto social media platform on Base — is making its own blockchain, Friendchain, which has many users wondering why.

China’s largest payments and everything app, Alipay, now has an artificial intelligence bot that can check for baldness.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.