Week ahead: Bitcoin dips under $63,000, meme coins fade with steep correction in top five

- Bitcoin price shows signs of further decay, falling below $63,000 on Monday.

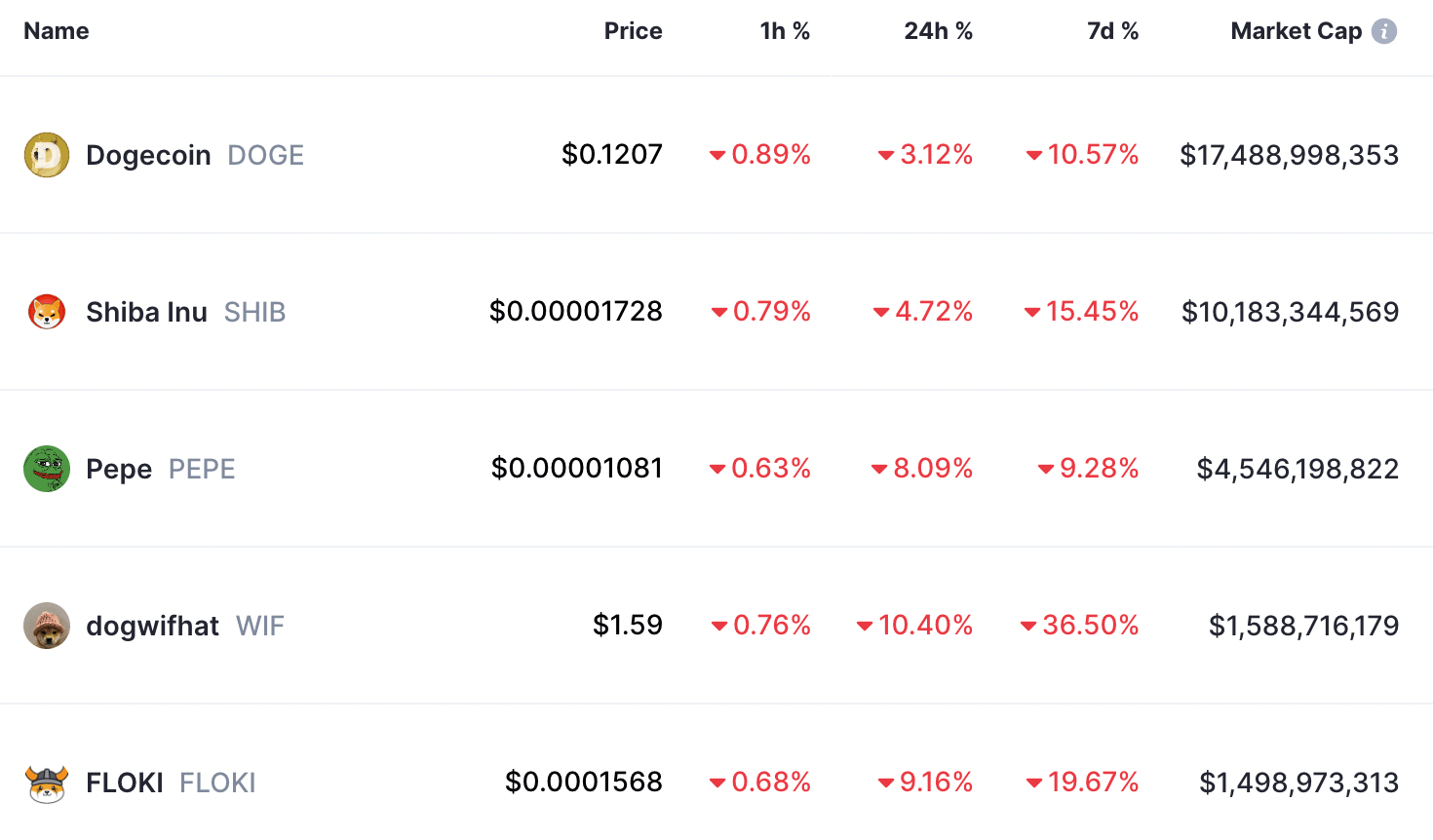

- Meme coin market capitalization shrinks, Dogecoin, Shiba Inu, Pepe, Dogwifhat, Floki hit by steep correction in the past 24 hours.

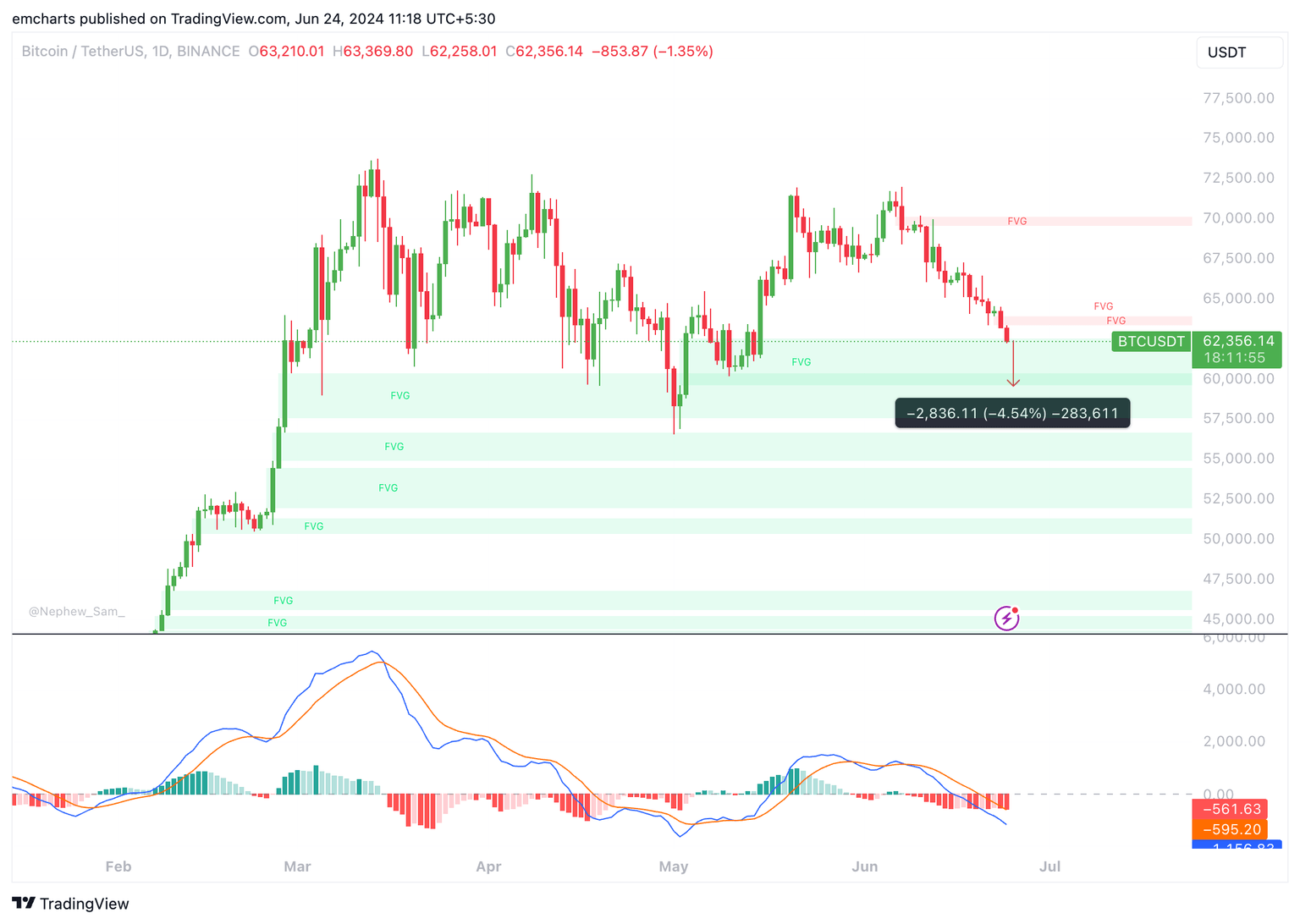

- Traders can expect a nosedive under $60,000 as BTC collects liquidity in the closest imbalance zone.

Bitcoin dipped under $63,000 on Monday, lowering crypto market capitalization by over 3%, per CoinGecko data. BTC is in a state of decline, and news of VanEck’s Spot Bitcoin ETF launch in Australia failed to improve traders' sentiment.

Weighted sentiment among Bitcoin traders has been largely negative since the third week of May, Santiment data shows.

With Bitcoin’s price declining, meme coins have suffered a steep correction in the past 24 hours. Top five meme tokens Dogecoin (DOGE), Shiba Inu (SHIB), Dogwifhat (WIF), Pepe (PEPE) and Floki (FLOKI) wiped out between 3% and 10% of their value, per CoinMarketCap data.

Traders can expect Bitcoin to sweep liquidity in the Fair Value Gap under $60,000. BTC is likely to revisit the $59,000 level briefly, before a recovery in the asset.

US macro events likely to influence Bitcoin price

The first quarter US Gross Domestic Product (GBP) is due on Thursday, and the core Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred inflation gauge, is due on Friday. If core PCE numbers support the thesis that inflation is sticky, risk assets like Bitcoin and altcoins could nosedive and extend their losses in the coming weeks.

Read more here: Week ahead – US PCE inflation the highlight of a relatively light agenda

Bitcoin slips under $63,000 on Monday, crypto market cap declines

Bitcoin corrected under the $63,000 mark on Monday amidst prolonged negative sentiment among traders. Santiment has tracked a consistently negative weighted sentiment among BTC traders since May 23, and predicted a bottom in Bitcoin price is near.

Negative sentiment is typically interpreted as the crowd’s disinterest in the asset, combined with trader fatigue.

The crowd is mainly fearful or disinterested toward Bitcoin as prices range between $65K to $66K. This extended level of FUD is rare, as traders continue to capitulate. BTC trader fatigue, combined with whale accumulation, generally leads to bounces that reward the patient. pic.twitter.com/WMy3lbdjEB

— Santiment (@santimentfeed) June 20, 2024

After weeks of choppy market outlook, Bitcoin looks ready to collect liquidity in the Fair Value Gap (FVG) between $59,625 and $62,541, as seen in the BTC/USDT 1-day chart. This could warrant a near 5% decline in Bitcoin, down to the $59,625 level this week.

The Moving Average Convergence Divergence (MACD) momentum indicator supports the bearish thesis. The red histogram bars under the neutral line show the underlying negative momentum in Bitcoin price trend.

BTC/USDT 1-day chart

Sentiment tracker LunarCrush noted that the bearish outlook on Bitcoin is accompanied by extreme quiet on social media platforms. Data shows that since January 11, engagements on Bitcoin-related social posts have been down roughly 90%.

The excitement that accompanied the launch and inflows to Bitcoin ETFs fizzled out, and we have yet to see major, broad-based social activity from retail investors.

Bitcoin-related posts see low engagement

Meme coin narrative fades, top 5 meme tokens hit by correction

While meme coins dominated the narrative throughout the cycle, the influence of these assets is fading. The top 5 meme coins ranked by market capitalization have corrected in the past 24 hours, as seen on Coinmarketcap.

The meme coins have extended their past week’s losses, and the correction can be attributed to the broadly negative sentiment among crypto traders.

Meme coin price changes on Coinmarketcap.com

The market capitalization of the meme coins is down 4.74% to $45.223 billion on Monday. It remains to be seen whether meme tokens recover from the recent correction or the narrative sees fewer takers in the coming weeks, signaling an end to a long rally in meme coins.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.