Week ahead: Fed speech and NFP likely to dictate crypto market moves this week

With the start of 2023’s fourth quarter, things are finally getting interesting in crypto. While the next 12 weeks are extremely important, let’s start by focusing on what to expect this week.

- Fed Chair’s speech draws attention on October 2.

- Nonfarm Payrolls (NFP) data arrives on October 5.

- Bitcoin fractal faces a reality check.

- Nearly $40 million worth of altcoin unlocks from October 2 through October 6.

- Multiple cryptos trigger a bullish breakout, signaling trend reversal.

Fed Chair speech and NFP

The Federal Reserve Chairman Jerome Powell has been repeating the same thing for the past year – the Fed’s decision is data-driven. The Nonfarm Payrolls (NFP) figure on October 5 will dictate if the Fed will keep interest rates higher for longer or choose to hike.

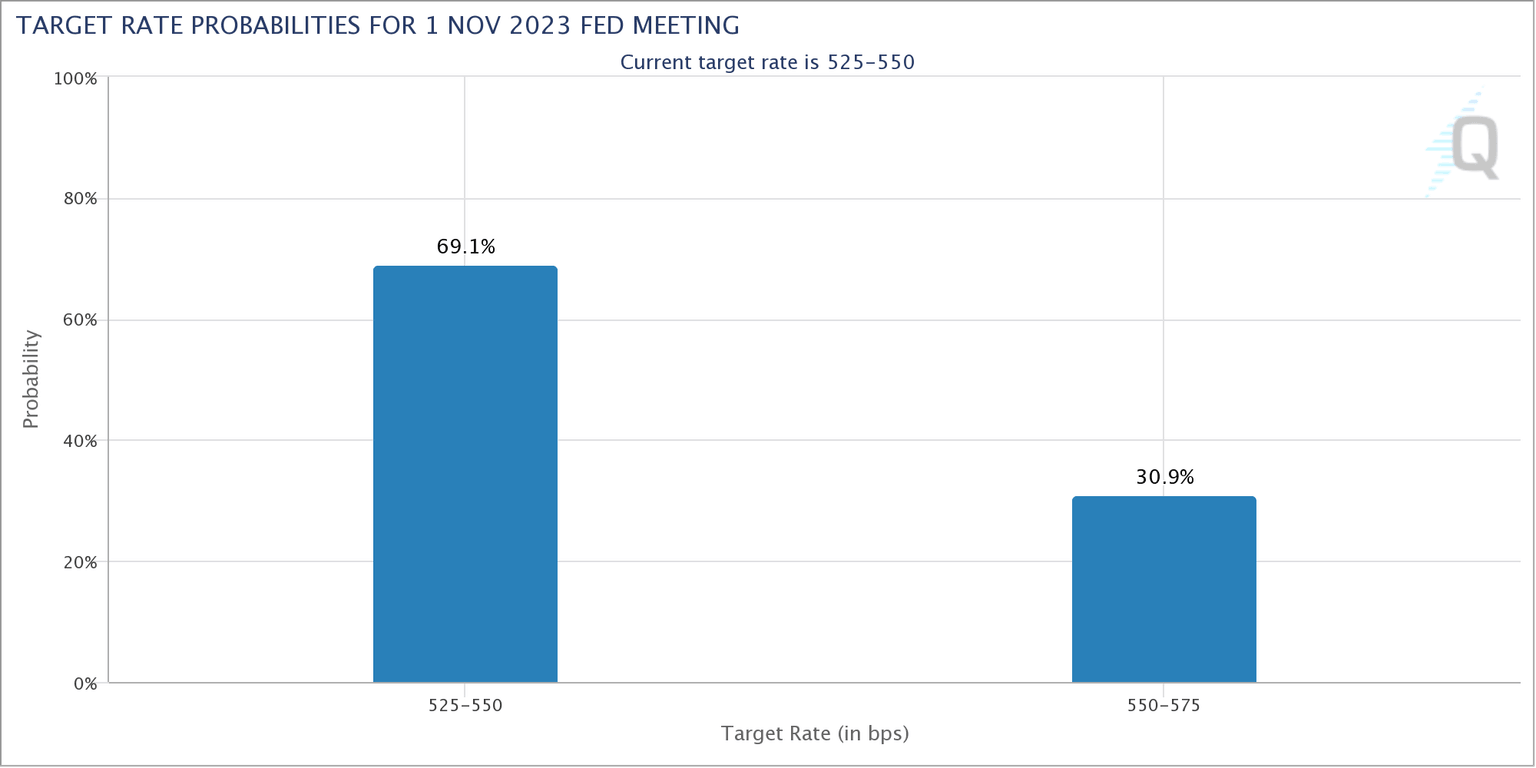

The CME FedWatch Tool shows a 69% probability that interest rates remain unchanged in the 5.25% to 5.50% range.

FXStreet’s Lead Analyst, Eren Sengezer, states that “an NFP print at or above 200,000 could cause investors to reassess the possibility of one more Fed rate increase and help the USD gather strength ahead of the weekend.”

On the other hand, lower-than-expected job growth could see markets flooded with dovish bets.

CME FedWatch Tool

Read more: Gold Price Weekly Forecast: Technicals turn bearish ahead of key events

Bitcoin price fractal at risk of invalidation

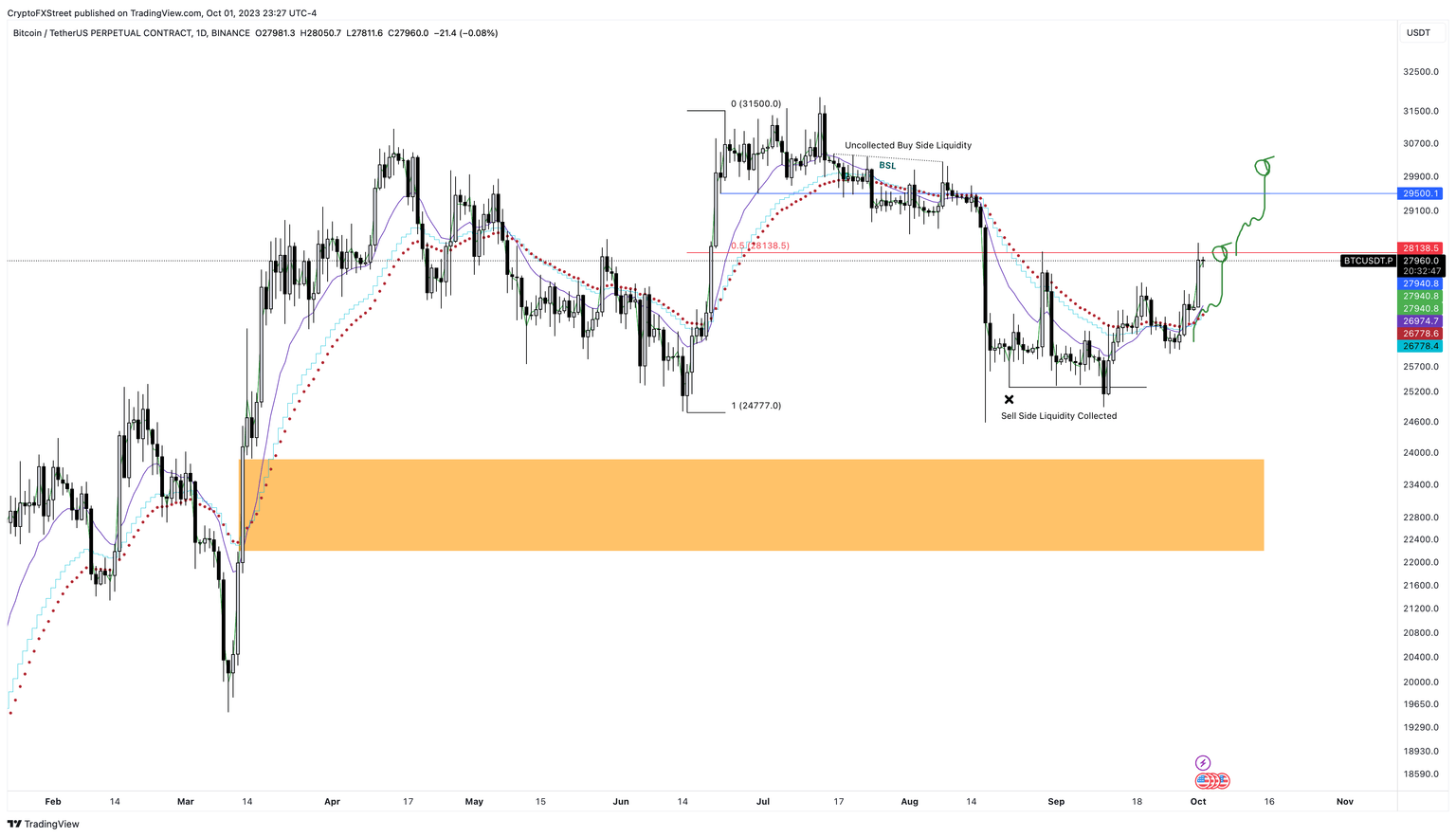

Bitcoin (BTC) price fractal, detailed in the last article, stated that a rejection at the 200-day Simple Moving Average (SMA) at roughly $28,000 was likely.

Now that Bitcoin price has arrived at the $28,138 resistance level, investors need to tread carefully. A flip of the aforementioned level into the support floor has two implications:

- BTC fractal discussed in the last two articles is invalid.

- BTC is targeting the buy-side liquidity resting between $29,500 and $30,500.

Considering the recent upswing in Bitcoin price, investors need to wait to see how BTC reacts to the $28,138 hurdle. Rejection could take BTC $26,000, but a flip of the key hurdle could propel the pioneer crypto to $30,000 and higher. Regardless, traders need to be cautious.

BTC/USDT 1-day chart

Read more:

Bitcoin Weekly Forecast: BTC recovery rally could be bull trap in disguise, here’s why

Bitcoin Weekly Forecast: This BTC fractal forecasts two key rejection levels to trap bulls

Token unlocks worth nearly $40 milion to flood crypto markets

According to the TokenUnlocks website, SUI, IMX and DYDX tokens worth $37.92 million are set to be unlocked between October 3 and 7. Depending on the market conditions and holders, these tokens could remain rangebound or notice a sharp rally before the unlock.

Regardless of what happens, traders need to keep their eyes peeled for trade opportunities.

Token Unlocks

Three altcoins that have kick-started the Q4 rally

- Polkadot (DOT)

- Chainlink (LINK)

- Floki Inu (FLOKI)

- Polkadot (DOT) price has breached a key consolidation range after shedding 92% in the last two years.

Read more: Polkadot Price Forecast: DOT confirms trend reversal, eyes retest of $5 after reclaiming key hurdle

DOT/USDT 1-day chart

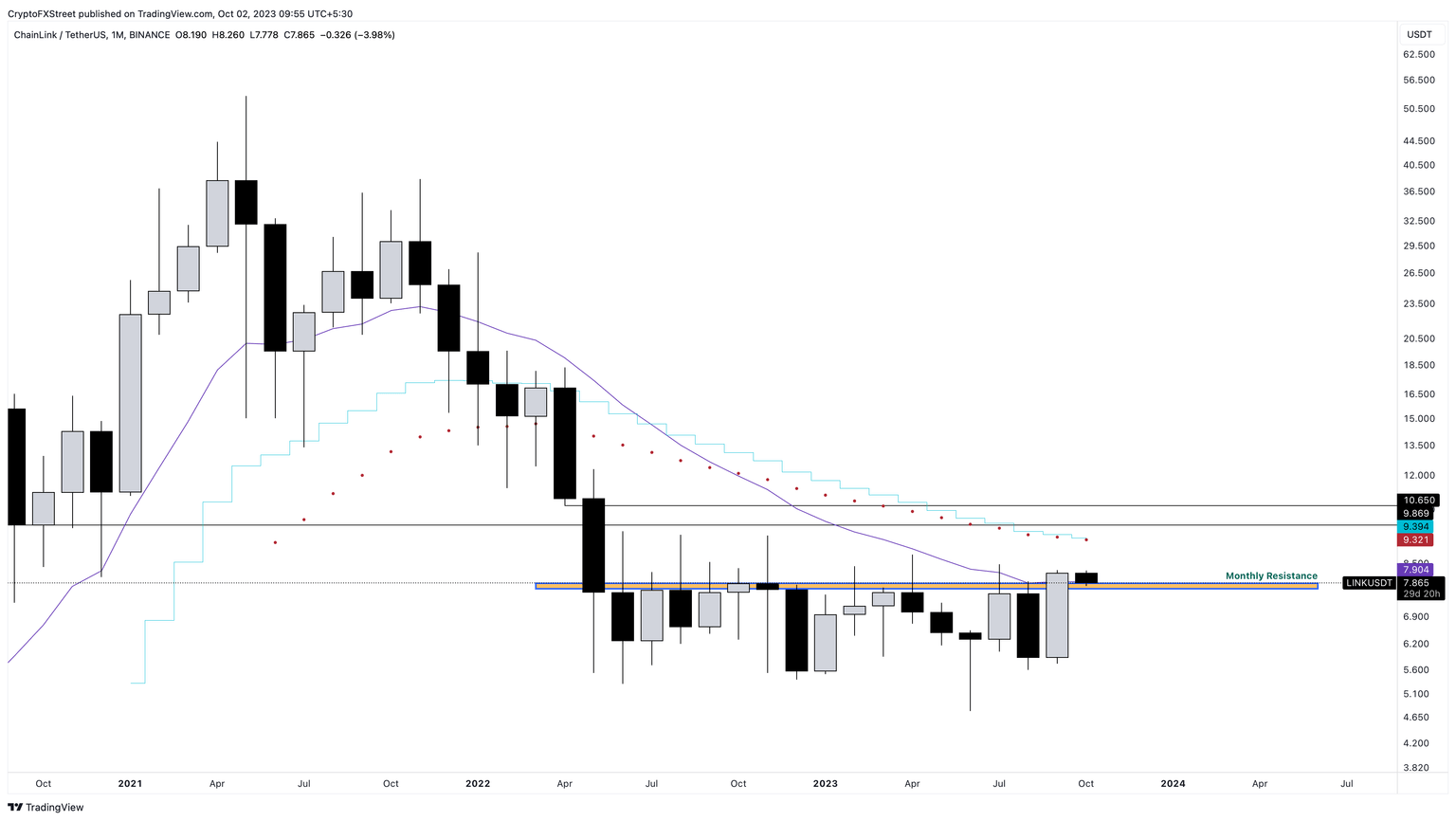

Chainlink (LINK) price has breached a 15-month resistance level around $7.80, signaling a trend reversal. This move could soon propel LINK to $10.

LINK/USDT 1-month chart

Read more:

Chainlink whales continue their accumulation spree after LINK’s 40% rally, why?

Chainlink Price Prediction: LINK bears set to wipe 25% gains

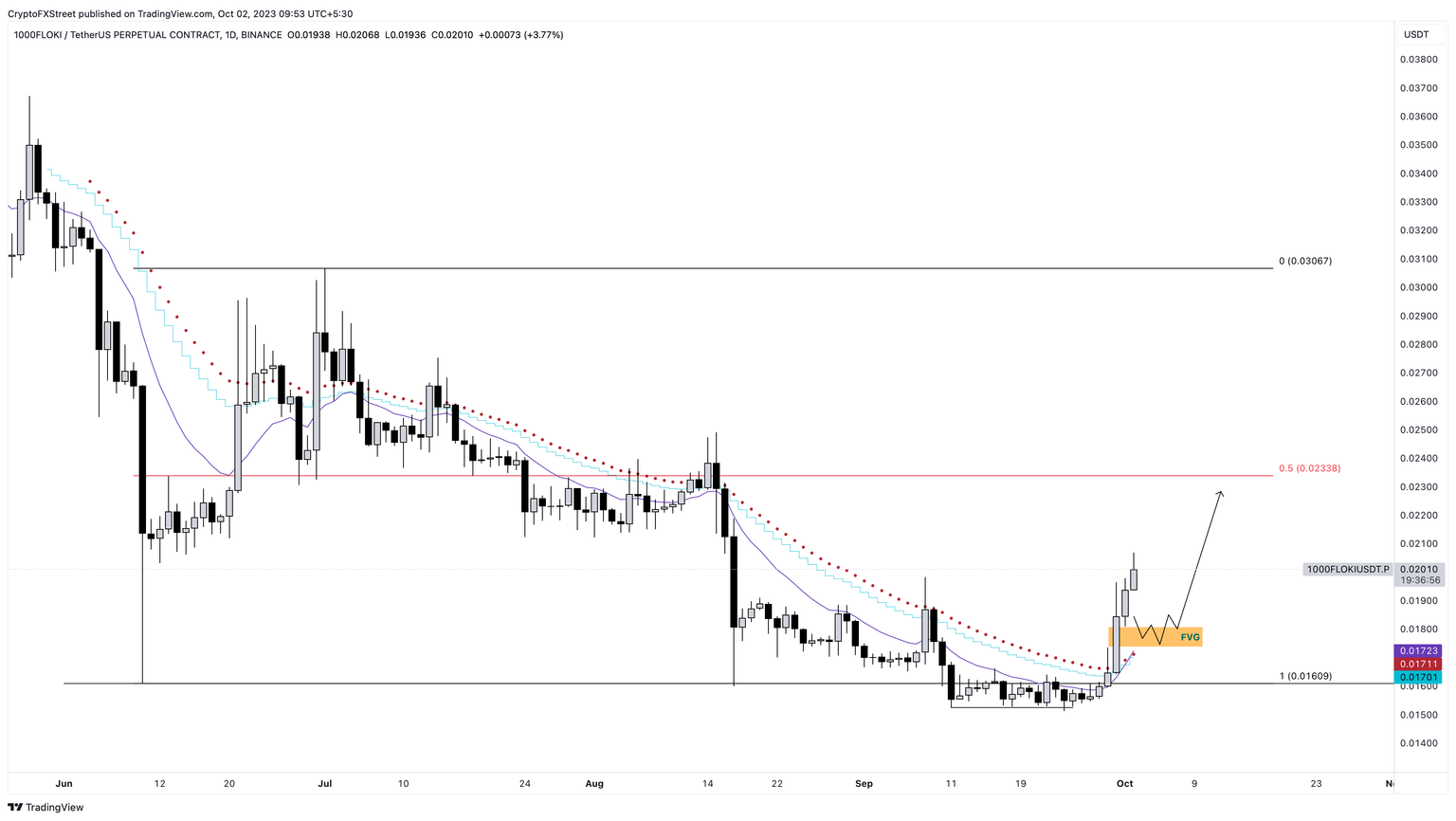

Floki Inu (FLOKI) price has initiated a breakout rally that could extend and tag the $0.0000233 hurdle.

FLOKI/USDT 1-day chart

Read more: Floki Inu Price Forecast: FLOKI sets stage for 30% rally

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.