Week Ahead: Bitcoin could dip below $20,000 soon if spot ETF is not approved

- This week’s macroeconomic market mover is the Federal Reserve Chairman Jerome Powell’s speech on October 19.

- Grayscale’s victory is all but sealed, as the US SEC does not want to appeal the court’s decision.

- Bitcoin price has flashed a trend reversal signal on the weekly chart, indicating that a downtrend is around the corner.

The main macroeconomic event for this week is the Federal Reserve Chairman Jerome Powell’s speech on October 19. With higher-than-expected Nonfarm Payrolls and Inflation numbers, the chances that Jerome Powell hints at another interest rate hike are high. However, the CME FedWatch Tool shows a 90.3% probability of policy rates remaining at 525 to 550 basis points. While the speech will likely have a short-term impact on Bitcoin price, investors need to be careful trading BTC as things could get dicey going forward.

CME FedWatch Tool

Bitcoin price weekly signal hints sell

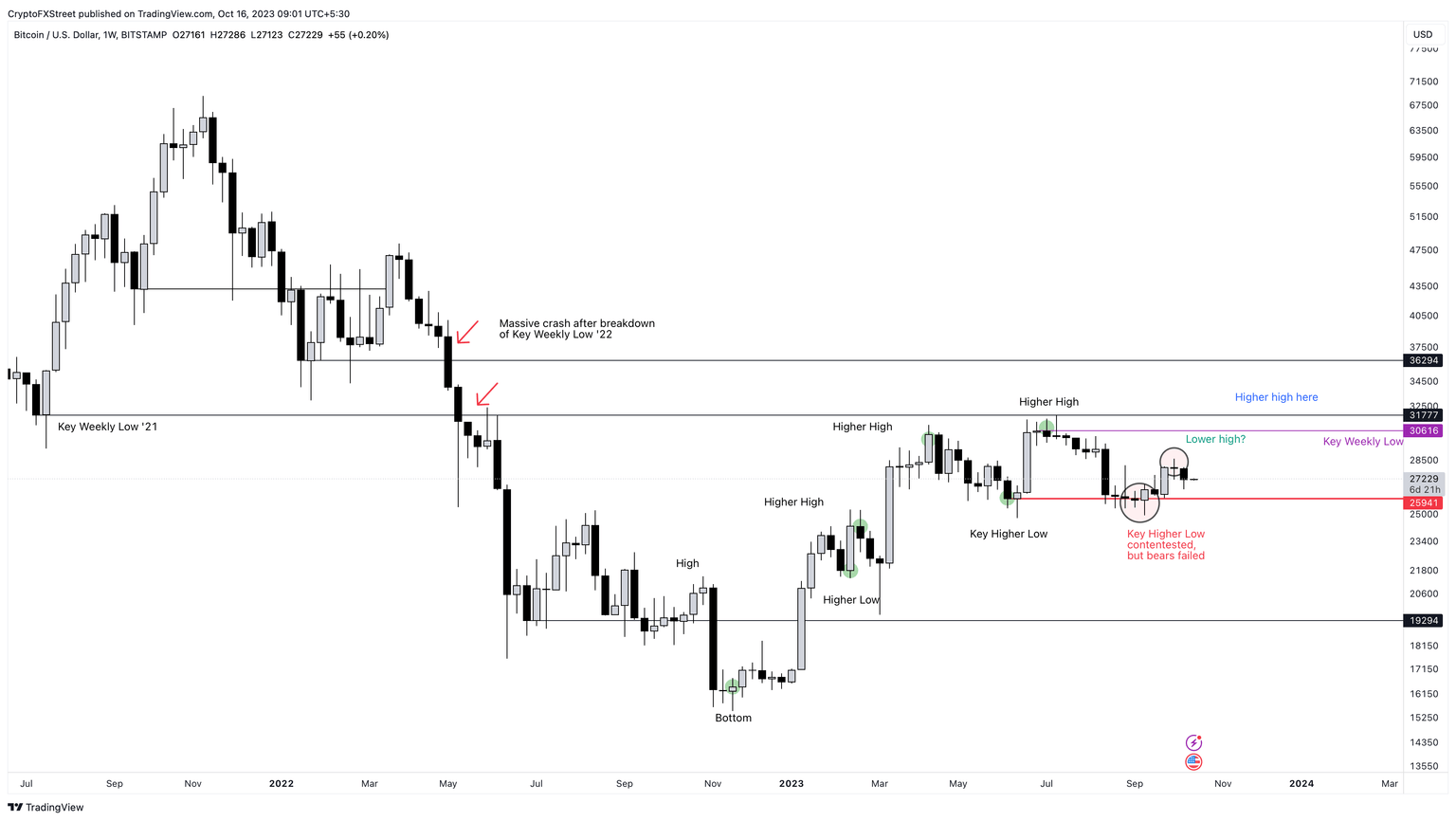

Bitcoin price has flipped bearish on the weekly by satisfying two key conditions for reversing an uptrend – a lower low and a lower high.

Read more: Bitcoin, Ethereum worth $1.8 million stolen in a phishing incident on a fake search website

In the first week of September, Bitcoin price slashed the June first-week low at $25,941 and produced a weekly swing low at $25,386. While this move satisfies the first condition of a trend reversal, the lower high produced in the first week of October at $28,592 is the second condition. With the two conditions met, Bitcoin price has officially produced a trend reversal signal on the weekly, indicating the potential end of the 2023 rally.

Going forward, investors need to be cautious of what comes next. Bitcoin’s history suggests a massively volatile downtrend when BTC breaches a key level after a trend reversal signal.

Targets include the $25,000 psychological level, a breakdown of which could trigger a nearly 26% crash to $19,294.

A spot Bitcoin ETF can invalidate bearish signals

The US Securities and Exchange Commission (SEC) is unlikely to appeal to reconsider Grayscale’s spot Bitcoin ETF ruling, which increases the chances of a spot Bitcoin ETF approval. Regardless of this win, Bitcoin only noticed a small spike in uptrend, which failed to sustain.

Read more: Bitcoin price surges as SEC misses appeal deadline for Grayscale GBTC conversion to spot BTC ETF

Hence, approval of spot Bitcoin ETF is the only outlook strong enough to kickstart an uptrend for BTC by invalidating the bearish outlook described above.

Other reads:

SBF trial prosecutors defy court’s moratorium for a five-page evidentiary letter 11 PM Friday

Bitcoin Weekly Forecast: Can BTC bears challenge crypto’s 2023 bull rally?

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

-638330310042687463.png&w=1536&q=95)